JOTUN GROUP

40

12 Financial and commercial risk management

Jotun is exposed to market risks like fluctuations in prices of

raw materials, currency exchange rates and interest rates, and

volatility in these may have a substantial impact on Jotun’s

results. Jotun’s business model, with four distinctive segments

and geographical spread, provide natural hedges to reduce the

financial and commercial risks inherent in the market. Jotun’s

main policy is to manage this risk exposure close to its origin

unless the risk is regarded as significant. Jotun strives to utilise

natural hedges of financial risks where possible.

Jotun’s treasury function provides service to the business and

shall ensure that the Group has financing to meet both shortterm

funding needs and the long-term strategic ambitions

of Jotun. Jotun maintains a robust financial capacity without

undertaking any rating from rating agencies.

Jotun A/S has International Swap Dealers Association (ISDA)

agreements with its counterparts for financial derivative

transactions, and transactions are made only with Jotun Group’s

core relationship banks with satisfactory ratings.

Raw material price risk

The Group is exposed to a significant price risk in a number of

raw materials. Raw material purchases account for a significant

portion of total sales revenue. The largest raw materials are

titanium dioxide, emulsions, epoxy resins, metals and solvent that

account for approximately 53 per cent of total raw material cost.

Volatility in raw material prices can have a significant impact on

the Group’s results. Large increases in the raw material prices

cannot be compensated immediately in the product prices. Until

the product prices can be increased, the profit will be impacted.

Currently, Jotun does not hedge this risk.

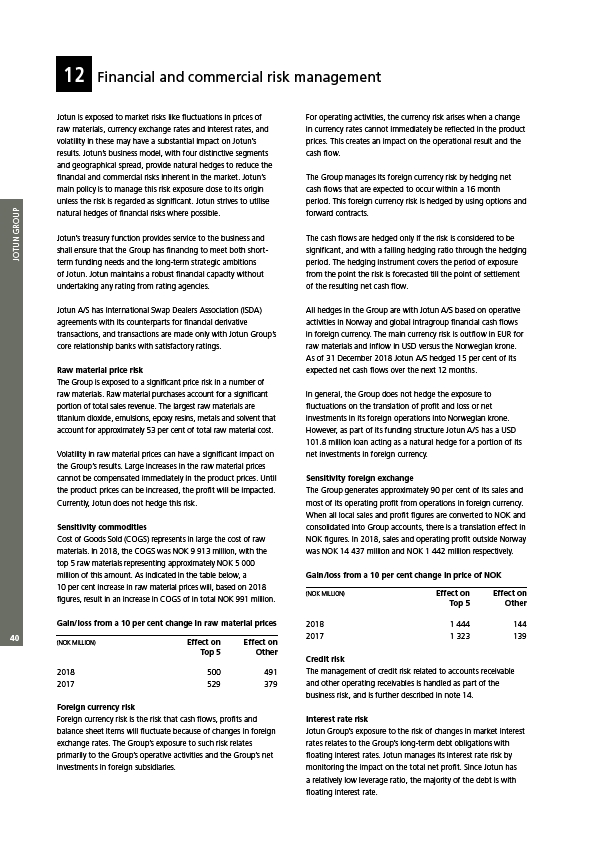

Sensitivity commodities

Cost of Goods Sold (COGS) represents in large the cost of raw

materials. In 2018, the COGS was NOK 9 913 million, with the

top 5 raw materials representing approximately NOK 5 000

million of this amount. As indicated in the table below, a

10 per cent increase in raw material prices will, based on 2018

figures, result in an increase in COGS of in total NOK 991 million.

Gain/loss from a 10 per cent change in raw material prices

Foreign currency risk

Foreign currency risk is the risk that cash flows, profits and

balance sheet items will fluctuate because of changes in foreign

exchange rates. The Group’s exposure to such risk relates

primarily to the Group’s operative activities and the Group’s net

investments in foreign subsidiaries.

For operating activities, the currency risk arises when a change

in currency rates cannot immediately be reflected in the product

prices. This creates an impact on the operational result and the

cash flow.

The Group manages its foreign currency risk by hedging net

cash flows that are expected to occur within a 16 month

period. This foreign currency risk is hedged by using options and

forward contracts.

The cash flows are hedged only if the risk is considered to be

significant, and with a falling hedging ratio through the hedging

period. The hedging instrument covers the period of exposure

from the point the risk is forecasted till the point of settlement

of the resulting net cash flow.

All hedges in the Group are with Jotun A/S based on operative

activities in Norway and global intragroup financial cash flows

in foreign currency. The main currency risk is outflow in EUR for

raw materials and inflow in USD versus the Norwegian krone.

As of 31 December 2018 Jotun A/S hedged 15 per cent of its

expected net cash flows over the next 12 months.

In general, the Group does not hedge the exposure to

fluctuations on the translation of profit and loss or net

investments in its foreign operations into Norwegian krone.

However, as part of its funding structure Jotun A/S has a USD

101.8 million loan acting as a natural hedge for a portion of its

net investments in foreign currency.

Sensitivity foreign exchange

The Group generates approximately 90 per cent of its sales and

most of its operating profit from operations in foreign currency.

When all local sales and profit figures are converted to NOK and

consolidated into Group accounts, there is a translation effect in

NOK figures. In 2018, sales and operating profit outside Norway

was NOK 14 437 million and NOK 1 442 million respectively.

Gain/loss from a 10 per cent change in price of NOK

(NOK MILLION) Effect on Effect on

Top 5 Other

2018 1 444 144

2017 1 323 139

Credit risk

The management of credit risk related to accounts receivable

and other operating receivables is handled as part of the

business risk, and is further described in note 14.

Interest rate risk

Jotun Group’s exposure to the risk of changes in market interest

rates relates to the Group’s long-term debt obligations with

floating interest rates. Jotun manages its interest rate risk by

monitoring the impact on the total net profit. Since Jotun has

a relatively low leverage ratio, the majority of the debt is with

floating interest rate.

(NOK MILLION) Effect on Effect on

Top 5 Other

2018 500 491

2017 529 379