JOTUN A/S

69

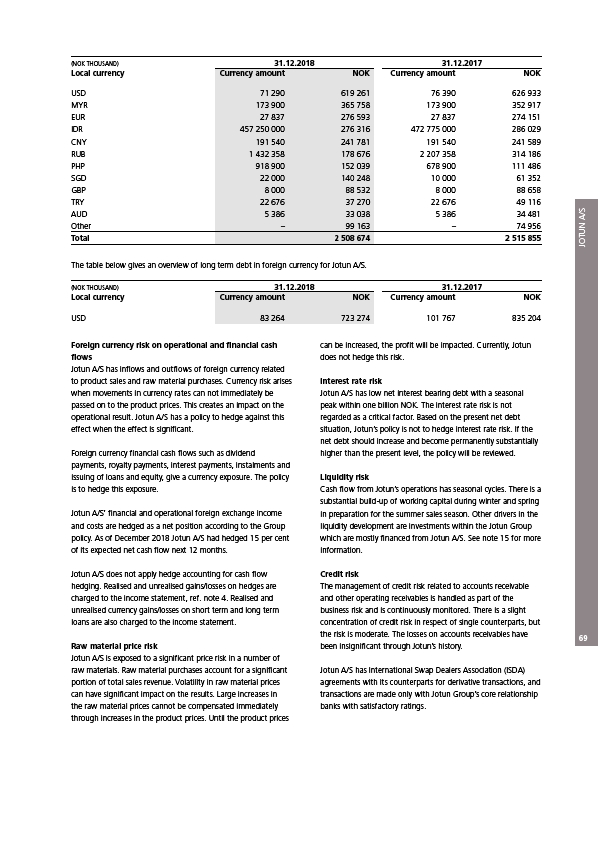

(NOK THOUSAND) 31.12.2018

31.12.2017

Local currency Currency amount NOK Currency amount NOK

USD 71 290 619 261 76 390 626 933

MYR 173 900 365 758 173 900 352 917

EUR 27 837 276 593 27 837 274 151

IDR 457 250 000 276 316 472 775 000 286 029

CNY 191 540 241 781 191 540 241 589

RUB 1 432 358 178 676 2 207 358 314 186

PHP 918 900 152 039 678 900 111 486

SGD 22 000 140 248 10 000 61 352

GBP 8 000 88 532 8 000 88 658

TRY 22 676 37 270 22 676 49 116

AUD 5 386 33 038 5 386 34 481

Other – 99 163 – 74 956

Total 2 508 674 2 515 855

The table below gives an overview of long term debt in foreign currency for Jotun A/S.

(NOK THOUSAND)

Local currency Currency amount NOK Currency amount NOK

USD 83 264 723 274 101 767 835 204

Foreign currency risk on operational and financial cash

flows

Jotun A/S has inflows and outflows of foreign currency related

to product sales and raw material purchases. Currency risk arises

when movements in currency rates can not immediately be

passed on to the product prices. This creates an impact on the

operational result. Jotun A/S has a policy to hedge against this

effect when the effect is significant.

Foreign currency financial cash flows such as dividend

payments, royalty payments, interest payments, instalments and

issuing of loans and equity, give a currency exposure. The policy

is to hedge this exposure.

Jotun A/S’ financial and operational foreign exchange income

and costs are hedged as a net position according to the Group

policy. As of December 2018 Jotun A/S had hedged 15 per cent

of its expected net cash flow next 12 months.

Jotun A/S does not apply hedge accounting for cash flow

hedging. Realised and unrealised gains/losses on hedges are

charged to the income statement, ref. note 4. Realised and

unrealised currency gains/losses on short term and long term

loans are also charged to the income statement.

Raw material price risk

Jotun A/S is exposed to a significant price risk in a number of

raw materials. Raw material purchases account for a significant

portion of total sales revenue. Volatility in raw material prices

can have significant impact on the results. Large increases in

the raw material prices cannot be compensated immediately

through increases in the product prices. Until the product prices

can be increased, the profit will be impacted. Currently, Jotun

does not hedge this risk.

Interest rate risk

Jotun A/S has low net interest bearing debt with a seasonal

peak within one billion NOK. The interest rate risk is not

regarded as a critical factor. Based on the present net debt

situation, Jotun’s policy is not to hedge interest rate risk. If the

net debt should increase and become permanently substantially

higher than the present level, the policy will be reviewed.

Liquidity risk

Cash flow from Jotun’s operations has seasonal cycles. There is a

substantial build-up of working capital during winter and spring

in preparation for the summer sales season. Other drivers in the

liquidity development are investments within the Jotun Group

which are mostly financed from Jotun A/S. See note 15 for more

information.

Credit risk

The management of credit risk related to accounts receivable

and other operating receivables is handled as part of the

business risk and is continuously monitored. There is a slight

concentration of credit risk in respect of single counterparts, but

the risk is moderate. The losses on accounts receivables have

been insignificant through Jotun’s history.

Jotun A/S has International Swap Dealers Association (ISDA)

agreements with its counterparts for derivative transactions, and

transactions are made only with Jotun Group’s core relationship

banks with satisfactory ratings.

31.12.2018

31.12.2017