JOTUN GROUP

36

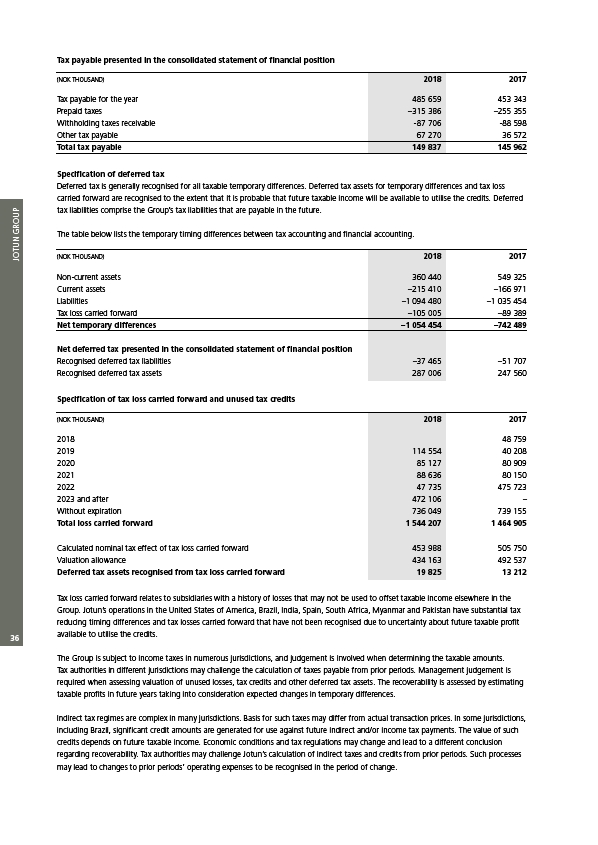

Tax payable presented in the consolidated statement of financial position

(NOK THOUSAND) 2018 2017

Tax payable for the year 485 659 453 343

Prepaid taxes –315 386 –255 355

Withholding taxes receivable -87 706 -88 598

Other tax payable 67 270 36 572

Total tax payable 149 837 145 962

Specification of deferred tax

Deferred tax is generally recognised for all taxable temporary differences. Deferred tax assets for temporary differences and tax loss

carried forward are recognised to the extent that it is probable that future taxable income will be available to utilise the credits. Deferred

tax liabilities comprise the Group’s tax liabilities that are payable in the future.

The table below lists the temporary timing differences between tax accounting and financial accounting.

(NOK THOUSAND) 2018 2017

Non-current assets 360 440 549 325

Current assets –215 410 –166 971

Liabilities –1 094 480 –1 035 454

Tax loss carried forward –105 005 –89 389

Net temporary differences –1 054 454 –742 489

Net deferred tax presented in the consolidated statement of financial position

Recognised deferred tax liabilities –37 465 –51 707

Recognised deferred tax assets 287 006 247 560

Specification of tax loss carried forward and unused tax credits

(NOK THOUSAND) 2018 2017

2018 48 759

2019 114 554 40 208

2020 85 127 80 909

2021 88 636 80 150

2022 47 735 475 723

2023 and after 472 106 –

Without expiration 736 049 739 155

Total loss carried forward 1 544 207 1 464 905

Calculated nominal tax effect of tax loss carried forward 453 988 505 750

Valuation allowance 434 163 492 537

Deferred tax assets recognised from tax loss carried forward 19 825 13 212

Tax loss carried forward relates to subsidiaries with a history of losses that may not be used to offset taxable income elsewhere in the

Group. Jotun’s operations in the United States of America, Brazil, India, Spain, South Africa, Myanmar and Pakistan have substantial tax

reducing timing differences and tax losses carried forward that have not been recognised due to uncertainty about future taxable profit

available to utilise the credits.

The Group is subject to income taxes in numerous jurisdictions, and judgement is involved when determining the taxable amounts.

Tax authorities in different jurisdictions may challenge the calculation of taxes payable from prior periods. Management judgement is

required when assessing valuation of unused losses, tax credits and other deferred tax assets. The recoverability is assessed by estimating

taxable profits in future years taking into consideration expected changes in temporary differences.

Indirect tax regimes are complex in many jurisdictions. Basis for such taxes may differ from actual transaction prices. In some jurisdictions,

including Brazil, significant credit amounts are generated for use against future indirect and/or income tax payments. The value of such

credits depends on future taxable income. Economic conditions and tax regulations may change and lead to a different conclusion

regarding recoverability. Tax authorities may challenge Jotun’s calculation of indirect taxes and credits from prior periods. Such processes

may lead to changes to prior periods’ operating expenses to be recognised in the period of change.