JOTUN GROUP

41

Jotun Group has bond funding of NOK 1 555 million. One of

the long-term bond agreements entered into in 2014, with a

carrying amount of NOK 400 million, is based on a fixed interest

rate of 3.85 per cent. In addition, Jotun Group has a bilateral

loan with Nordic Investment Bank (NIB) of USD 101.6 million

with floating interest rate.

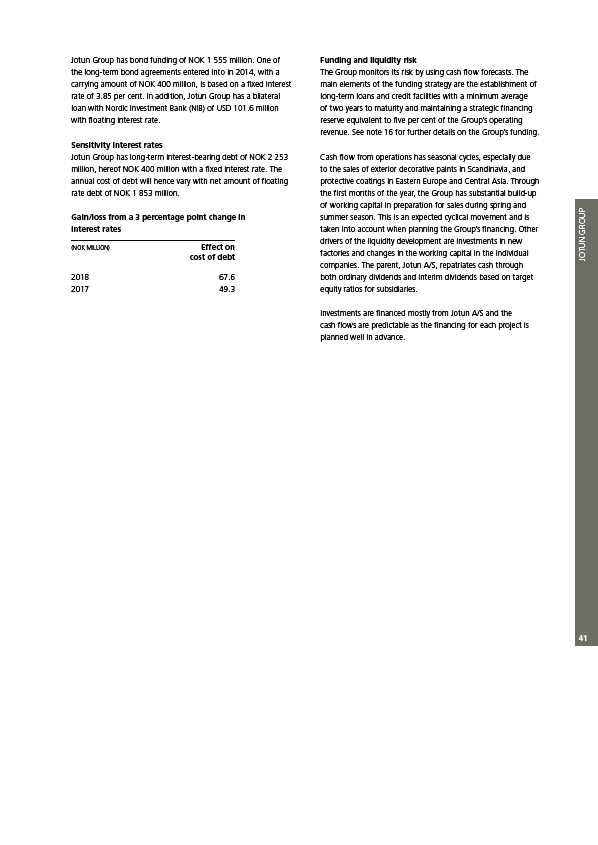

Sensitivity interest rates

Jotun Group has long-term interest-bearing debt of NOK 2 253

million, hereof NOK 400 million with a fixed interest rate. The

annual cost of debt will hence vary with net amount of floating

rate debt of NOK 1 853 million.

Gain/loss from a 3 percentage point change in

interest rates

Funding and liquidity risk

The Group monitors its risk by using cash flow forecasts. The

main elements of the funding strategy are the establishment of

long-term loans and credit facilities with a minimum average

of two years to maturity and maintaining a strategic financing

reserve equivalent to five per cent of the Group’s operating

revenue. See note 16 for further details on the Group’s funding.

Cash flow from operations has seasonal cycles, especially due

to the sales of exterior decorative paints in Scandinavia, and

protective coatings in Eastern Europe and Central Asia. Through

the first months of the year, the Group has substantial build-up

of working capital in preparation for sales during spring and

summer season. This is an expected cyclical movement and is

taken into account when planning the Group’s financing. Other

drivers of the liquidity development are investments in new

factories and changes in the working capital in the individual

companies. The parent, Jotun A/S, repatriates cash through

both ordinary dividends and interim dividends based on target

equity ratios for subsidiaries.

Investments are financed mostly from Jotun A/S and the

cash flows are predictable as the financing for each project is

planned well in advance.

(NOK MILLION) Effect on

cost of debt

2018 67.6

2017 49.3