JOTUN GROUP

35

7 Tax

Income tax expense refers to the authorities’ taxation of the profits of the different companies in the Group. Indirect taxes like value

added tax, social security contribution etc. are not included as part of income taxes. Income tax is computed on the basis of accounting

profit or loss and broken down into current taxes and change in deferred taxes. Deferred tax is the result of temporary timing differences

between financial accounting and tax accounting. The major components of the income tax expense for the years ended 31 December

2018 and 2017 are:

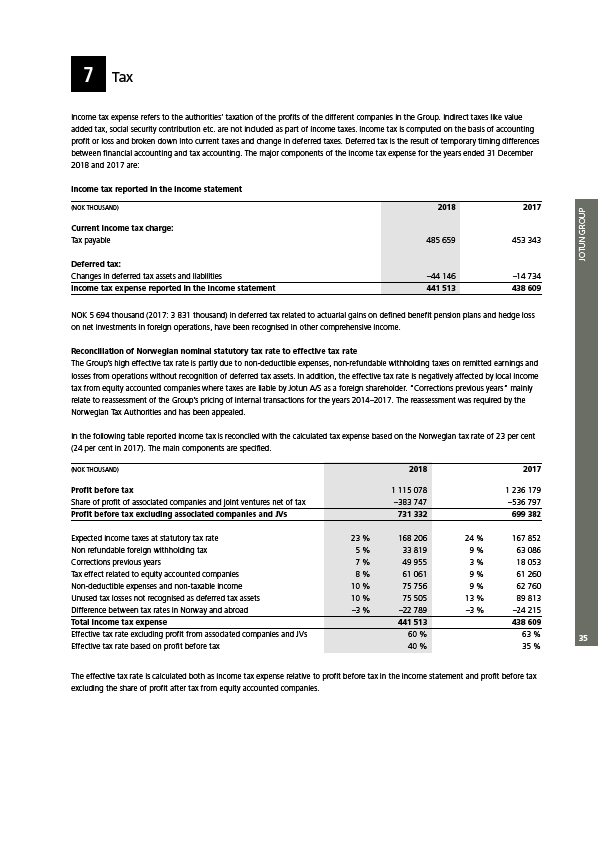

Income tax reported in the income statement

(NOK THOUSAND) 2018 2017

Current income tax charge:

Tax payable 485 659 453 343

Deferred tax:

Changes in deferred tax assets and liabilities –44 146 –14 734

Income tax expense reported in the income statement 441 513 438 609

NOK 5 694 thousand (2017: 3 831 thousand) in deferred tax related to actuarial gains on defined benefit pension plans and hedge loss

on net investments in foreign operations, have been recognised in other comprehensive income.

Reconciliation of Norwegian nominal statutory tax rate to effective tax rate

The Group’s high effective tax rate is partly due to non-deductible expenses, non-refundable withholding taxes on remitted earnings and

losses from operations without recognition of deferred tax assets. In addition, the effective tax rate is negatively affected by local income

tax from equity accounted companies where taxes are liable by Jotun A/S as a foreign shareholder. “Corrections previous years” mainly

relate to reassessment of the Group’s pricing of internal transactions for the years 2014–2017. The reassessment was required by the

Norwegian Tax Authorities and has been appealed.

In the following table reported income tax is reconciled with the calculated tax expense based on the Norwegian tax rate of 23 per cent

(24 per cent in 2017). The main components are specified.

(NOK THOUSAND) 2018 2017

Profit before tax 1 115 078 1 236 179

Share of profit of associated companies and joint ventures net of tax –383 747 –536 797

Profit before tax excluding associated companies and JVs 731 332 699 382

Expected income taxes at statutory tax rate 23 % 168 206 24 % 167 852

Non refundable foreign withholding tax 5 % 33 819 9 % 63 086

Corrections previous years 7 % 49 955 3 % 18 053

Tax effect related to equity accounted companies 8 % 61 061 9 % 61 260

Non-deductible expenses and non-taxable income 10 % 75 756 9 % 62 760

Unused tax losses not recognised as deferred tax assets 10 % 75 505 13 % 89 813

Difference between tax rates in Norway and abroad –3 % –22 789 –3 % –24 215

Total income tax expense 441 513 438 609

Effective tax rate excluding profit from associated companies and JVs 60 % 63 %

Effective tax rate based on profit before tax 40 % 35 %

The effective tax rate is calculated both as income tax expense relative to profit before tax in the income statement and profit before tax

excluding the share of profit after tax from equity accounted companies.