JOTUN A/S

62

3 Pensions and other long-term employee benefits

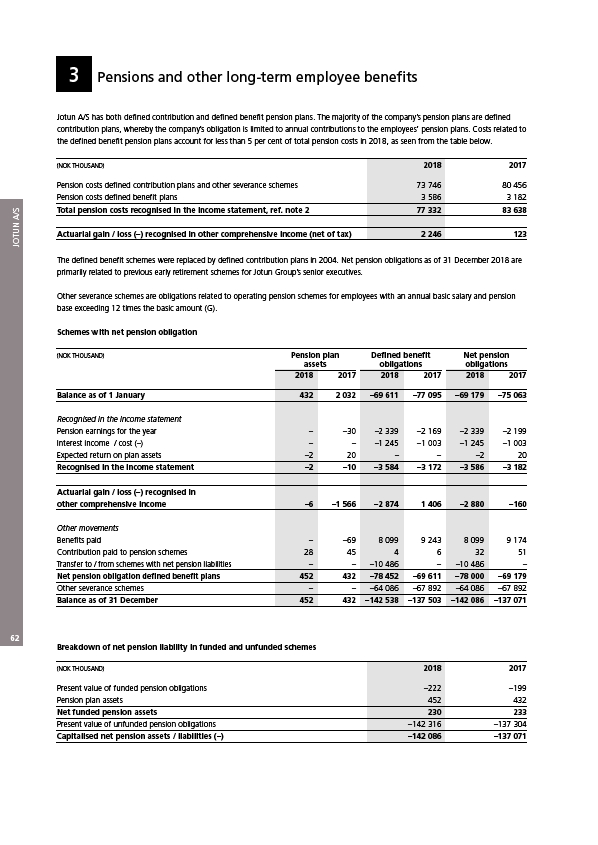

Jotun A/S has both defined contribution and defined benefit pension plans. The majority of the company’s pension plans are defined

contribution plans, whereby the company’s obligation is limited to annual contributions to the employees’ pension plans. Costs related to

the defined benefit pension plans account for less than 5 per cent of total pension costs in 2018, as seen from the table below.

(NOK THOUSAND) 2018 2017

Pension costs defined contribution plans and other severance schemes 73 746 80 456

Pension costs defined benefit plans 3 586 3 182

Total pension costs recognised in the income statement, ref. note 2 77 332 83 638

Actuarial gain / loss (–) recognised in other comprehensive income (net of tax) 2 246 123

The defined benefit schemes were replaced by defined contribution plans in 2004. Net pension obligations as of 31 December 2018 are

primarily related to previous early retirement schemes for Jotun Group’s senior executives.

Other severance schemes are obligations related to operating pension schemes for employees with an annual basic salary and pension

base exceeding 12 times the basic amount (G).

Schemes with net pension obligation

(NOK THOUSAND)

Pension plan

Defined benefit

Net pension

assets

obligations

obligations

2018 2017 2018 2017 2018 2017

Balance as of 1 January 432 2 032 –69 611 –77 095 –69 179 –75 063

Recognised in the income statement

Pension earnings for the year – –30 –2 339 –2 169 –2 339 –2 199

Interest income / cost (–) – – –1 245 –1 003 –1 245 –1 003

Expected return on plan assets –2 20 – – –2 20

Recognised in the income statement –2 –10 –3 584 –3 172 –3 586 –3 182

Actuarial gain / loss (–) recognised in

other comprehensive income –6 –1 566 –2 874 1 406 –2 880 –160

Other movements

Benefits paid – –69 8 099 9 243 8 099 9 174

Contribution paid to pension schemes 28 45 4 6 32 51

Transfer to / from schemes with net pension liabilities – – –10 486 – –10 486 –

Net pension obligation defined benefit plans 452 432 –78 452 –69 611 –78 000 –69 179

Other severance schemes – – –64 086 –67 892 –64 086 –67 892

Balance as of 31 December 452 432 –142 538 –137 503 –142 086 –137 071

Breakdown of net pension liability in funded and unfunded schemes

(NOK THOUSAND) 2018 2017

Present value of funded pension obligations –222 –199

Pension plan assets 452 432

Net funded pension assets 230 233

Present value of unfunded pension obligations –142 316 –137 304

Capitalised net pension assets / liabilities (–) –142 086 –137 071