JOTUN A/S

65

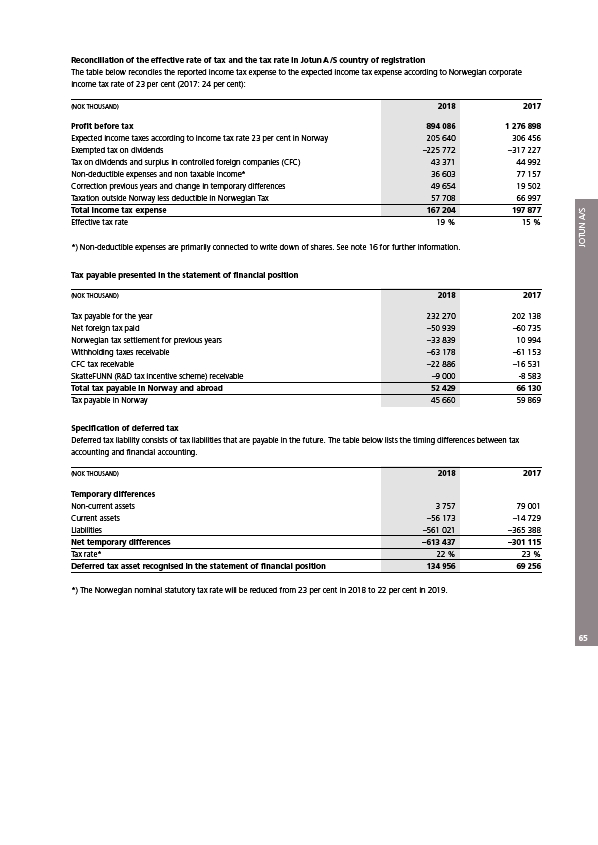

Reconciliation of the effective rate of tax and the tax rate in Jotun A/S country of registration

The table below reconciles the reported income tax expense to the expected income tax expense according to Norwegian corporate

income tax rate of 23 per cent (2017: 24 per cent):

(NOK THOUSAND) 2018 2017

Profit before tax 894 086 1 276 898

Expected income taxes according to income tax rate 23 per cent in Norway 205 640 306 456

Exempted tax on dividends –225 772 –317 227

Tax on dividends and surplus in controlled foreign companies (CFC) 43 371 44 992

Non-deductible expenses and non taxable income* 36 603 77 157

Correction previous years and change in temporary differences 49 654 19 502

Taxation outside Norway less deductible in Norwegian Tax 57 708 66 997

Total income tax expense 167 204 197 877

Effective tax rate 19 % 15 %

*) Non-deductible expenses are primarily connected to write down of shares. See note 16 for further information.

Tax payable presented in the statement of financial position

(NOK THOUSAND) 2018 2017

Tax payable for the year 232 270 202 138

Net foreign tax paid –50 939 –60 735

Norwegian tax settlement for previous years –33 839 10 994

Withholding taxes receivable –63 178 –61 153

CFC tax receivable –22 886 –16 531

SkatteFUNN (R&D tax incentive scheme) receivable –9 000 -8 583

Total tax payable in Norway and abroad 52 429 66 130

Tax payable in Norway 45 660 59 869

Specification of deferred tax

Deferred tax liability consists of tax liabilities that are payable in the future. The table below lists the timing differences between tax

accounting and financial accounting.

(NOK THOUSAND) 2018 2017

Temporary differences

Non-current assets 3 757 79 001

Current assets –56 173 –14 729

Liabilities –561 021 –365 388

Net temporary differences –613 437 –301 115

Tax rate* 22 % 23 %

Deferred tax asset recognised in the statement of financial position 134 956 69 256

*) The Norwegian nominal statutory tax rate will be reduced from 23 per cent in 2018 to 22 per cent in 2019.