JOTUN GROUP

38

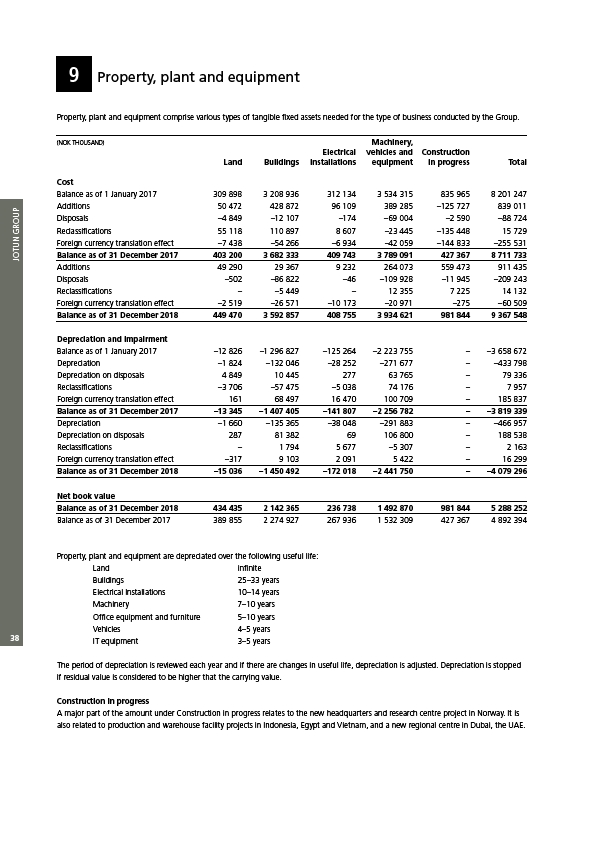

9 Property, plant and equipment

Property, plant and equipment comprise various types of tangible fixed assets needed for the type of business conducted by the Group.

(NOK THOUSAND) Machinery,

Electrical vehicles and Construction

Land Buildings installations equipment in progress Total

Cost

Balance as of 1 January 2017 309 898 3 208 936 312 134 3 534 315 835 965 8 201 247

Additions 50 472 428 872 96 109 389 285 –125 727 839 011

Disposals –4 849 –12 107 –174 –69 004 –2 590 –88 724

Reclassifications 55 118 110 897 8 607 –23 445 –135 448 15 729

Foreign currency translation effect –7 438 –54 266 –6 934 –42 059 –144 833 –255 531

Balance as of 31 December 2017 403 200 3 682 333 409 743 3 789 091 427 367 8 711 733

Additions 49 290 29 367 9 232 264 073 559 473 911 435

Disposals –502 –86 822 –46 –109 928 –11 945 –209 243

Reclassifications – –5 449 – 12 355 7 225 14 132

Foreign currency translation effect –2 519 –26 571 –10 173 –20 971 –275 –60 509

Balance as of 31 December 2018 449 470 3 592 857 408 755 3 934 621 981 844 9 367 548

Depreciation and impairment

Balance as of 1 January 2017 –12 826 –1 296 827 –125 264 –2 223 755 – –3 658 672

Depreciation –1 824 –132 046 –28 252 –271 677 – –433 798

Depreciation on disposals 4 849 10 445 277 63 765 – 79 336

Reclassifications –3 706 –57 475 –5 038 74 176 – 7 957

Foreign currency translation effect 161 68 497 16 470 100 709 – 185 837

Balance as of 31 December 2017 –13 345 –1 407 405 –141 807 –2 256 782 – –3 819 339

Depreciation –1 660 –135 365 –38 048 –291 883 – –466 957

Depreciation on disposals 287 81 382 69 106 800 – 188 538

Reclassifications – 1 794 5 677 –5 307 – 2 163

Foreign currency translation effect –317 9 103 2 091 5 422 – 16 299

Balance as of 31 December 2018 –15 036 –1 450 492 –172 018 –2 441 750 – –4 079 296

Net book value

Balance as of 31 December 2018 434 435 2 142 365 236 738 1 492 870 981 844 5 288 252

Balance as of 31 December 2017 389 855 2 274 927 267 936 1 532 309 427 367 4 892 394

Property, plant and equipment are depreciated over the following useful life:

Land infinite

Buildings 25–33 years

Electrical Installations 10–14 years

Machinery 7–10 years

Office equipment and furniture 5–10 years

Vehicles 4–5 years

IT equipment 3–5 years

The period of depreciation is reviewed each year and if there are changes in useful life, depreciation is adjusted. Depreciation is stopped

if residual value is considered to be higher that the carrying value.

Construction in progress

A major part of the amount under Construction in progress relates to the new headquarters and research centre project in Norway. It is

also related to production and warehouse facility projects in Indonesia, Egypt and Vietnam, and a new regional centre in Dubai, the UAE.