56

JOTUN A/S

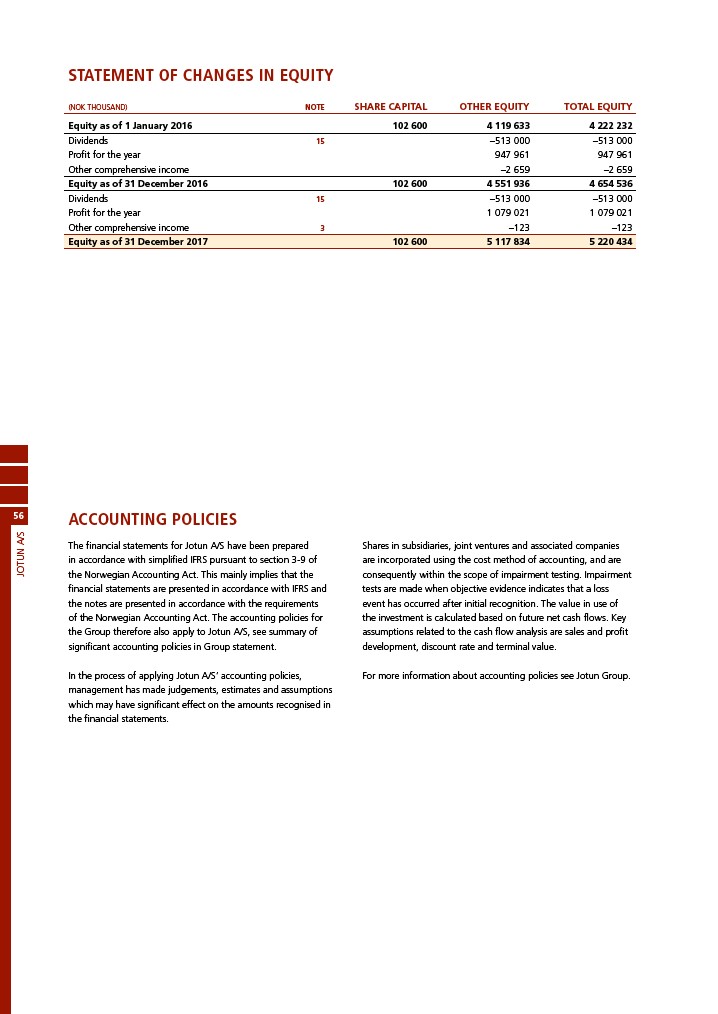

STATEMENT OF CHANGES IN EQUITY

(NOK THOUSAND) NOTE SHARE CAPITAL OTHER EQUITY TOTAL EQUITY

Equity as of 1 January 2016 102 600 4 119 633 4 222 232

Dividends 15 –513 000 –513 000

Profit for the year 947 961 947 961

Other comprehensive income –2 659 –2 659

Equity as of 31 December 2016 102 600 4 551 936 4 654 536

Dividends 15 –513 000 –513 000

Profit for the year 1 079 021 1 079 021

Other comprehensive income 3 –123 –123

Equity as of 31 December 2017 102 600 5 117 834 5 220 434

ACCOUNTING POLICIES

The financial statements for Jotun A/S have been prepared

in accordance with simplified IFRS pursuant to section 3-9 of

the Norwegian Accounting Act. This mainly implies that the

financial statements are presented in accordance with IFRS and

the notes are presented in accordance with the requirements

of the Norwegian Accounting Act. The accounting policies for

the Group therefore also apply to Jotun A/S, see summary of

significant accounting policies in Group statement.

In the process of applying Jotun A/S’ accounting policies,

management has made judgements, estimates and assumptions

which may have significant effect on the amounts recognised in

the financial statements.

Shares in subsidiaries, joint ventures and associated companies

are incorporated using the cost method of accounting, and are

consequently within the scope of impairment testing. Impairment

tests are made when objective evidence indicates that a loss

event has occurred after initial recognition. The value in use of

the investment is calculated based on future net cash flows. Key

assumptions related to the cash flow analysis are sales and profit

development, discount rate and terminal value.

For more information about accounting policies see Jotun Group.