35

JOTUN GROUP

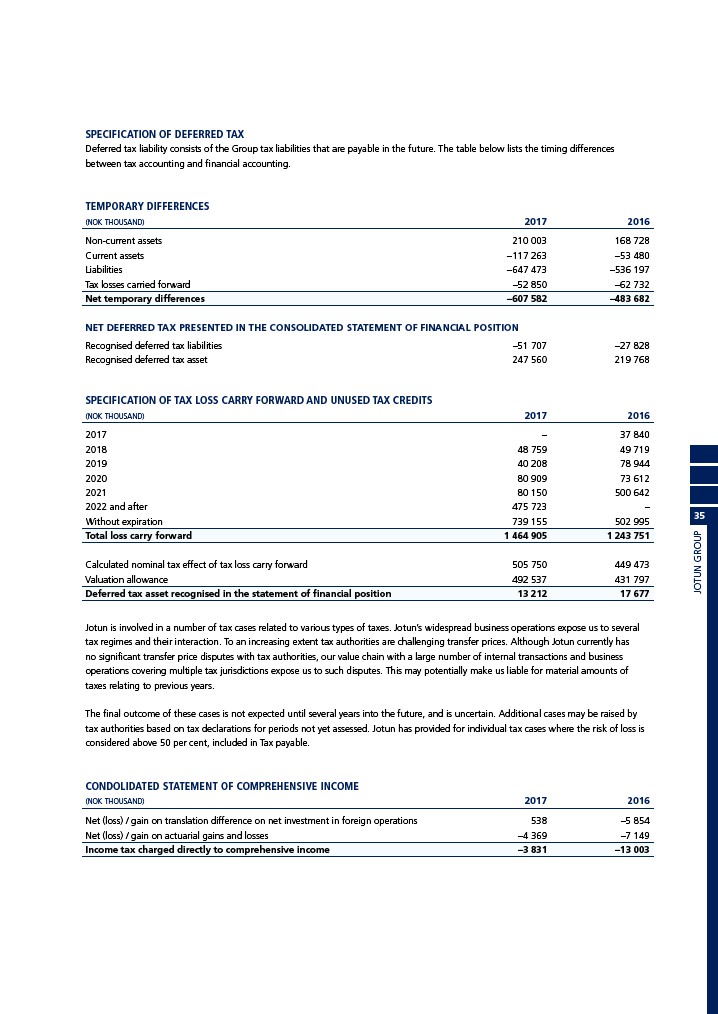

SPECIFICATION OF DEFERRED TAX

Deferred tax liability consists of the Group tax liabilities that are payable in the future. The table below lists the timing differences

between tax accounting and financial accounting.

TEMPORARY DIFFERENCES

(NOK THOUSAND) 2017 2016

Non-current assets 210 003 168 728

Current assets –117 263 –53 480

Liabilities –647 473 –536 197

Tax losses carried forward –52 850 –62 732

Net temporary differences –607 582 –483 682

NET DEFERRED TAX PRESENTED IN THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Recognised deferred tax liabilities –51 707 –27 828

Recognised deferred tax asset 247 560 219 768

SPECIFICATION OF TAX LOSS CARRY FORWARD AND UNUSED TAX CREDITS

(NOK THOUSAND) 2017 2016

2017 – 37 840

2018 48 759 49 719

2019 40 208 78 944

2020 80 909 73 612

2021 80 150 500 642

2022 and after 475 723 –

Without expiration 739 155 502 995

Total loss carry forward 1 464 905 1 243 751

Calculated nominal tax effect of tax loss carry forward 505 750 449 473

Valuation allowance 492 537 431 797

Deferred tax asset recognised in the statement of financial position 13 212 17 677

Jotun is involved in a number of tax cases related to various types of taxes. Jotun’s widespread business operations expose us to several

tax regimes and their interaction. To an increasing extent tax authorities are challenging transfer prices. Although Jotun currently has

no significant transfer price disputes with tax authorities, our value chain with a large number of internal transactions and business

operations covering multiple tax jurisdictions expose us to such disputes. This may potentially make us liable for material amounts of

taxes relating to previous years.

The final outcome of these cases is not expected until several years into the future, and is uncertain. Additional cases may be raised by

tax authorities based on tax declarations for periods not yet assessed. Jotun has provided for individual tax cases where the risk of loss is

considered above 50 per cent, included in Tax payable.

CONDOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(NOK THOUSAND) 2017 2016

Net (loss) / gain on translation difference on net investment in foreign operations 538 –5 854

Net (loss) / gain on actuarial gains and losses –4 369 –7 149

Income tax charged directly to comprehensive income –3 831 –13 003