JOTUN A/S

64

Research and development

Research and development consists of costs from projects in a research phase and development costs related to cancelled projects.

Salaries and social costs are not included. Total gross research and development costs are NOK 447 million (2017: NOK 423 million).

Development costs which meet the recognition criteria for intangible assets are capitalised. Further details on development costs are

disclosed in note 6 and in Jotun Group’s note 8.

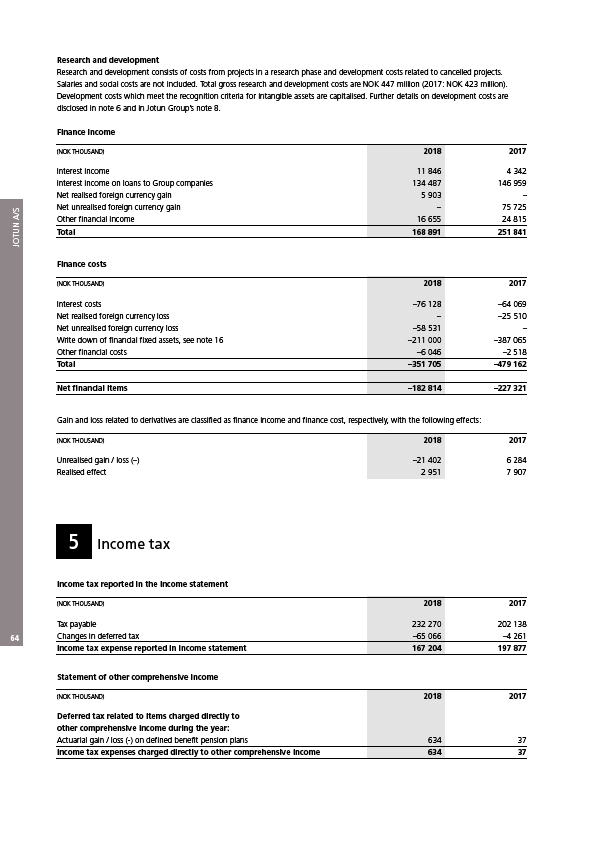

Finance income

(NOK THOUSAND) 2018 2017

Interest income 11 846 4 342

Interest income on loans to Group companies 134 487 146 959

Net realised foreign currency gain 5 903 –

Net unrealised foreign currency gain – 75 725

Other financial income 16 655 24 815

Total 168 891 251 841

Finance costs

(NOK THOUSAND) 2018 2017

Interest costs –76 128 –64 069

Net realised foreign currency loss – –25 510

Net unrealised foreign currency loss –58 531 –

Write down of financial fixed assets, see note 16 –211 000 –387 065

Other financial costs –6 046 –2 518

Total –351 705 –479 162

Net financial items –182 814 –227 321

Gain and loss related to derivatives are classified as finance income and finance cost, respectively, with the following effects:

(NOK THOUSAND) 2018 2017

Unrealised gain / loss (–) –21 402 6 284

Realised effect 2 951 7 907

5 Income tax

Income tax reported in the income statement

(NOK THOUSAND) 2018 2017

Tax payable 232 270 202 138

Changes in deferred tax –65 066 –4 261

Income tax expense reported in income statement 167 204 197 877

Statement of other comprehensive income

(NOK THOUSAND) 2018 2017

Deferred tax related to items charged directly to

other comprehensive income during the year:

Actuarial gain / loss (-) on defined benefit pension plans 634 37

Income tax expenses charged directly to other comprehensive income 634 37