JOTUN GROUP

44

14 Trade and other receivables

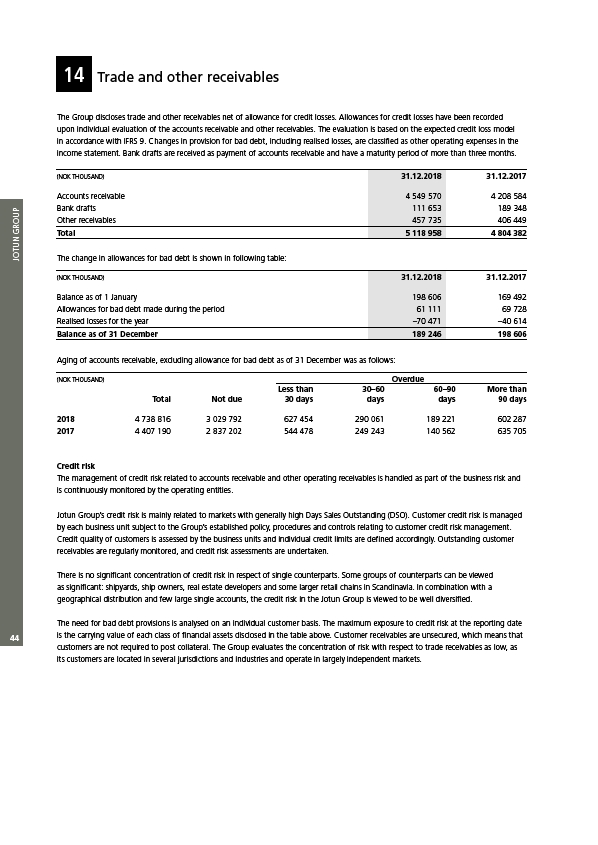

The Group discloses trade and other receivables net of allowance for credit losses. Allowances for credit losses have been recorded

upon individual evaluation of the accounts receivable and other receivables. The evaluation is based on the expected credit loss model

in accordance with IFRS 9. Changes in provision for bad debt, including realised losses, are classified as other operating expenses in the

income statement. Bank drafts are received as payment of accounts receivable and have a maturity period of more than three months.

(NOK THOUSAND) 31.12.2018 31.12.2017

Accounts receivable 4 549 570 4 208 584

Bank drafts 111 653 189 348

Other receivables 457 735 406 449

Total 5 118 958 4 804 382

The change in allowances for bad debt is shown in following table:

(NOK THOUSAND) 31.12.2018 31.12.2017

Balance as of 1 January 198 606 169 492

Allowances for bad debt made during the period 61 111 69 728

Realised losses for the year –70 471 –40 614

Balance as of 31 December 189 246 198 606

Aging of accounts receivable, excluding allowance for bad debt as of 31 December was as follows:

(NOK THOUSAND) Overdueeeeeeee

Less than 30–60 60–90 More than

Total Not due 30 days days days 90 days

2018 4 738 816 3 029 792 627 454 290 061 189 221 602 287

2017 4 407 190 2 837 202 544 478 249 243 140 562 635 705

Credit risk

The management of credit risk related to accounts receivable and other operating receivables is handled as part of the business risk and

is continuously monitored by the operating entities.

Jotun Group’s credit risk is mainly related to markets with generally high Days Sales Outstanding (DSO). Customer credit risk is managed

by each business unit subject to the Group’s established policy, procedures and controls relating to customer credit risk management.

Credit quality of customers is assessed by the business units and individual credit limits are defined accordingly. Outstanding customer

receivables are regularly monitored, and credit risk assessments are undertaken.

There is no significant concentration of credit risk in respect of single counterparts. Some groups of counterparts can be viewed

as significant: shipyards, ship owners, real estate developers and some larger retail chains in Scandinavia. In combination with a

geographical distribution and few large single accounts, the credit risk in the Jotun Group is viewed to be well diversified.

The need for bad debt provisions is analysed on an individual customer basis. The maximum exposure to credit risk at the reporting date

is the carrying value of each class of financial assets disclosed in the table above. Customer receivables are unsecured, which means that

customers are not required to post collateral. The Group evaluates the concentration of risk with respect to trade receivables as low, as

its customers are located in several jurisdictions and industries and operate in largely independent markets.