JOTUN A/S

63

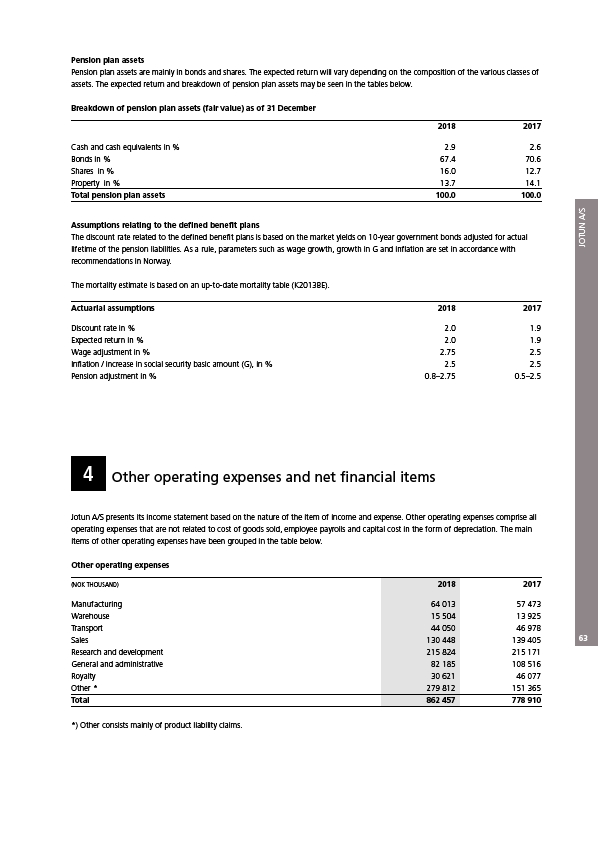

Pension plan assets

Pension plan assets are mainly in bonds and shares. The expected return will vary depending on the composition of the various classes of

assets. The expected return and breakdown of pension plan assets may be seen in the tables below.

Breakdown of pension plan assets (fair value) as of 31 December

2018 2017

Cash and cash equivalents in % 2.9 2.6

Bonds in % 67.4 70.6

Shares in % 16.0 12.7

Property in % 13.7 14.1

Total pension plan assets 100.0 100.0

Assumptions relating to the defined benefit plans

The discount rate related to the defined benefit plans is based on the market yields on 10-year government bonds adjusted for actual

lifetime of the pension liabilities. As a rule, parameters such as wage growth, growth in G and inflation are set in accordance with

recommendations in Norway.

The mortality estimate is based on an up-to-date mortality table (K2013BE).

Actuarial assumptions 2018 2017

Discount rate in % 2.0 1.9

Expected return in % 2.0 1.9

Wage adjustment in % 2.75 2.5

Inflation / increase in social security basic amount (G), in % 2.5 2.5

Pension adjustment in % 0.8–2.75 0.5–2.5

4 Other operating expenses and net financial items

Jotun A/S presents its income statement based on the nature of the item of income and expense. Other operating expenses comprise all

operating expenses that are not related to cost of goods sold, employee payrolls and capital cost in the form of depreciation. The main

items of other operating expenses have been grouped in the table below.

Other operating expenses

(NOK THOUSAND) 2018 2017

Manufacturing 64 013 57 473

Warehouse 15 504 13 925

Transport 44 050 46 978

Sales 130 448 139 405

Research and development 215 824 215 171

General and administrative 82 185 108 516

Royalty 30 621 46 077

Other * 279 812 151 365

Total 862 457 778 910

*) Other consists mainly of product liability claims.