62

JOTUN A/S

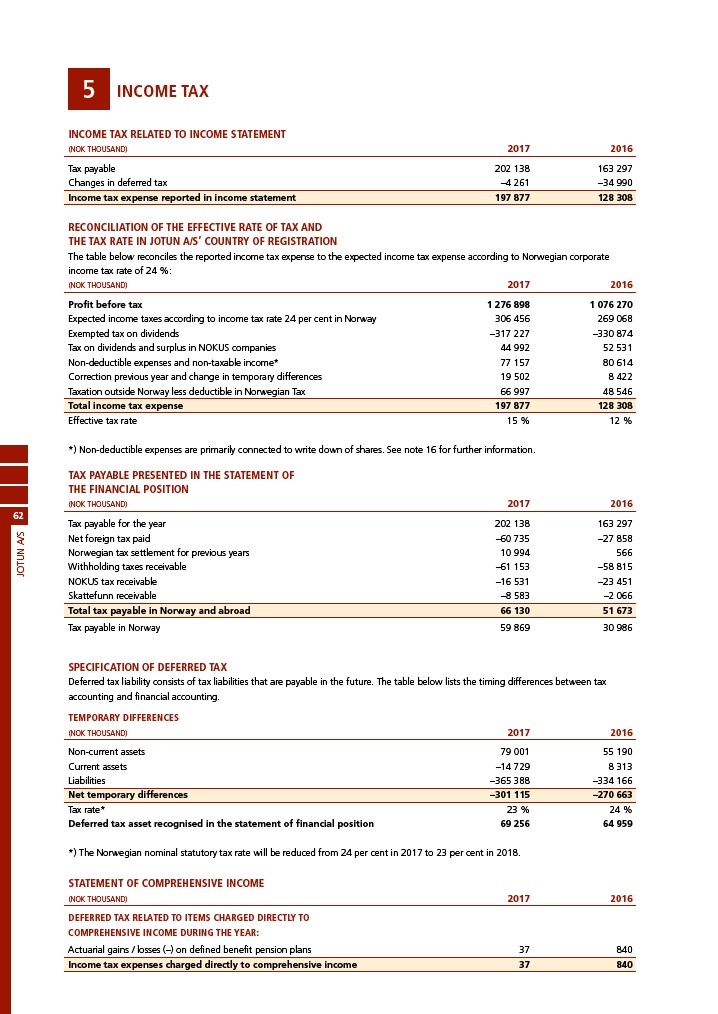

5 INCOME TAX

INCOME TAX RELATED TO INCOME STATEMENT

(NOK THOUSAND) 2017 2016

Tax payable 202 138 163 297

Changes in deferred tax –4 261 –34 990

Income tax expense reported in income statement 197 877 128 308

RECONCILIATION OF THE EFFECTIVE RATE OF TAX AND

THE TAX RATE IN JOTUN A/S’ COUNTRY OF REGISTRATION

The table below reconciles the reported income tax expense to the expected income tax expense according to Norwegian corporate

income tax rate of 24 %:

(NOK THOUSAND) 2017 2016

Profit before tax 1 276 898 1 076 270

Expected income taxes according to income tax rate 24 per cent in Norway 306 456 269 068

Exempted tax on dividends –317 227 –330 874

Tax on dividends and surplus in NOKUS companies 44 992 52 531

Non-deductible expenses and non-taxable income* 77 157 80 614

Correction previous year and change in temporary differences 19 502 8 422

Taxation outside Norway less deductible in Norwegian Tax 66 997 48 546

Total income tax expense 197 877 128 308

Effective tax rate 15 % 12 %

*) Non-deductible expenses are primarily connected to write down of shares. See note 16 for further information.

TAX PAYABLE PRESENTED IN THE STATEMENT OF

THE FINANCIAL POSITION

(NOK THOUSAND) 2017 2016

Tax payable for the year 202 138 163 297

Net foreign tax paid –60 735 –27 858

Norwegian tax settlement for previous years 10 994 566

Withholding taxes receivable –61 153 –58 815

NOKUS tax receivable –16 531 –23 451

Skattefunn receivable –8 583 –2 066

Total tax payable in Norway and abroad 66 130 51 673

Tax payable in Norway 59 869 30 986

SPECIFICATION OF DEFERRED TAX

Deferred tax liability consists of tax liabilities that are payable in the future. The table below lists the timing differences between tax

accounting and financial accounting.

TEMPORARY DIFFERENCES

(NOK THOUSAND) 2017 2016

Non-current assets 79 001 55 190

Current assets –14 729 8 313

Liabilities –365 388 –334 166

Net temporary differences –301 115 –270 663

Tax rate* 23 % 24 %

Deferred tax asset recognised in the statement of financial position 69 256 64 959

*) The Norwegian nominal statutory tax rate will be reduced from 24 per cent in 2017 to 23 per cent in 2018.

STATEMENT OF COMPREHENSIVE INCOME

(NOK THOUSAND) 2017 2016

DEFERRED TAX RELATED TO ITEMS CHARGED DIRECTLY TO

COMPREHENSIVE INCOME DURING THE YEAR:

Actuarial gains / losses (–) on defined benefit pension plans 37 840

Income tax expenses charged directly to comprehensive income 37 840