51

JOTUN GROUP

22 RELATED PARTIES

Two parties are deemed to be related if one party can influence

the decisions of the other.

During 2017 we purchased and sold goods and services to

various related parties in which we hold a 50 per cent or less

equity interest. Investments in associated and joint venture

companies are presented in note 2, shareholder and dividend

information is presented in note 17 and subsidiaries are

presented in note 18.

TERMS AND CONDITIONS OF TRANSACTIONS WITH

RELATED PARTIES

The transactions between related parties are purchases and

sales of finished goods, raw materials and technical service.

Joint expenses are distributed in accordance with agreed cost

contribution arrangements. Internal trading within the Group is

carried out in accordance with arm’s length principles.

For raw materials, the normal process for producing entities

is to call off volumes on frame agreements entered into at

a corporate level. Raw materials are regularly sold within

the Group (from large to small entities), but the majority of

raw material supplies comes directly from external suppliers.

Sales transactions between the Group and joint ventures and

associates are mainly related to sales of finished goods from

producing units to non-producing units. Other situations can be

levelling of stock between entities and coordination of deliveries

to customers around the world. Prices are based on fixed

intercompany price lists.

Outstanding balances at the year-end are unsecured and

settlement occurs in cash. There have been no guarantees

provided or received for any related party receivables or payables.

As of 31 December 2017, the Group has not recorded any

impairment of receivables relating to amounts owed by related

parties (2016: NOK Nil). This assessment is undertaken each

financial year by examining the financial position of the related

party and the market in which the related party operates. The

amount of these transactions is shown in the table below.

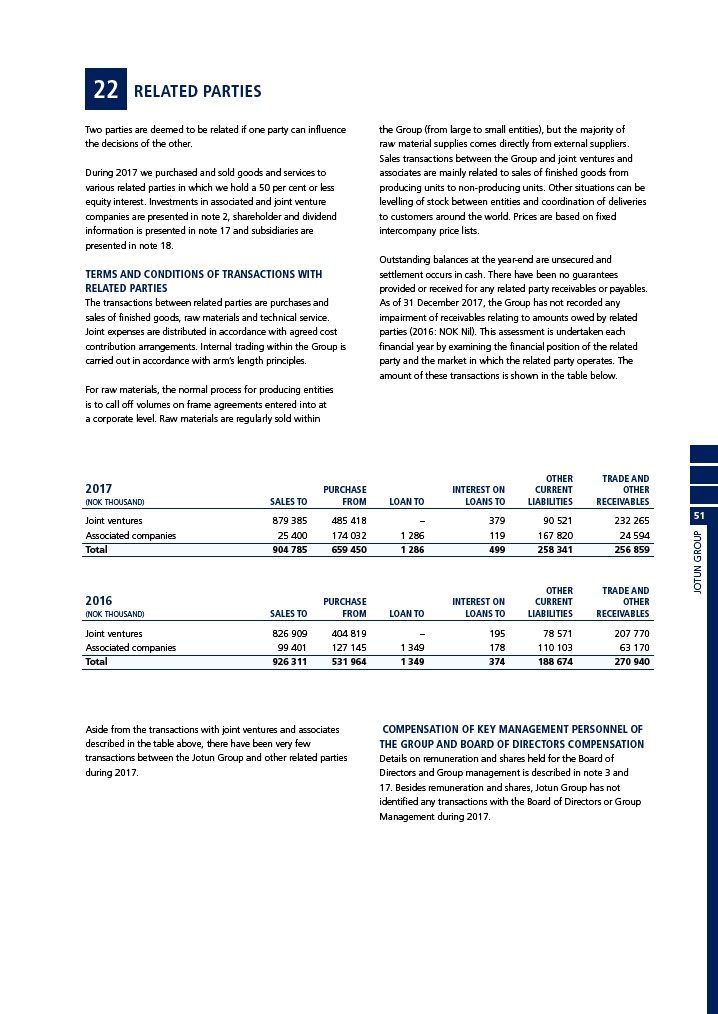

OTHER TRADE AND

2017 PURCHASE INTEREST ON CURRENT OTHER

(NOK THOUSAND) SALES TO FROM LOAN TO LOANS TO LIABILITIES RECEIVABLES

Joint ventures 879 385 485 418 – 379 90 521 232 265

Associated companies 25 400 174 032 1 286 119 167 820 24 594

Total 904 785 659 450 1 286 499 258 341 256 859

OTHER TRADE AND

2016 PURCHASE INTEREST ON CURRENT OTHER

(NOK THOUSAND) SALES TO FROM LOAN TO LOANS TO LIABILITIES RECEIVABLES

Joint ventures 826 909 404 819 – 195 78 571 207 770

Associated companies 99 401 127 145 1 349 178 110 103 63 170

Total 926 311 531 964 1 349 374 188 674 270 940

Aside from the transactions with joint ventures and associates

described in the table above, there have been very few

transactions between the Jotun Group and other related parties

during 2017.

COMPENSATION OF KEY MANAGEMENT PERSONNEL OF

THE GROUP AND BOARD OF DIRECTORS COMPENSATION

Details on remuneration and shares held for the Board of

Directors and Group management is described in note 3 and

17. Besides remuneration and shares, Jotun Group has not

identified any transactions with the Board of Directors or Group

Management during 2017.