JOTUN GROUP

42

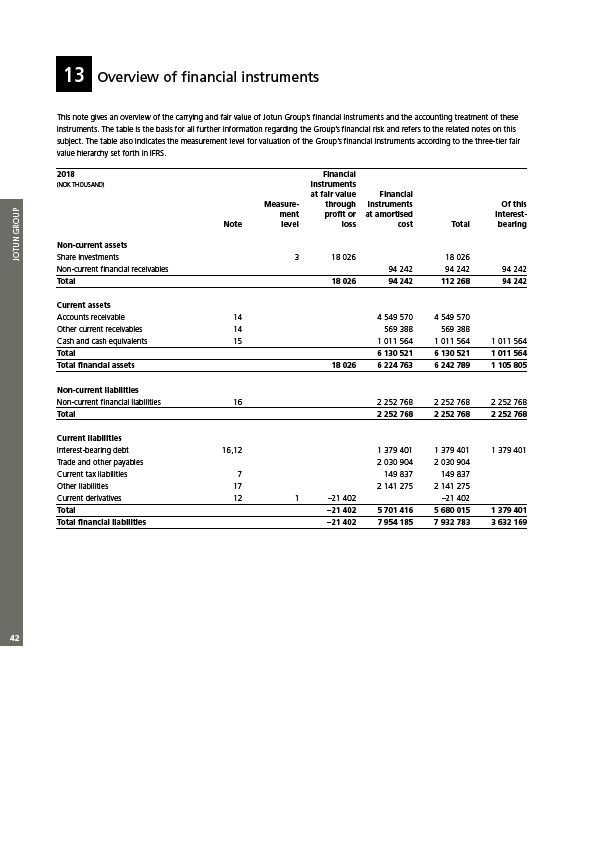

13 Overview of financial instruments

This note gives an overview of the carrying and fair value of Jotun Group’s financial instruments and the accounting treatment of these

instruments. The table is the basis for all further information regarding the Group’s financial risk and refers to the related notes on this

subject. The table also indicates the measurement level for valuation of the Group’s financial instruments according to the three-tier fair

value hierarchy set forth in IFRS.

2018 Financial

(NOK THOUSAND) instruments

at fair value Financial

Measure- through instruments Of this

ment profit or at amortised interest-

Note level loss cost Total bearing

Non-current assets

Share investments 3 18 026 18 026

Non-current financial receivables 94 242 94 242 94 242

Total 18 026 94 242 112 268 94 242

Current assets

Accounts receivable 14 4 549 570 4 549 570

Other current receivables 14 569 388 569 388

Cash and cash equivalents 15 1 011 564 1 011 564 1 011 564

Total 6 130 521 6 130 521 1 011 564

Total financial assets 18 026 6 224 763 6 242 789 1 105 805

Non-current liabilities

Non-current financial liabilities 16 2 252 768 2 252 768 2 252 768

Total 2 252 768 2 252 768 2 252 768

Current liabilities

Interest-bearing debt 16,12 1 379 401 1 379 401 1 379 401

Trade and other payables 2 030 904 2 030 904

Current tax liabilities 7 149 837 149 837

Other liabilities 17 2 141 275 2 141 275

Current derivatives 12 1 –21 402 –21 402

Total –21 402 5 701 416 5 680 015 1 379 401

Total financial liabilities –21 402 7 954 185 7 932 783 3 632 169