JOTUN A/S

78

Leases

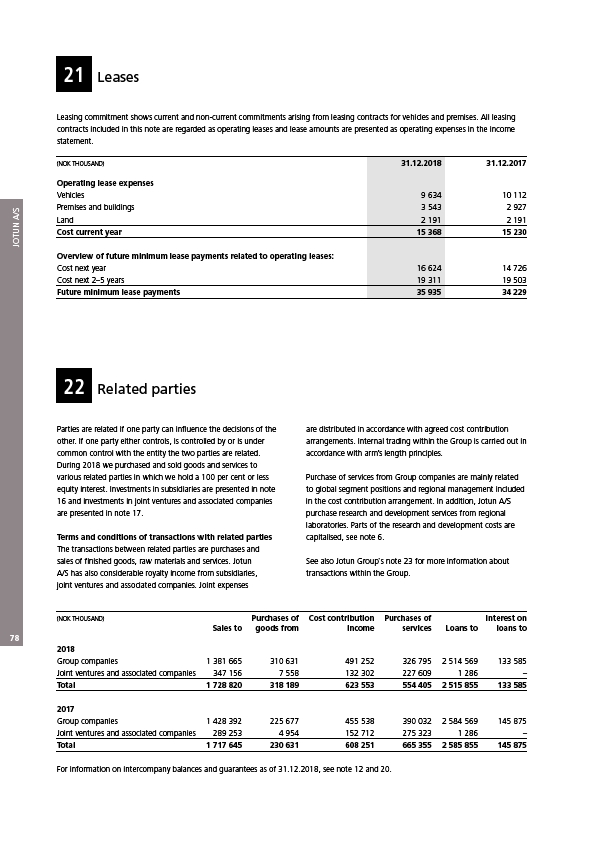

Leasing commitment shows current and non-current commitments arising from leasing contracts for vehicles and premises. All leasing

contracts included in this note are regarded as operating leases and lease amounts are presented as operating expenses in the income

statement.

(NOK THOUSAND) 31.12.2018 31.12.2017

Operating lease expenses

Vehicles 9 634 10 112

Premises and buildings 3 543 2 927

Land 2 191 2 191

Cost current year 15 368 15 230

Overview of future minimum lease payments related to operating leases:

Cost next year 16 624 14 726

Cost next 2–5 years 19 311 19 503

Future minimum lease payments 35 935 34 229

Related parties

21

22

Parties are related if one party can influence the decisions of the

other. If one party either controls, is controlled by or is under

common control with the entity the two parties are related.

During 2018 we purchased and sold goods and services to

various related parties in which we hold a 100 per cent or less

equity interest. Investments in subsidiaries are presented in note

16 and investments in joint ventures and associated companies

are presented in note 17.

Terms and conditions of transactions with related parties

The transactions between related parties are purchases and

sales of finished goods, raw materials and services. Jotun

A/S has also considerable royalty income from subsidiaries,

joint ventures and associated companies. Joint expenses

are distributed in accordance with agreed cost contribution

arrangements. Internal trading within the Group is carried out in

accordance with arm’s length principles.

Purchase of services from Group companies are mainly related

to global segment positions and regional management included

in the cost contribution arrangement. In addition, Jotun A/S

purchase research and development services from regional

laboratories. Parts of the research and development costs are

capitalised, see note 6.

See also Jotun Group`s note 23 for more information about

transactions within the Group.

(NOK THOUSAND) Purchases of Cost contribution Purchases of Interest on

Sales to goods from income services Loans to loans to

2018

Group companies 1 381 665 310 631 491 252 326 795 2 514 569 133 585

Joint ventures and associated companies 347 156 7 558 132 302 227 609 1 286 –

Total 1 728 820 318 189 623 553 554 405 2 515 855 133 585

2017

Group companies 1 428 392 225 677 455 538 390 032 2 584 569 145 875

Joint ventures and associated companies 289 253 4 954 152 712 275 323 1 286 –

Total 1 717 645 230 631 608 251 665 355 2 585 855 145 875

For information on intercompany balances and guarantees as of 31.12.2018, see note 12 and 20.