66

JOTUN A/S

10 FINANCIAL AND COMMERCIAL RISK MANAGEMENT

Jotun A/S is exposed to market risks like fluctuations in prices of

raw materials, currency exchange rates and interest rates. Jotun

A/S uses financial instruments to reduce these risks in accordance

with the Group’s treasury policy.

CATEGORIES OF FINANCIAL RISKS AND RISK POLICIES

FOR JOTUN A/S

FOREIGN CURRENCY RISK

Foreign currency risk on net investments

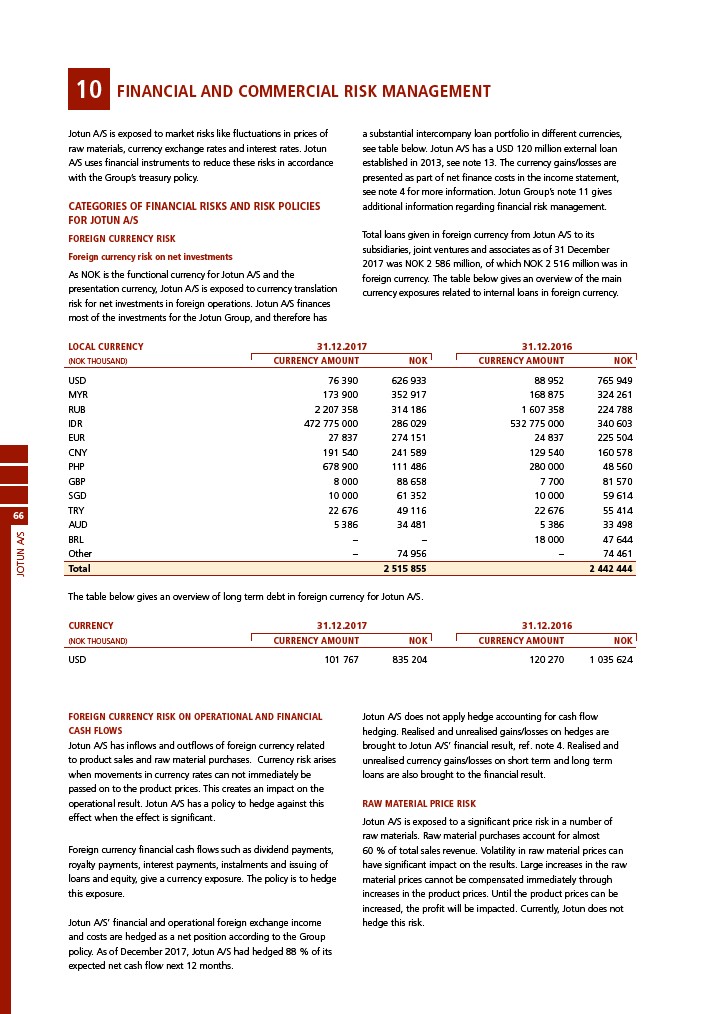

As NOK is the functional currency for Jotun A/S and the

presentation currency, Jotun A/S is exposed to currency translation

risk for net investments in foreign operations. Jotun A/S finances

most of the investments for the Jotun Group, and therefore has

a substantial intercompany loan portfolio in different currencies,

see table below. Jotun A/S has a USD 120 million external loan

established in 2013, see note 13. The currency gains/losses are

presented as part of net finance costs in the income statement,

see note 4 for more information. Jotun Group’s note 11 gives

additional information regarding financial risk management.

Total loans given in foreign currency from Jotun A/S to its

subsidiaries, joint ventures and associates as of 31 December

2017 was NOK 2 586 million, of which NOK 2 516 million was in

foreign currency. The table below gives an overview of the main

currency exposures related to internal loans in foreign currency.

LOCAL CURRENCY 31.12.2017 31.12.2016

(NOK THOUSAND) CURRENCY AMOUNT NOK CURRENCY AMOUNT NOK

USD 76 390 626 933 88 952 765 949

MYR 173 900 352 917 168 875 324 261

RUB 2 207 358 314 186 1 607 358 224 788

IDR 472 775 000 286 029 532 775 000 340 603

EUR 27 837 274 151 24 837 225 504

CNY 191 540 241 589 129 540 160 578

PHP 678 900 111 486 280 000 48 560

GBP 8 000 88 658 7 700 81 570

SGD 10 000 61 352 10 000 59 614

TRY 22 676 49 116 22 676 55 414

AUD 5 386 34 481 5 386 33 498

BRL – – 18 000 47 644

Other – 74 956 – 74 461

Total 2 515 855 2 442 444

The table below gives an overview of long term debt in foreign currency for Jotun A/S.

CURRENCY 31.12.2017 31.12.2016

(NOK THOUSAND) CURRENCY AMOUNT NOK CURRENCY AMOUNT NOK

USD 101 767 835 204 120 270 1 035 624

FOREIGN CURRENCY RISK ON OPERATIONAL AND FINANCIAL

CASH FLOWS

Jotun A/S has inflows and outflows of foreign currency related

to product sales and raw material purchases. Currency risk arises

when movements in currency rates can not immediately be

passed on to the product prices. This creates an impact on the

operational result. Jotun A/S has a policy to hedge against this

effect when the effect is significant.

Foreign currency financial cash flows such as dividend payments,

royalty payments, interest payments, instalments and issuing of

loans and equity, give a currency exposure. The policy is to hedge

this exposure.

Jotun A/S’ financial and operational foreign exchange income

and costs are hedged as a net position according to the Group

policy. As of December 2017, Jotun A/S had hedged 88 % of its

expected net cash flow next 12 months.

Jotun A/S does not apply hedge accounting for cash flow

hedging. Realised and unrealised gains/losses on hedges are

brought to Jotun A/S’ financial result, ref. note 4. Realised and

unrealised currency gains/losses on short term and long term

loans are also brought to the financial result.

RAW MATERIAL PRICE RISK

Jotun A/S is exposed to a significant price risk in a number of

raw materials. Raw material purchases account for almost

60 % of total sales revenue. Volatility in raw material prices can

have significant impact on the results. Large increases in the raw

material prices cannot be compensated immediately through

increases in the product prices. Until the product prices can be

increased, the profit will be impacted. Currently, Jotun does not

hedge this risk.