41

JOTUN GROUP

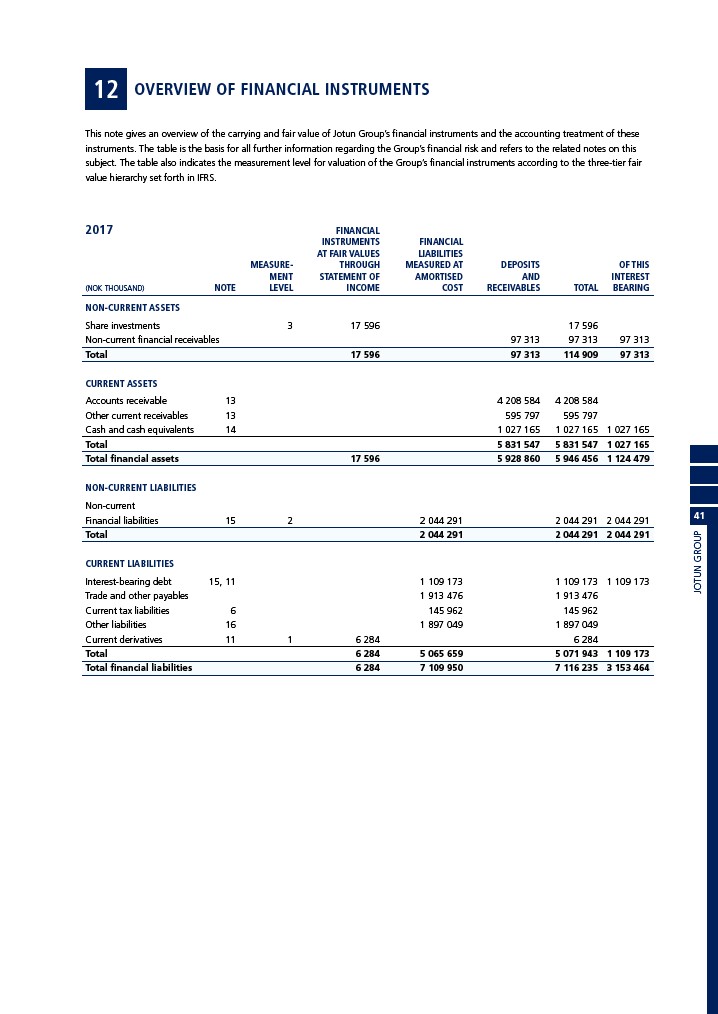

12 OVERVIEW OF FINANCIAL INSTRUMENTS

This note gives an overview of the carrying and fair value of Jotun Group’s financial instruments and the accounting treatment of these

instruments. The table is the basis for all further information regarding the Group’s financial risk and refers to the related notes on this

subject. The table also indicates the measurement level for valuation of the Group’s financial instruments according to the three-tier fair

value hierarchy set forth in IFRS.

2017 FINANCIAL

INSTRUMENTS FINANCIAL

AT FAIR VALUES LIABILITIES

MEASURE- THROUGH MEASURED AT DEPOSITS OF THIS

MENT STATEMENT OF AMORTISED AND INTEREST

(NOK THOUSAND) NOTE LEVEL INCOME COST RECEIVABLES TOTAL BEARING

NON-CURRENT ASSETS

Share investments 3 17 596 17 596

Non-current financial receivables 97 313 97 313 97 313

Total 17 596 97 313 114 909 97 313

CURRENT ASSETS

Accounts receivable 13 4 208 584 4 208 584

Other current receivables 13 595 797 595 797

Cash and cash equivalents 14 1 027 165 1 027 165 1 027 165

Total 5 831 547 5 831 547 1 027 165

Total financial assets 17 596 5 928 860 5 946 456 1 124 479

NON-CURRENT LIABILITIES

Non-current

Financial liabilities 15 2 2 044 291 2 044 291 2 044 291

Total 2 044 291 2 044 291 2 044 291

CURRENT LIABILITIES

Interest-bearing debt 15, 11 1 109 173 1 109 173 1 109 173

Trade and other payables 1 913 476 1 913 476

Current tax liabilities 6 145 962 145 962

Other liabilities 16 1 897 049 1 897 049

Current derivatives 11 1 6 284 6 284

Total 6 284 5 065 659 5 071 943 1 109 173

Total financial liabilities 6 284 7 109 950 7 116 235 3 153 464