JOTUN A/S

60

Accounting policies

The financial statements for Jotun A/S have been prepared

in accordance with simplified IFRS pursuant to section 3-9 of

the Norwegian Accounting Act. This mainly implies that the

financial statements are presented in accordance with IFRS and

the notes are presented in accordance with the requirements

of the Norwegian Accounting Act. The accounting policies for

the Group therefore also apply to Jotun A/S, see summary of

significant accounting policies in Group statement.

In the process of applying Jotun A/S’ accounting policies,

Management has made judgements, estimates and assumptions

which may have significant effect on the amounts recognised in

the financial statements.

1 Operating revenue

Shares in subsidiaries, joint ventures and associated companies

are incorporated using the cost method of accounting, and

are consequently within the scope of impairment testing.

Impairment tests are made when objective evidence indicates

that a loss event has occurred after initial recognition. The value

in use of the investment is calculated based on future net cash

flows. Key assumptions related to the cash flow analysis are

sales and profit development, discount rate and terminal value.

For more information about accounting policies, see Jotun

Group.

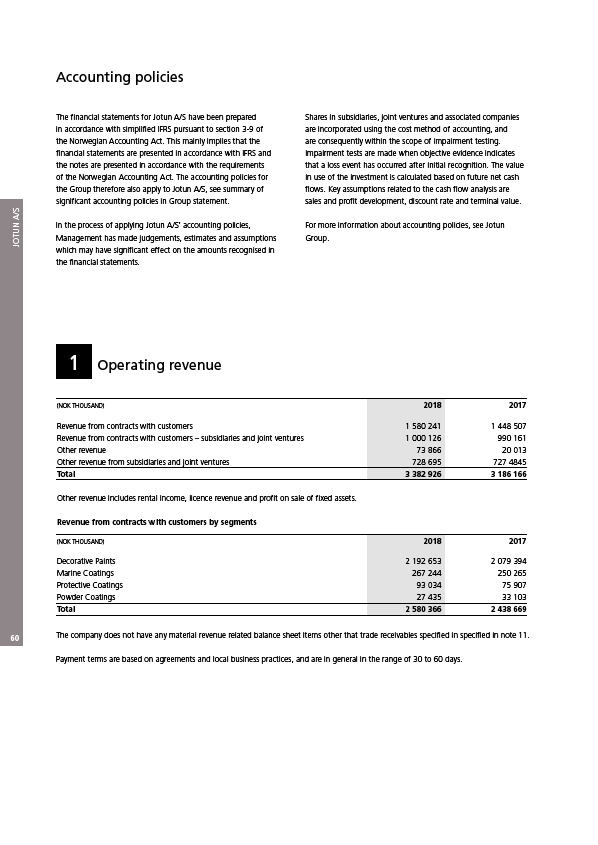

(NOK THOUSAND) 2018 2017

Revenue from contracts with customers 1 580 241 1 448 507

Revenue from contracts with customers – subsidiaries and joint ventures 1 000 126 990 161

Other revenue 73 866 20 013

Other revenue from subsidiaries and joint ventures 728 695 727 4845

Total 3 382 926 3 186 166

Other revenue includes rental income, licence revenue and profit on sale of fixed assets.

Revenue from contracts with customers by segments

(NOK THOUSAND) 2018 2017

Decorative Paints 2 192 653 2 079 394

Marine Coatings 267 244 250 265

Protective Coatings 93 034 75 907

Powder Coatings 27 435 33 103

Total 2 580 366 2 438 669

The company does not have any material revenue related balance sheet items other that trade receivables specified in specified in note 11.

Payment terms are based on agreements and local business practices, and are in general in the range of 30 to 60 days.