34

JOTUN GROUP

6 INCOME TAX

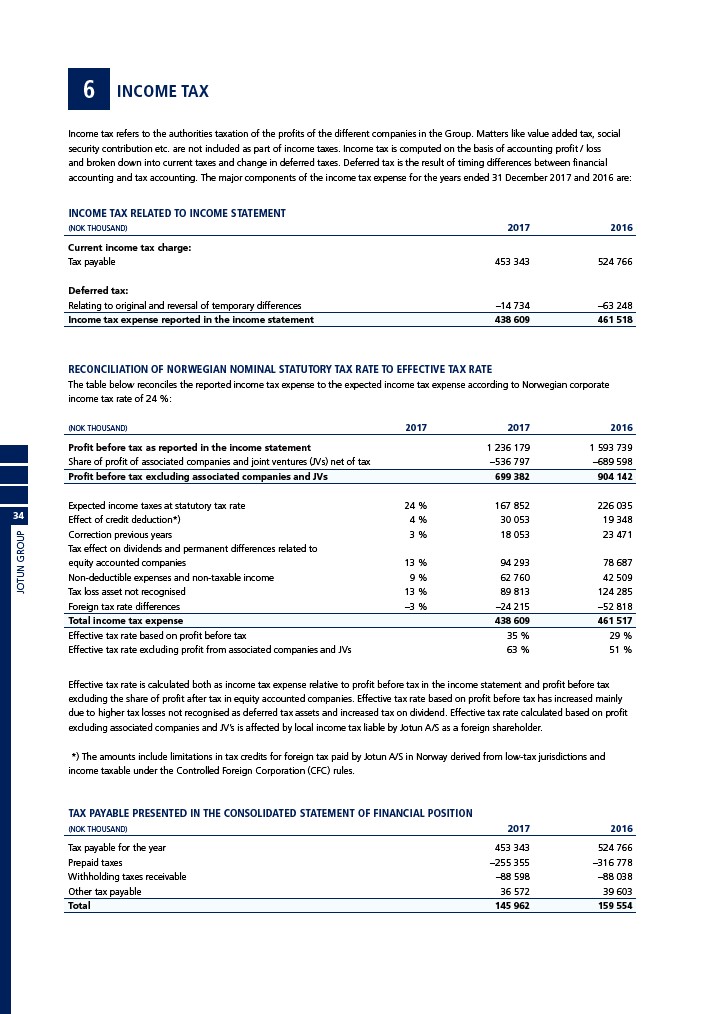

Income tax refers to the authorities taxation of the profits of the different companies in the Group. Matters like value added tax, social

security contribution etc. are not included as part of income taxes. Income tax is computed on the basis of accounting profit / loss

and broken down into current taxes and change in deferred taxes. Deferred tax is the result of timing differences between financial

accounting and tax accounting. The major components of the income tax expense for the years ended 31 December 2017 and 2016 are:

INCOME TAX RELATED TO INCOME STATEMENT

(NOK THOUSAND) 2017 2016

Current income tax charge:

Tax payable 453 343 524 766

Deferred tax:

Relating to original and reversal of temporary differences –14 734 –63 248

Income tax expense reported in the income statement 438 609 461 518

RECONCILIATION OF NORWEGIAN NOMINAL STATUTORY TAX RATE TO EFFECTIVE TAX RATE

The table below reconciles the reported income tax expense to the expected income tax expense according to Norwegian corporate

income tax rate of 24 %:

(NOK THOUSAND) 2017 2017 2016

Profit before tax as reported in the income statement 1 236 179 1 593 739

Share of profit of associated companies and joint ventures (JVs) net of tax –536 797 –689 598

Profit before tax excluding associated companies and JVs 699 382 904 142

Expected income taxes at statutory tax rate 24 % 167 852 226 035

Effect of credit deduction*) 4 % 30 053 19 348

Correction previous years 3 % 18 053 23 471

Tax effect on dividends and permanent differences related to

equity accounted companies 13 % 94 293 78 687

Non-deductible expenses and non-taxable income 9 % 62 760 42 509

Tax loss asset not recognised 13 % 89 813 124 285

Foreign tax rate differences –3 % –24 215 –52 818

Total income tax expense 438 609 461 517

Effective tax rate based on profit before tax 35 % 29 %

Effective tax rate excluding profit from associated companies and JVs 63 % 51 %

Effective tax rate is calculated both as income tax expense relative to profit before tax in the income statement and profit before tax

excluding the share of profit after tax in equity accounted companies. Effective tax rate based on profit before tax has increased mainly

due to higher tax losses not recognised as deferred tax assets and increased tax on dividend. Effective tax rate calculated based on profit

excluding associated companies and JV’s is affected by local income tax liable by Jotun A/S as a foreign shareholder.

*) The amounts include limitations in tax credits for foreign tax paid by Jotun A/S in Norway derived from low-tax jurisdictions and

income taxable under the Controlled Foreign Corporation (CFC) rules.

TAX PAYABLE PRESENTED IN THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(NOK THOUSAND) 2017 2016

Tax payable for the year 453 343 524 766

Prepaid taxes –255 355 –316 778

Withholding taxes receivable –88 598 –88 038

Other tax payable 36 572 39 603

Total 145 962 159 554