JOTUN A/S

68

10 Financial and commercial risk management

Jotun A/S is exposed to market risks like fluctuations in prices

of raw materials, currency exchange rates and interest rates.

Jotun A/S uses financial instruments to reduce these risks in

accordance with the Group’s treasury policy.

Categories of financial risks and risk policies

for Jotun A/S

FOREIGN CURRENCY RISK

Foreign currency risk on net investments

As NOK is the functional currency for Jotun A/S and the

presentation currency, Jotun A/S is exposed to currency

translation risk for net investments in foreign operations. Jotun

A/S finances most of the investments for the Jotun Group,

and therefore has a substantial intercompany loan portfolio

in different currencies, see table below. Jotun A/S has a USD

102 million external loan established in 2013, see note 13. The

currency gains/losses are presented as part of net finance costs

in the income statement, see note 4 for more information.

Jotun Group’s note 12 gives additional information regarding

financial risk management.

Total loans given in foreign currency from Jotun A/S to its

subsidiaries, joint ventures and associates as of 31 December

2018 was NOK 2 579 million, of which NOK 2 509 million was

in foreign currency. The following table gives an overview of

the main currency exposures related to internal loans in foreign

currency.

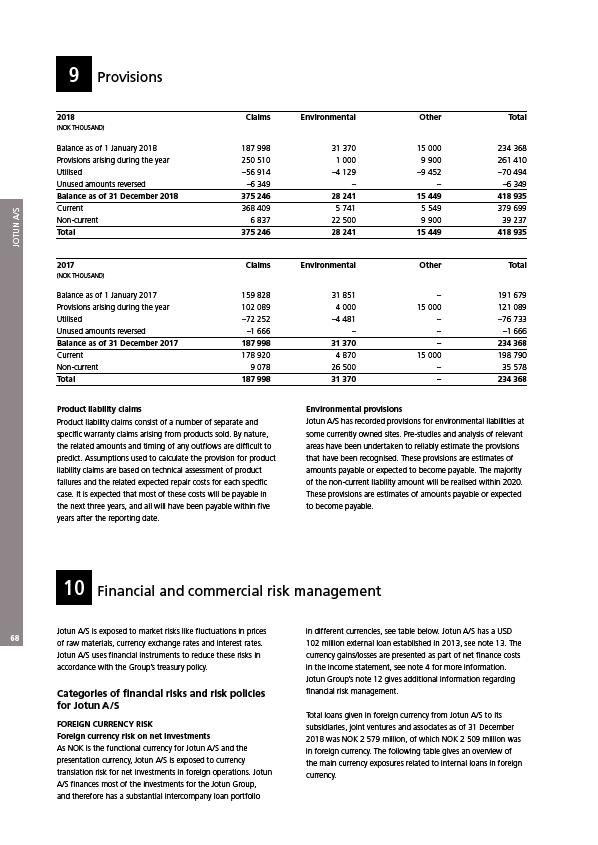

Product liability claims

Product liability claims consist of a number of separate and

specific warranty claims arising from products sold. By nature,

the related amounts and timing of any outflows are difficult to

predict. Assumptions used to calculate the provision for product

liability claims are based on technical assessment of product

failures and the related expected repair costs for each specific

case. It is expected that most of these costs will be payable in

the next three years, and all will have been payable within five

years after the reporting date.

Environmental provisions

Jotun A/S has recorded provisions for environmental liabilities at

some currently owned sites. Pre-studies and analysis of relevant

areas have been undertaken to reliably estimate the provisions

that have been recognised. These provisions are estimates of

amounts payable or expected to become payable. The majority

of the non-current liability amount will be realised within 2020.

These provisions are estimates of amounts payable or expected

to become payable.

9 Provisions

2018 Claims Environmental Other Total

(NOK THOUSAND)

Balance as of 1 January 2018 187 998 31 370 15 000 234 368

Provisions arising during the year 250 510 1 000 9 900 261 410

Utilised –56 914 –4 129 –9 452 –70 494

Unused amounts reversed –6 349 – – –6 349

Balance as of 31 December 2018 375 246 28 241 15 449 418 935

Current 368 409 5 741 5 549 379 699

Non-current 6 837 22 500 9 900 39 237

Total 375 246 28 241 15 449 418 935

2017 Claims Environmental Other Total

(NOK THOUSAND)

Balance as of 1 January 2017 159 828 31 851 – 191 679

Provisions arising during the year 102 089 4 000 15 000 121 089

Utilised –72 252 –4 481 – –76 733

Unused amounts reversed –1 666 – – –1 666

Balance as of 31 December 2017 187 998 31 370 – 234 368

Current 178 920 4 870 15 000 198 790

Non-current 9 078 26 500 – 35 578

Total 187 998 31 370 – 234 368