JOTUN A/S

70

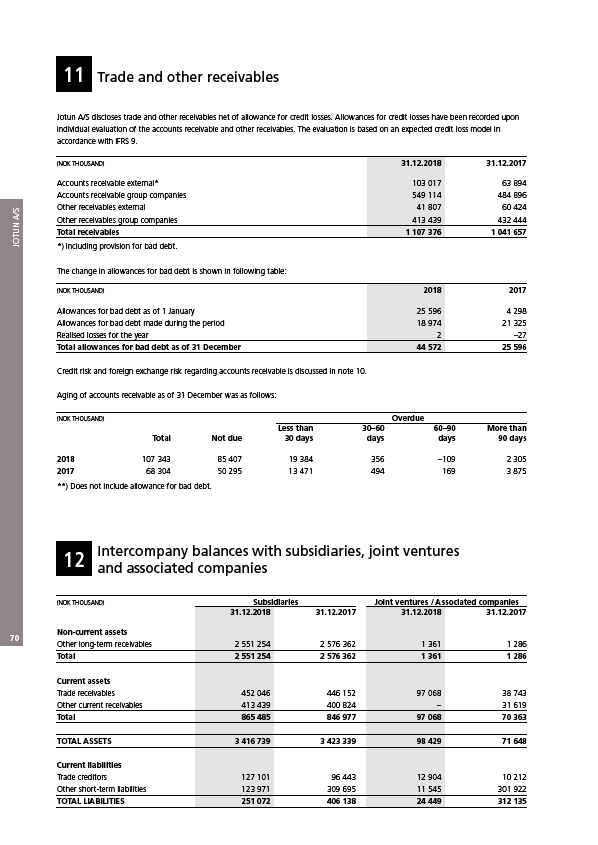

11 Trade and other receivables

Jotun A/S discloses trade and other receivables net of allowance for credit losses. Allowances for credit losses have been recorded upon

individual evaluation of the accounts receivable and other receivables. The evaluation is based on an expected credit loss model in

accordance with IFRS 9.

(NOK THOUSAND) 31.12.2018 31.12.2017

Accounts receivable external* 103 017 63 894

Accounts receivable group companies 549 114 484 896

Other receivables external 41 807 60 424

Other receivables group companies 413 439 432 444

Total receivables 1 107 376 1 041 657

*) Including provision for bad debt.

The change in allowances for bad debt is shown in following table:

(NOK THOUSAND) 2018 2017

Allowances for bad debt as of 1 January 25 596 4 298

Allowances for bad debt made during the period 18 974 21 325

Realised losses for the year 2 –27

Total allowances for bad debt as of 31 December 44 572 25 596

Credit risk and foreign exchange risk regarding accounts receivable is discussed in note 10.

Aging of accounts receivable as of 31 December was as follows:

(NOK THOUSAND) Overdueeeeeeee

Less than 30–60 60–90 More than

Total Not due 30 days days days 90 days

2018 107 343 85 407 19 384 356 –109 2 305

2017 68 304 50 295 13 471 494 169 3 875

**) Does not include allowance for bad debt.

Intercompany balances with subsidiaries, joint ventures

and associated companies 12

Subsidiaries Joint ventures / Associated companies

(NOK THOUSAND)

31.12.2018 31.12.2017 31.12.2018 31.12.2017

Non-current assets

Other long-term receivables 2 551 254 2 576 362 1 361 1 286

Total 2 551 254 2 576 362 1 361 1 286

Current assets

Trade receivables 452 046 446 152 97 068 38 743

Other current receivables 413 439 400 824 – 31 619

Total 865 485 846 977 97 068 70 363

TOTAL ASSETS 3 416 739 3 423 339 98 429 71 648

Current liabilities

Trade creditors 127 101 96 443 12 904 10 212

Other short-term liabilities 123 971 309 695 11 545 301 922

TOTAL LIABILITIES 251 072 406 138 24 449 312 135