44

JOTUN GROUP

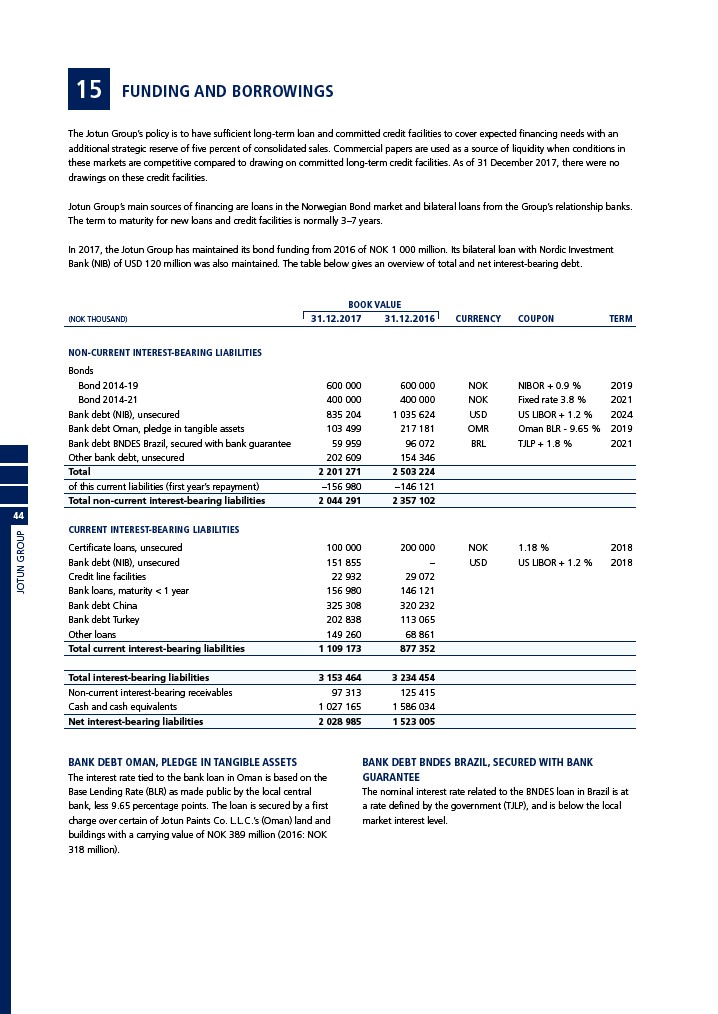

15 FUNDING AND BORROWINGS

The Jotun Group’s policy is to have sufficient long-term loan and committed credit facilities to cover expected financing needs with an

additional strategic reserve of five percent of consolidated sales. Commercial papers are used as a source of liquidity when conditions in

these markets are competitive compared to drawing on committed long-term credit facilities. As of 31 December 2017, there were no

drawings on these credit facilities.

Jotun Group’s main sources of financing are loans in the Norwegian Bond market and bilateral loans from the Group’s relationship banks.

The term to maturity for new loans and credit facilities is normally 3–7 years.

In 2017, the Jotun Group has maintained its bond funding from 2016 of NOK 1 000 million. Its bilateral loan with Nordic Investment

Bank (NIB) of USD 120 million was also maintained. The table below gives an overview of total and net interest-bearing debt.

BOOK VALUE

(NOK THOUSAND) 31.12.2017 31.12.2016 CURRENCY COUPON TERM

NON-CURRENT INTEREST-BEARING LIABILITIES

Bonds

Bond 2014-19 600 000 600 000 NOK NIBOR + 0.9 % 2019

Bond 2014-21 400 000 400 000 NOK Fixed rate 3.8 % 2021

Bank debt (NIB), unsecured 835 204 1 035 624 USD US LIBOR + 1.2 % 2024

Bank debt Oman, pledge in tangible assets 103 499 217 181 OMR Oman BLR - 9.65 % 2019

Bank debt BNDES Brazil, secured with bank guarantee 59 959 96 072 BRL TJLP + 1.8 % 2021

Other bank debt, unsecured 202 609 154 346

Total 2 201 271 2 503 224

of this current liabilities (first year’s repayment) –156 980 –146 121

Total non-current interest-bearing liabilities 2 044 291 2 357 102

CURRENT INTEREST-BEARING LIABILITIES

Certificate loans, unsecured 100 000 200 000 NOK 1.18 % 2018

Bank debt (NIB), unsecured 151 855 – USD US LIBOR + 1.2 % 2018

Credit line facilities 22 932 29 072

Bank loans, maturity < 1 year 156 980 146 121

Bank debt China 325 308 320 232

Bank debt Turkey 202 838 113 065

Other loans 149 260 68 861

Total current interest-bearing liabilities 1 109 173 877 352

Total interest-bearing liabilities 3 153 464 3 234 454

Non-current interest-bearing receivables 97 313 125 415

Cash and cash equivalents 1 027 165 1 586 034

Net interest-bearing liabilities 2 028 985 1 523 005

BANK DEBT OMAN, PLEDGE IN TANGIBLE ASSETS

The interest rate tied to the bank loan in Oman is based on the

Base Lending Rate (BLR) as made public by the local central

bank, less 9.65 percentage points. The loan is secured by a first

charge over certain of Jotun Paints Co. L.L.C.’s (Oman) land and

buildings with a carrying value of NOK 389 million (2016: NOK

318 million).

BANK DEBT BNDES BRAZIL, SECURED WITH BANK

GUARANTEE

The nominal interest rate related to the BNDES loan in Brazil is at

a rate defined by the government (TJLP), and is below the local

market interest level.