JOTUN GROUP

52

Contractual obligations and guarantees

Purchase obligations

The Group’s contractual purchase obligations are mainly

related to investments in new plants and buildings. There is

a substantial investment program ongoing in the Group. Out

of the total ongoing investment program, NOK 613 million is

contractual committed capital expenditures (CAPEX) at year

end. These contractual commitments mainly relate to projects

in Norway. For purchase of raw materials there are no actual

commitments for the Group. In general, these contracts can be

terminated without significant penalties.

Leases

21

22

Other obligations

The parent company has guarantees covering tax withholding

and other guarantees for subsidiaries. These amounted to

approximately NOK 219 million in 2018 (2017: NOK 290 million).

A subsidiary in China, Jotun Coatings (Zhangjiagang) Co. Ltd.,

has used bank drafts to pay some of its suppliers. The issuing

bank(s) is obligated to make unconditional payment to the

supplier (or bearer) on a designated date. If unforeseen events

occur and the issuing bank(s) is not able to meet its obligation,

then Jotun would still hold the final obligation towards its

suppliers. Unsettled bank drafts totalling NOK 553 million have

been used as payment as of 31 December 2018.

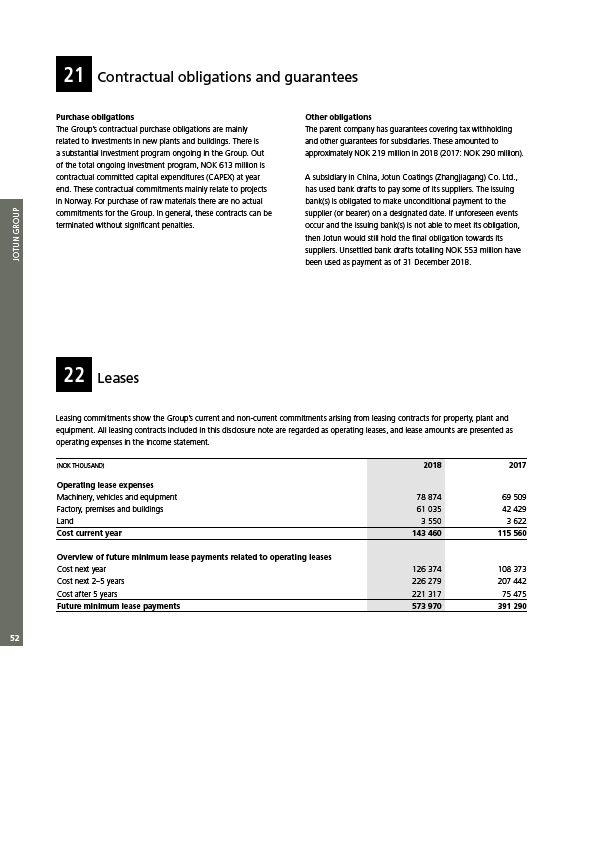

Leasing commitments show the Group’s current and non-current commitments arising from leasing contracts for property, plant and

equipment. All leasing contracts included in this disclosure note are regarded as operating leases, and lease amounts are presented as

operating expenses in the income statement.

(NOK THOUSAND) 2018 2017

Operating lease expenses

Machinery, vehicles and equipment 78 874 69 509

Factory, premises and buildings 61 035 42 429

Land 3 550 3 622

Cost current year 143 460 115 560

Overview of future minimum lease payments related to operating leases

Cost next year 126 374 108 373

Cost next 2–5 years 226 279 207 442

Cost after 5 years 221 317 75 475

Future minimum lease payments 573 970 391 290