INTRODUCTION

2

Jotun Group

In response to consumer and industrial demand, Jotun is migrating from a products-based offering to a

solutions-based offering.

For more than 90 years, Jotun has developed paints and

coatings to protect and beautify assets. However, as more

consumers and businesses are turning to paints and coatings to

help solve different challenges, Jotun has expanded its service

offering in every segment to meet specific end user needs.

Performance coatings solutions

For example, shipowners seeking to reduce fuel costs and

lower corresponding carbon emissions can utilise Jotun’s Hull

Performance Solutions, which combines premium marine

antifoulings, priority technical service and tools to measure hull

performance. For stakeholders seeking to reduce application

and maintenance costs in the hydrocarbon processing industry,

Jotun offers Thermosafe. This collection of five coatings

solutions provides protection against a range of risks and issues,

from fire to cryogenic spills, thermal exposure to corrosion

under insulation.

In the Powder Coatings segment, Jotun develops solutions

not only for end users but also for applicators. To serve this

important customer group, Jotun has created client teams

that include sales, technical sales support and R&D personnel

to work closely with applicators to help them achieve optimal

results. In the Decorative Paints segment, Jotun offers Global

Colour Trends, an annual collection of trendy, inspiring colour

schemes, linked by a common theme, that makes it easier for

consumers and designers to select and match complementary

colours. For project owners seeking to simplify supplier

relationships, Jotun works across the Decorative Paints, and

Protective and Powder Coatings segments to offer the Single

Source Solution.

Customer loyalty

By developing products and services to meet specific needs,

Jotun helps customers manage challenges. This approach

encourages long-term partnerships, builds customer loyalty and

allows Jotun to compete for more profitable contracts.

Selling solutions

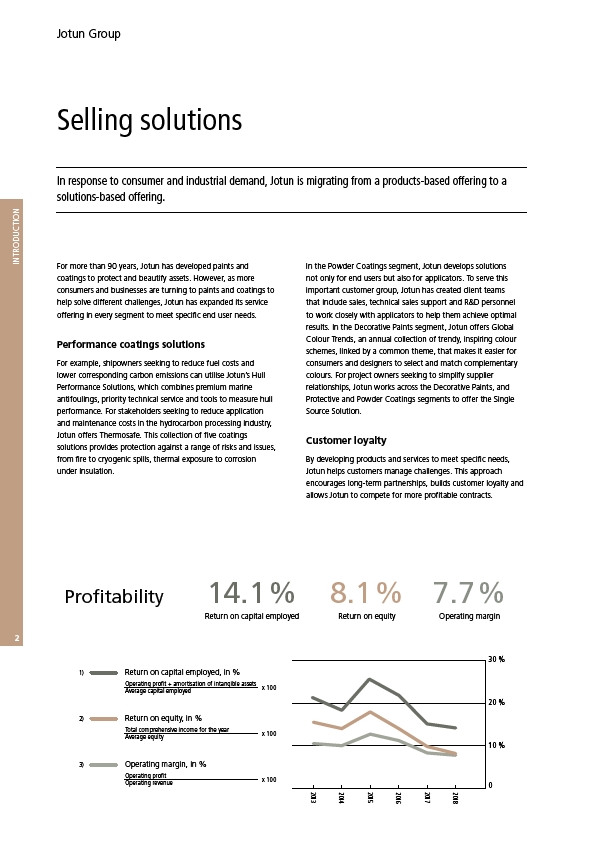

Profitability

2016

2017

2015

2013

2014

30 %

20 %

10 %

0

1) Return on capital employed, in %

2)

3)

Operating profit + amortisation of intangible assets

Average capital employed

x 100

Return on equity, in %

Total comprehensive income for the year

Average equity

x 100

Operating margin, in %

Operating profit

Operating revenue

x 100

2018

14.1 %

Return on capital employed

7.7 %

Operating margin

8.1 %

Return on equity