JOTUN GROUP

33

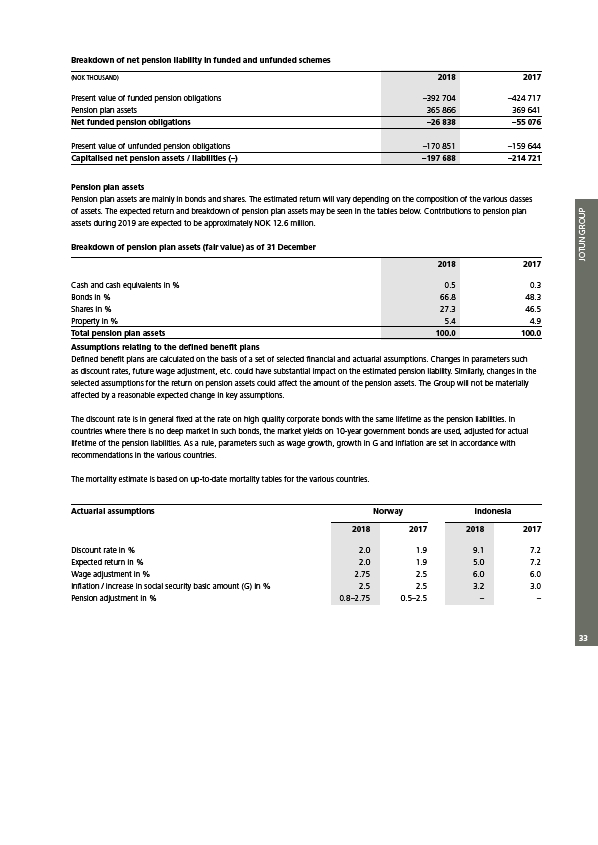

Breakdown of net pension liability in funded and unfunded schemes

(NOK THOUSAND) 2018 2017

Present value of funded pension obligations –392 704 –424 717

Pension plan assets 365 866 369 641

Net funded pension obligations –26 838 –55 076

Present value of unfunded pension obligations –170 851 –159 644

Capitalised net pension assets / liabilities (–) –197 688 –214 721

Pension plan assets

Pension plan assets are mainly in bonds and shares. The estimated return will vary depending on the composition of the various classes

of assets. The expected return and breakdown of pension plan assets may be seen in the tables below. Contributions to pension plan

assets during 2019 are expected to be approximately NOK 12.6 million.

Breakdown of pension plan assets (fair value) as of 31 December

2018 2017

Cash and cash equivalents in % 0.5 0.3

Bonds in % 66.8 48.3

Shares in % 27.3 46.5

Property in % 5.4 4.9

Total pension plan assets 100.0 100.0

Assumptions relating to the defined benefit plans

Defined benefit plans are calculated on the basis of a set of selected financial and actuarial assumptions. Changes in parameters such

as discount rates, future wage adjustment, etc. could have substantial impact on the estimated pension liability. Similarly, changes in the

selected assumptions for the return on pension assets could affect the amount of the pension assets. The Group will not be materially

affected by a reasonable expected change in key assumptions.

The discount rate is in general fixed at the rate on high quality corporate bonds with the same lifetime as the pension liabilities. In

countries where there is no deep market in such bonds, the market yields on 10-year government bonds are used, adjusted for actual

lifetime of the pension liabilities. As a rule, parameters such as wage growth, growth in G and inflation are set in accordance with

recommendations in the various countries.

The mortality estimate is based on up-to-date mortality tables for the various countries.

Norway Indonesia

Actuarial assumptions

2018 2017 2018 2017

Discount rate in % 2.0 1.9 9.1 7.2

Expected return in % 2.0 1.9 5.0 7.2

Wage adjustment in % 2.75 2.5 6.0 6.0

Inflation / increase in social security basic amount (G) in % 2.5 2.5 3.2 3.0

Pension adjustment in % 0.8–2.75 0.5–2.5 – –