67

JOTUN A/S

INTEREST RATE RISK

Jotun A/S has low net interest bearing debt with a seasonal peak

within one billion NOK. The interest rate risk is not regarded as

a critical factor. Based on the present net debt situation, Jotun’s

policy is not to hedge interest rate risk. If the net debt should

increase and become permanently substantially higher than the

present level, the policy will be reviewed.

LIQUIDITY RISK

Cash flow from Jotun’s operations has seasonal cycles. There is a

substantial build-up of working capital during winter and spring

in preparation for the summer sales season. Other drivers in the

liquidity development are investments within the Jotun Group

which are mostly financed from Jotun A/S. See note 15 for more

information.

CREDIT RISK

The management of credit risk related to accounts receivable and

other operating receivables is handled as part of the business risk

and is continuously monitored. There is a slight concentration

of credit risk in respect of single counterparts, but the risk

is moderate. The losses on accounts receivables have been

insignificant through Jotun’s history.

Jotun A/S has International Swap Dealers Association (ISDA)

agreements with its counterparts for derivative transactions, and

transactions are made only with Jotun Group’s core relationship

banks with satisfactory ratings.

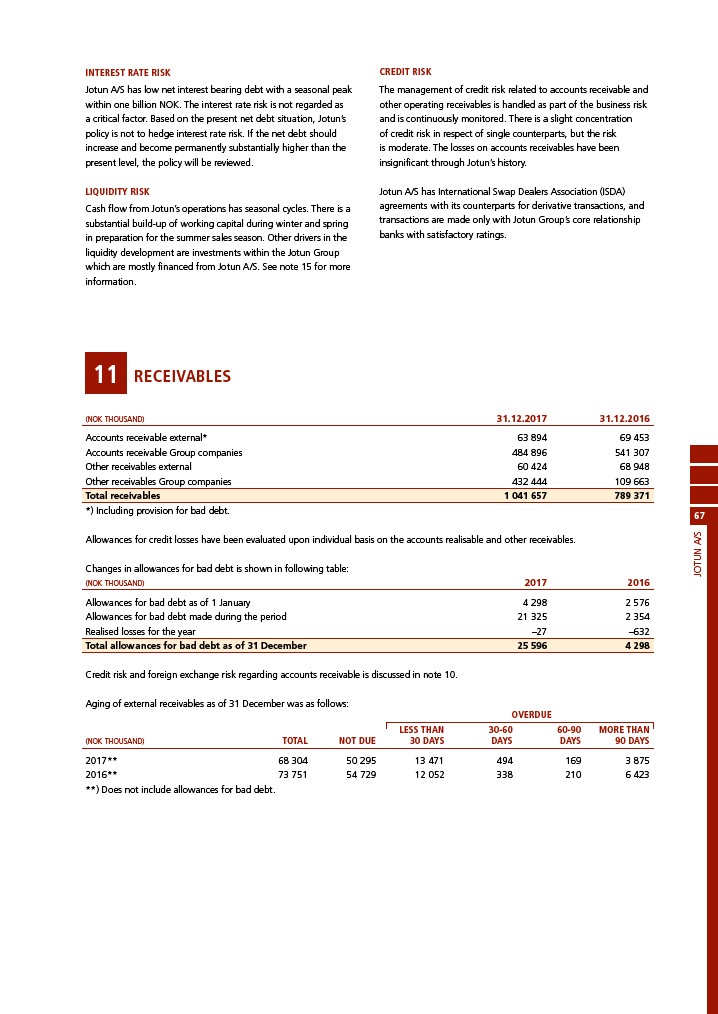

11 RECEIVABLES

(NOK THOUSAND) 31.12.2017 31.12.2016

Accounts receivable external* 63 894 69 453

Accounts receivable Group companies 484 896 541 307

Other receivables external 60 424 68 948

Other receivables Group companies 432 444 109 663

Total receivables 1 041 657 789 371

*) Including provision for bad debt.

Allowances for credit losses have been evaluated upon individual basis on the accounts realisable and other receivables.

Changes in allowances for bad debt is shown in following table:

(NOK THOUSAND) 2017 2016

Allowances for bad debt as of 1 January 4 298 2 576

Allowances for bad debt made during the period 21 325 2 354

Realised losses for the year –27 –632

Total allowances for bad debt as of 31 December 25 596 4 298

Credit risk and foreign exchange risk regarding accounts receivable is discussed in note 10.

Aging of external receivables as of 31 December was as follows:

OVERDUE

LESS THAN 30-60 60-90 MORE THAN

(NOK THOUSAND) TOTAL NOT DUE 30 DAYS DAYS DAYS 90 DAYS

2017** 68 304 50 295 13 471 494 169 3 875

2016** 73 751 54 729 12 052 338 210 6 423

**) Does not include allowances for bad debt.