40

JOTUN GROUP

by the business units and individual credit limits are defined

accordingly. Outstanding customer receivables are regularly

monitored and credit risk assessments are undertaken.

There is no significant concentration of credit risk in respect of

single counterparts. Some groups of counterparts can be viewed

as significant: shipyards, ship owners, real estate developers and

some larger retail chains in Scandinavia. In combination with

a geographical distribution and few large single accounts, the

credit risk in the Jotun Group is viewed to be well diversified.

The need for bad debt provisions is analysed on an individual

customer basis. The maximum exposure to credit risk at the

reporting date is the carrying value of each class of financial

assets disclosed in note 12. The Group does not hold collateral

as security. The Group evaluates the concentration of risk with

respect to trade receivables as low, as its customers are located

in several jurisdictions and industries and operate in largely

independent markets.

Jotun A/S has International Swap Dealers Association (ISDA)

agreements with its counterparts for derivative transactions, and

transactions are made only with Jotun Group’s core relationship

banks with satisfactory ratings.

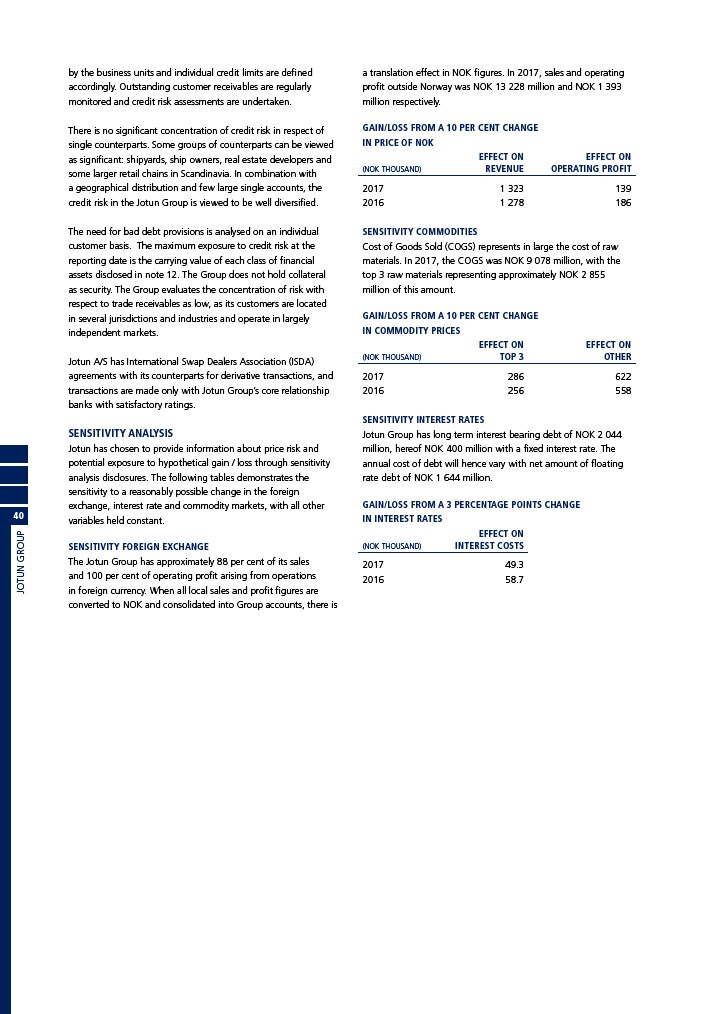

SENSITIVITY ANALYSIS

Jotun has chosen to provide information about price risk and

potential exposure to hypothetical gain / loss through sensitivity

analysis disclosures. The following tables demonstrates the

sensitivity to a reasonably possible change in the foreign

exchange, interest rate and commodity markets, with all other

variables held constant.

SENSITIVITY FOREIGN EXCHANGE

The Jotun Group has approximately 88 per cent of its sales

and 100 per cent of operating profit arising from operations

in foreign currency. When all local sales and profit figures are

converted to NOK and consolidated into Group accounts, there is

a translation effect in NOK figures. In 2017, sales and operating

profit outside Norway was NOK 13 228 million and NOK 1 393

million respectively.

GAIN/LOSS FROM A 10 PER CENT CHANGE

IN PRICE OF NOK

EFFECT ON EFFECT ON

(NOK THOUSAND) REVENUE OPERATING PROFIT

2017 1 323 139

2016 1 278 186

SENSITIVITY COMMODITIES

Cost of Goods Sold (COGS) represents in large the cost of raw

materials. In 2017, the COGS was NOK 9 078 million, with the

top 3 raw materials representing approximately NOK 2 855

million of this amount.

GAIN/LOSS FROM A 10 PER CENT CHANGE

IN COMMODITY PRICES

EFFECT ON EFFECT ON

(NOK THOUSAND) TOP 3 OTHER

2017 286 622

2016 256 558

SENSITIVITY INTEREST RATES

Jotun Group has long term interest bearing debt of NOK 2 044

million, hereof NOK 400 million with a fixed interest rate. The

annual cost of debt will hence vary with net amount of floating

rate debt of NOK 1 644 million.

GAIN/LOSS FROM A 3 PERCENTAGE POINTS CHANGE

IN INTEREST RATES

EFFECT ON

(NOK THOUSAND) INTEREST COSTS

2017 49.3

2016 58.7