59

JOTUN A/S

3 PENSIONS AND OTHER LONG-TERM EMPLOYEE BENEFITS

Jotun A/S has both defined contribution and defined benefit

pension plans. In the defined contribution plans, the cost is equal

to the contributions to the employees’ pension savings in the

accounting period. The future pension will be determined by

the amount of the contributions and the return on the pension

savings. In the defined benefit plans, the company is responsible

for paying a pension to the employee based on pensionable

salary. The cost for the accounting periods shows the employees’

pension entitlement of the agreed future pensions in the

accounting year.

DEFINED CONTRIBUTION PLANS

Defined contribution plans comprise arrangements whereby the

company makes annual contributions to the employees’ pension

plans, and where the future pension is determined by the

amount of the contributions and the return on the pension plan

assets. Employees in Jotun A/S are mainly covered by pension

plans that are classified as contribution plans. Costs associated

with defined contribution plans are specified in note 2.

DEFINED BENEFIT PLANS

Defined benefit plans comprise arrangements whereby the

company is responsible for paying a future pension to the

employees based on pensionable salary at the time the

employee retires.

In Jotun A/S the defined benefit schemes were replaced by

defined contribution plans in 2004. Net pension obligations

as of 31 December 2017, are primarily related to previous

early retirement schemes for Jotun Group’s senior executives.

In addition, there are pension obligations related to old-age

pensions and pension plans for employees who earn more than

twelve times the social security basic amount (12G).

OTHER SEVERANCE SCHEMES

Included in this schemes are Jotun’s operating pension schemes

for employees with an annual base salary and pension base

exceeding 12 times the social security basic amount (12G).

ASSUMPTIONS RELATING TO THE DEFINED BENEFIT PLANS

The discount rate related to the defined benefit plans is based

on the market yields on 10-year government bonds adjusted for

actual lifetime of the pension liabilities.

As a rule, parameters such as wage growth, growth in G and

inflation are set in accordance with recommendations in Norway.

The mortality estimate is based on an up-to-date mortality table

(K2013BE).

ACCOUNTING OF ACTUARIAL LOSSES AND GAINS

All actuarial losses and gains related to pensions are presented

under other comprehensive income in the income statement.

PENSION PLAN ASSETS

Pension plan assets are mainly in bonds and shares. The expected

return will vary depending on the composition of the various

classes of assets. The expected return and breakdown of pension

plan assets may be seen in the tables below.

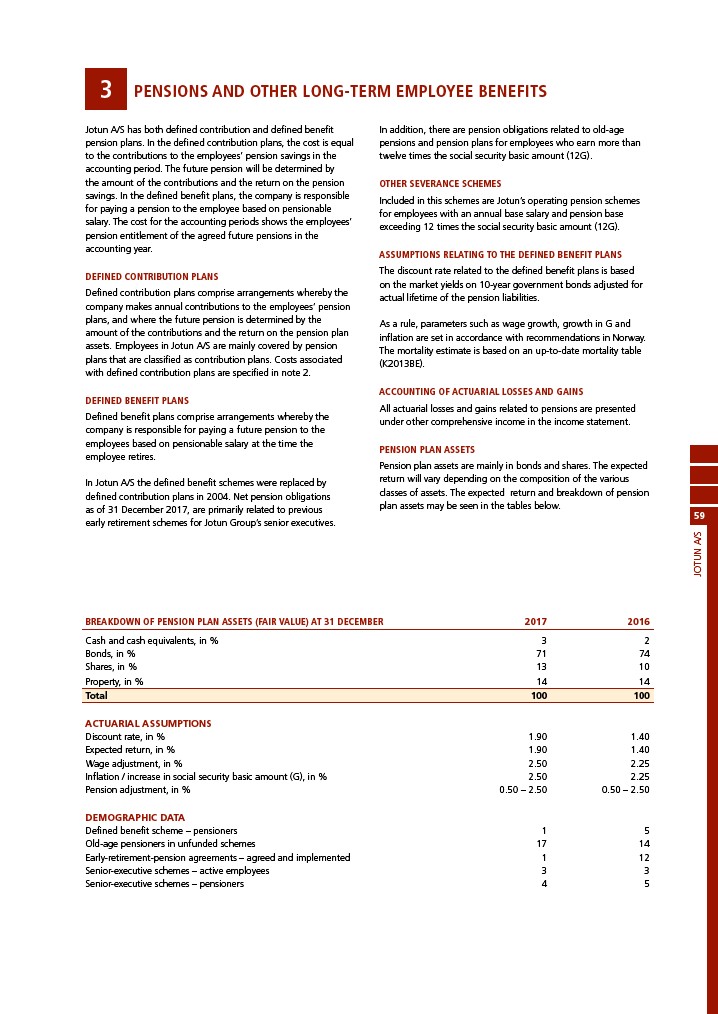

BREAKDOWN OF PENSION PLAN ASSETS (FAIR VALUE) AT 31 DECEMBER 2017 2016

Cash and cash equivalents, in % 3 2

Bonds, in % 71 74

Shares, in % 13 10

Property, in % 14 14

Total 100 100

ACTUARIAL ASSUMPTIONS

Discount rate, in % 1.90 1.40

Expected return, in % 1.90 1.40

Wage adjustment, in % 2.50 2.25

Inflation / increase in social security basic amount (G), in % 2.50 2.25

Pension adjustment, in % 0.50 – 2.50 0.50 – 2.50

DEMOGRAPHIC DATA

Defined benefit scheme – pensioners 1 5

Old-age pensioners in unfunded schemes 17 14

Early-retirement-pension agreements – agreed and implemented 1 12

Senior-executive schemes – active employees 3 3

Senior-executive schemes – pensioners 4 5