JOTUN GROUP

27

respective countries. Further details about the assumptions used

are given in note 5.

Environmental provisions

A number of factories have been inspected regarding

environmental conditions in the ground. Actions have either

been taken on own initiative or implemented on the order

of local authorities. Inspections and measurements are made

by independent specialists in the field. For clean-up projects

where implementation is considered to be probable, and for

which reliable estimates have been done, provisions are made

accordingly. Provisions for remediation costs are made based on

the following;

• Laws and regulations presently or virtually certain to be

enacted

• Conducted inspections, either taken on own initiative or

implemented on the order of local authorities

• Inspections and measurements made by independent

specialists in the field

• Prior experience in remediation of contaminated sites

Future expenditures for remediation work depend on a number

of uncertain factors which include, but are not limited to, the

extent and type of remediation required. Environmental laws

and regulations may change, and such changes may require

the Group to make investments and/or increase costs. Due to

uncertainties inherent in the estimation process, it is possible

that such estimates could be revised in the near term. Further

reference is made to note 11.

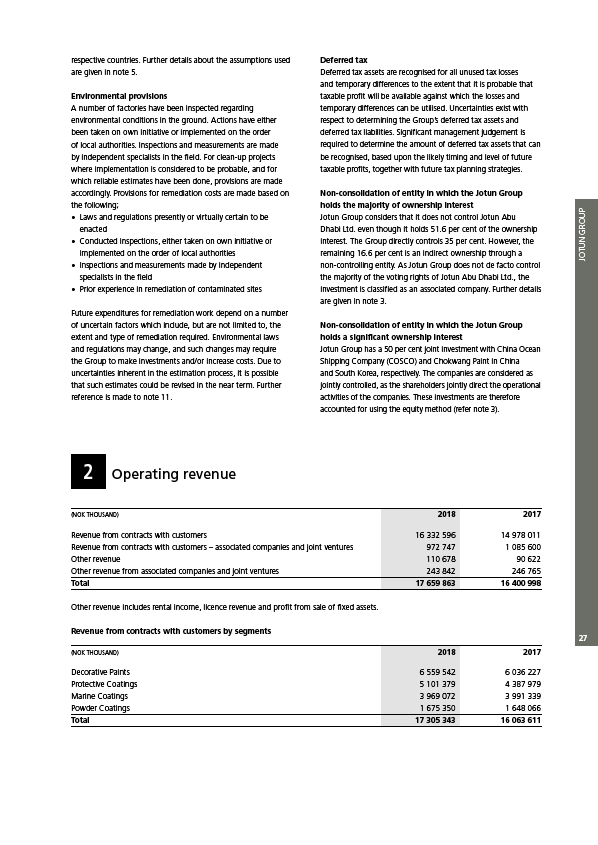

2 Operating revenue

Deferred tax

Deferred tax assets are recognised for all unused tax losses

and temporary differences to the extent that it is probable that

taxable profit will be available against which the losses and

temporary differences can be utilised. Uncertainties exist with

respect to determining the Group’s deferred tax assets and

deferred tax liabilities. Significant management judgement is

required to determine the amount of deferred tax assets that can

be recognised, based upon the likely timing and level of future

taxable profits, together with future tax planning strategies.

Non-consolidation of entity in which the Jotun Group

holds the majority of ownership interest

Jotun Group considers that it does not control Jotun Abu

Dhabi Ltd. even though it holds 51.6 per cent of the ownership

interest. The Group directly controls 35 per cent. However, the

remaining 16.6 per cent is an indirect ownership through a

non-controlling entity. As Jotun Group does not de facto control

the majority of the voting rights of Jotun Abu Dhabi Ltd., the

investment is classified as an associated company. Further details

are given in note 3.

Non-consolidation of entity in which the Jotun Group

holds a significant ownership interest

Jotun Group has a 50 per cent joint investment with China Ocean

Shipping Company (COSCO) and Chokwang Paint in China

and South Korea, respectively. The companies are considered as

jointly controlled, as the shareholders jointly direct the operational

activities of the companies. These investments are therefore

accounted for using the equity method (refer note 3).

(NOK THOUSAND) 2018 2017

Revenue from contracts with customers 16 332 596 14 978 011

Revenue from contracts with customers – associated companies and joint ventures 972 747 1 085 600

Other revenue 110 678 90 622

Other revenue from associated companies and joint ventures 243 842 246 765

Total 17 659 863 16 400 998

Other revenue includes rental income, licence revenue and profit from sale of fixed assets.

Revenue from contracts with customers by segments

(NOK THOUSAND) 2018 2017

Decorative Paints 6 559 542 6 036 227

Protective Coatings 5 101 379 4 387 979

Marine Coatings 3 969 072 3 991 339

Powder Coatings 1 675 350 1 648 066

Total 17 305 343 16 063 611