76

JOTUN A/S

22 RELATED PARTIES

Parties are related if one party can influence the decisions of the

other. If one party either controls, is controlled by or is under

common control with the entity the two parties are related.

During 2017 we purchased and sold goods and services to

various related parties in which we hold a 100 per cent or less

equity interest. Investments in subsidiaries are presented in note

16 and investments in joint ventures and associated companies

are presented in note 17.

TERMS AND CONDITIONS OF TRANSACTIONS WITH RELATED

PARTIES

The transactions between related parties are purchases and sales

of finished goods, raw materials and services. Jotun A/S has also

considerable royalty income from subsidiaries, joint ventures

and associated companies. Joint expenses are distributed in

accordance with agreed cost contribution arrangements. Internal

trading within the Group is carried out in accordance with arm’s

length principles.

Purchase of services from Group companies are mainly related

to global segment positions and regional management included

in the cost contribution arrangement. In addition, Jotun A/S

purchase R&D services from regional laboratories. Parts of the

R&D costs are capitalized, see note 6.

See also Group`s note 22 for more information about

transactions within the Group.

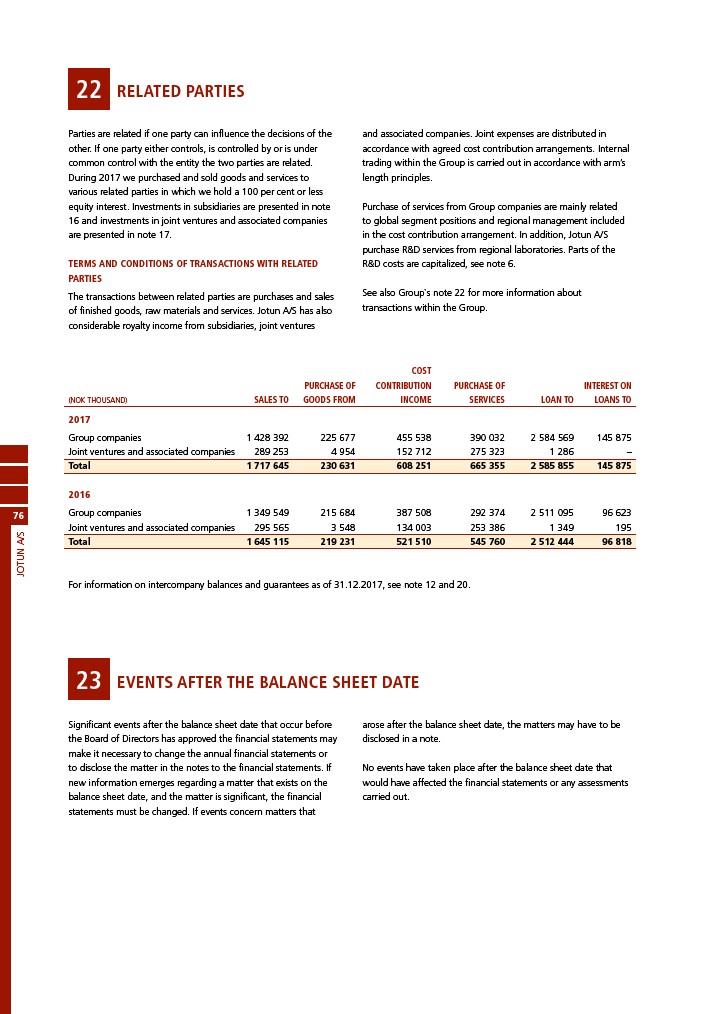

COST

PURCHASE OF CONTRIBUTION PURCHASE OF INTEREST ON

(NOK THOUSAND) SALES TO GOODS FROM INCOME SERVICES LOAN TO LOANS TO

2017

Group companies 1 428 392 225 677 455 538 390 032 2 584 569 145 875

Joint ventures and associated companies 289 253 4 954 152 712 275 323 1 286 –

Total 1 717 645 230 631 608 251 665 355 2 585 855 145 875

2016

Group companies 1 349 549 215 684 387 508 292 374 2 511 095 96 623

Joint ventures and associated companies 295 565 3 548 134 003 253 386 1 349 195

Total 1 645 115 219 231 521 510 545 760 2 512 444 96 818

For information on intercompany balances and guarantees as of 31.12.2017, see note 12 and 20.

23 EVENTS AFTER THE BALANCE SHEET DATE

Significant events after the balance sheet date that occur before

the Board of Directors has approved the financial statements may

make it necessary to change the annual financial statements or

to disclose the matter in the notes to the financial statements. If

new information emerges regarding a matter that exists on the

balance sheet date, and the matter is significant, the financial

statements must be changed. If events concern matters that

arose after the balance sheet date, the matters may have to be

disclosed in a note.

No events have taken place after the balance sheet date that

would have affected the financial statements or any assessments

carried out.