45

JOTUN GROUP

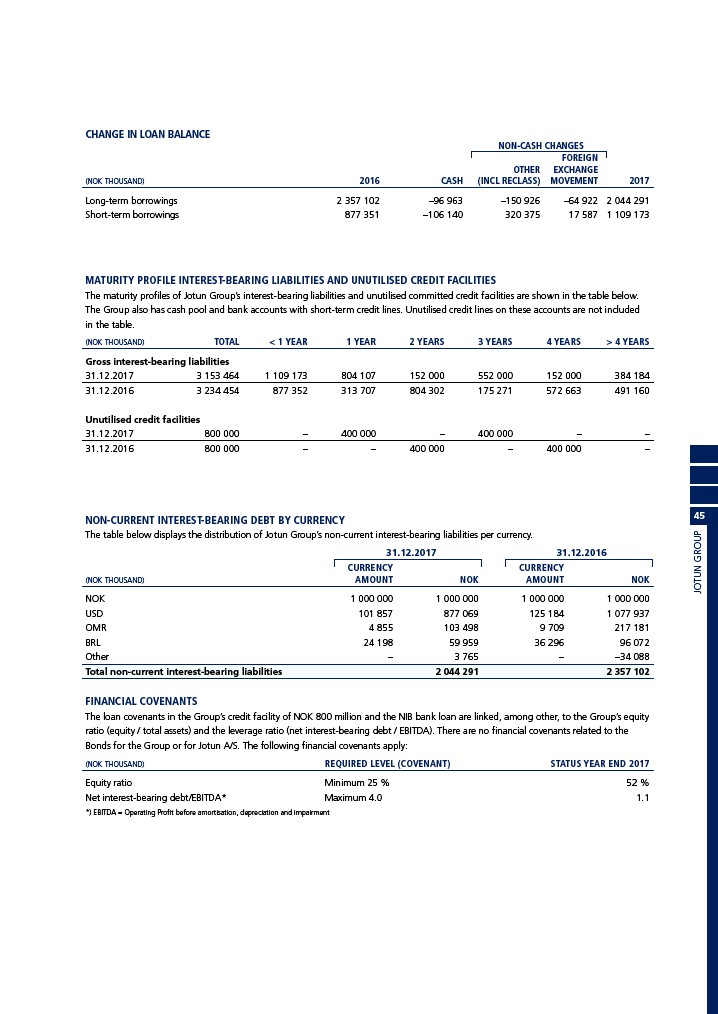

CHANGE IN LOAN BALANCE

NON-CASH CHANGES

FOREIGN

OTHER EXCHANGE

(NOK THOUSAND) 2016 CASH (INCL RECLASS) MOVEMENT 2017

Long-term borrowings 2 357 102 –96 963 –150 926 –64 922 2 044 291

Short-term borrowings 877 351 –106 140 320 375 17 587 1 109 173

MATURITY PROFILE INTEREST-BEARING LIABILITIES AND UNUTILISED CREDIT FACILITIES

The maturity profiles of Jotun Group’s interest-bearing liabilities and unutilised committed credit facilities are shown in the table below.

The Group also has cash pool and bank accounts with short-term credit lines. Unutilised credit lines on these accounts are not included

in the table.

(NOK THOUSAND) TOTAL < 1 YEAR 1 YEAR 2 YEARS 3 YEARS 4 YEARS > 4 YEARS

Gross interest-bearing liabilities

31.12.2017 3 153 464 1 109 173 804 107 152 000 552 000 152 000 384 184

31.12.2016 3 234 454 877 352 313 707 804 302 175 271 572 663 491 160

Unutilised credit facilities

31.12.2017 800 000 – 400 000 – 400 000 – –

31.12.2016 800 000 – – 400 000 – 400 000 –

NON-CURRENT INTEREST-BEARING DEBT BY CURRENCY

The table below displays the distribution of Jotun Group’s non-current interest-bearing liabilities per currency.

31.12.2017 31.12.2016

CURRENCY CURRENCY

(NOK THOUSAND) AMOUNT NOK AMOUNT NOK

NOK 1 000 000 1 000 000 1 000 000 1 000 000

USD 101 857 877 069 125 184 1 077 937

OMR 4 855 103 498 9 709 217 181

BRL 24 198 59 959 36 296 96 072

Other – 3 765 – –34 088

Total non-current interest-bearing liabilities 2 044 291 2 357 102

FINANCIAL COVENANTS

The loan covenants in the Group’s credit facility of NOK 800 million and the NIB bank loan are linked, among other, to the Group’s equity

ratio (equity / total assets) and the leverage ratio (net interest-bearing debt / EBITDA). There are no financial covenants related to the

Bonds for the Group or for Jotun A/S. The following financial covenants apply:

(NOK THOUSAND) REQUIRED LEVEL (COVENANT) STATUS YEAR END 2017

Equity ratio Minimum 25 % 52 %

Net interest-bearing debt/EBITDA* Maximum 4.0 1.1

*) EBITDA = Operating Profit before amortisation, depreciation and impairment