JOTUN GROUP

43

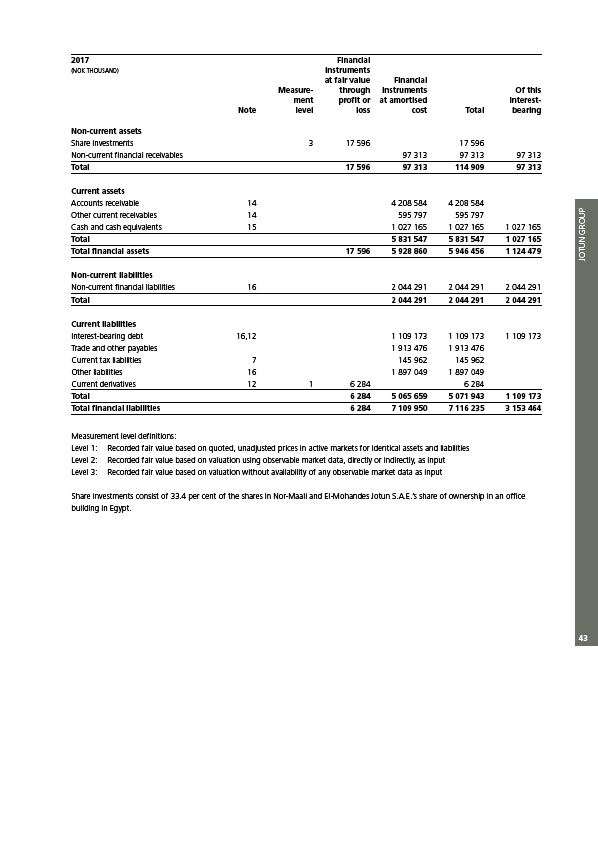

2017 Financial

(NOK THOUSAND) instruments

at fair value Financial

Measure- through instruments Of this

ment profit or at amortised interest-

Note level loss cost Total bearing

Non-current assets

Share investments 3 17 596 17 596

Non-current financial receivables 97 313 97 313 97 313

Total 17 596 97 313 114 909 97 313

Current assets

Accounts receivable 14 4 208 584 4 208 584

Other current receivables 14 595 797 595 797

Cash and cash equivalents 15 1 027 165 1 027 165 1 027 165

Total 5 831 547 5 831 547 1 027 165

Total financial assets 17 596 5 928 860 5 946 456 1 124 479

Non-current liabilities

Non-current financial liabilities 16 2 044 291 2 044 291 2 044 291

Total 2 044 291 2 044 291 2 044 291

Current liabilities

Interest-bearing debt 16,12 1 109 173 1 109 173 1 109 173

Trade and other payables 1 913 476 1 913 476

Current tax liabilities 7 145 962 145 962

Other liabilities 16 1 897 049 1 897 049

Current derivatives 12 1 6 284 6 284

Total 6 284 5 065 659 5 071 943 1 109 173

Total financial liabilities 6 284 7 109 950 7 116 235 3 153 464

Measurement level definitions:

Level 1: Recorded fair value based on quoted, unadjusted prices in active markets for identical assets and liabilities

Level 2: Recorded fair value based on valuation using observable market data, directly or indirectly, as input

Level 3: Recorded fair value based on valuation without availability of any observable market data as input

Share investments consist of 33.4 per cent of the shares in Nor-Maali and El-Mohandes Jotun S.A.E.’s share of ownership in an office

building in Egypt.