37

JOTUN GROUP

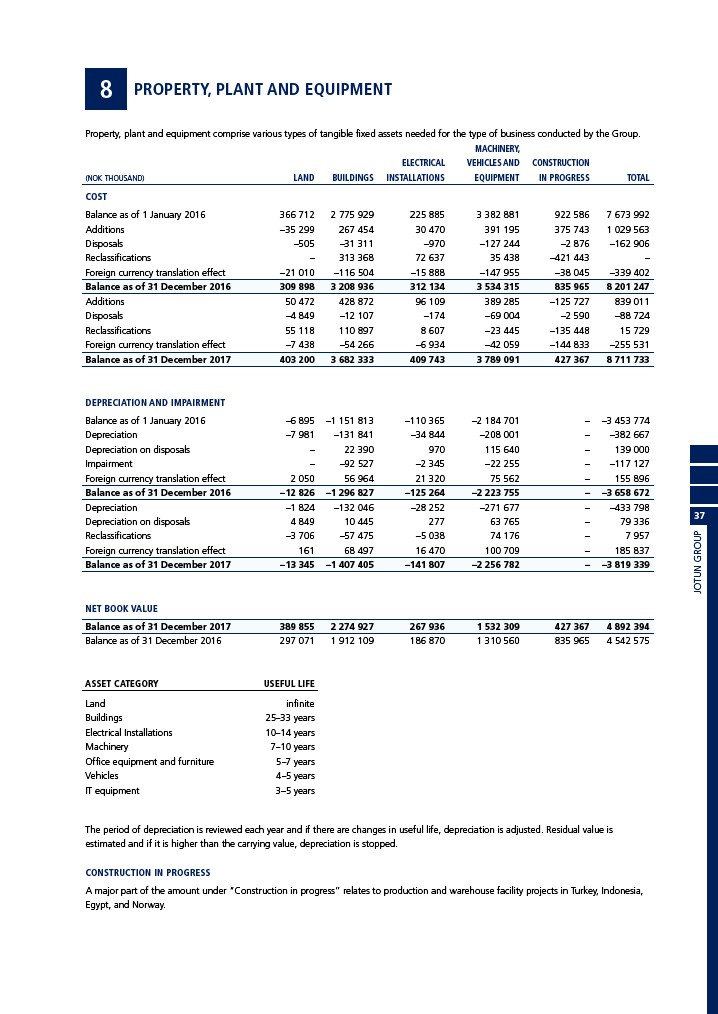

8 PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment comprise various types of tangible fixed assets needed for the type of business conducted by the Group.

MACHINERY,

ELECTRICAL VEHICLES AND CONSTRUCTION

(NOK THOUSAND) LAND BUILDINGS INSTALLATIONS EQUIPMENT IN PROGRESS TOTAL

COST

Balance as of 1 January 2016 366 712 2 775 929 225 885 3 382 881 922 586 7 673 992

Additions –35 299 267 454 30 470 391 195 375 743 1 029 563

Disposals –505 –31 311 –970 –127 244 –2 876 –162 906

Reclassifications – 313 368 72 637 35 438 –421 443 –

Foreign currency translation effect –21 010 –116 504 –15 888 –147 955 –38 045 –339 402

Balance as of 31 December 2016 309 898 3 208 936 312 134 3 534 315 835 965 8 201 247

Additions 50 472 428 872 96 109 389 285 –125 727 839 011

Disposals –4 849 –12 107 –174 –69 004 –2 590 –88 724

Reclassifications 55 118 110 897 8 607 –23 445 –135 448 15 729

Foreign currency translation effect –7 438 –54 266 –6 934 –42 059 –144 833 –255 531

Balance as of 31 December 2017 403 200 3 682 333 409 743 3 789 091 427 367 8 711 733

DEPRECIATION AND IMPAIRMENT

Balance as of 1 January 2016 –6 895 –1 151 813 –110 365 –2 184 701 – –3 453 774

Depreciation –7 981 –131 841 –34 844 –208 001 – –382 667

Depreciation on disposals – 22 390 970 115 640 – 139 000

Impairment – –92 527 –2 345 –22 255 – –117 127

Foreign currency translation effect 2 050 56 964 21 320 75 562 – 155 896

Balance as of 31 December 2016 –12 826 –1 296 827 –125 264 –2 223 755 – –3 658 672

Depreciation –1 824 –132 046 –28 252 –271 677 – –433 798

Depreciation on disposals 4 849 10 445 277 63 765 – 79 336

Reclassifications –3 706 –57 475 –5 038 74 176 – 7 957

Foreign currency translation effect 161 68 497 16 470 100 709 – 185 837

Balance as of 31 December 2017 –13 345 –1 407 405 –141 807 –2 256 782 – –3 819 339

NET BOOK VALUE

Balance as of 31 December 2017 389 855 2 274 927 267 936 1 532 309 427 367 4 892 394

Balance as of 31 December 2016 297 071 1 912 109 186 870 1 310 560 835 965 4 542 575

ASSET CATEGORY USEFUL LIFE

Land infinite

Buildings 25–33 years

Electrical Installations 10–14 years

Machinery 7–10 years

Office equipment and furniture 5–7 years

Vehicles 4–5 years

IT equipment 3–5 years

The period of depreciation is reviewed each year and if there are changes in useful life, depreciation is adjusted. Residual value is

estimated and if it is higher than the carrying value, depreciation is stopped.

CONSTRUCTION IN PROGRESS

A major part of the amount under “Construction in progress” relates to production and warehouse facility projects in Turkey, Indonesia,

Egypt, and Norway.