Managing unpredictability

Over the last five years, Jotun’s year-end results have been influenced by a complex set of macro-economic

factors, from changing oil prices and trade policies, to fluctuations in currency values and

raw material prices. In some years, this volatility has slowed Jotun’s performance, while in other years,

as in 2019, these conditions worked in our favour. While Jotun will always respond quickly to manage

events that it cannot control, the company is developing its business to deliver more balanced and

predictable growth and profitability.

Balanced growth

Jotun’s Marine and Protective Coatings segments are developing more products and services geared

towards asset maintenance. This contributes to reducing the business risk associated with steep drops

in global trade and oil prices, which negatively impacts new constructions in the shipping and oil and

gas industries. In addition, Jotun is making its maintenance products available to more customers

by expanding distribution through dealers. By further diversifying Jotun’s business through the

development of high-quality maintenance products and services that enable customers to extend the

lifecycle of assets, Jotun can achieve more predictable growth.

In periods when macro-economic factors work to the company’s advantage, operating costs tend

to rise. It is important that the company becomes more cost efficient to safeguard profitability, even

when demand for paints and coatings declines. The Board is pleased to report that the company’s

record-high profitability in 2019 was partly due to good cost control.

Secure future

Another way in which Jotun seeks to achieve more predictable results is by making investments in

personnel, production capacity and Research and Development. These investments are not conditioned

on year-end results but are consistent with Jotun’s long-term growth strategy. The Board acknowledges

that not all new investments will pay off immediately, but by exercising patience and remaining true to

Jotun values, strategy and core mission, we can achieve long-term value creation. This will benefit not

only owners, but also employees, communities where we operate and society at large.

By remaining true to Jotun’s values, strategy and core mission, the

company achieved strong results in 2019. By investing in the future

while working to control costs, Jotun can achieve more balanced

growth in the years ahead.

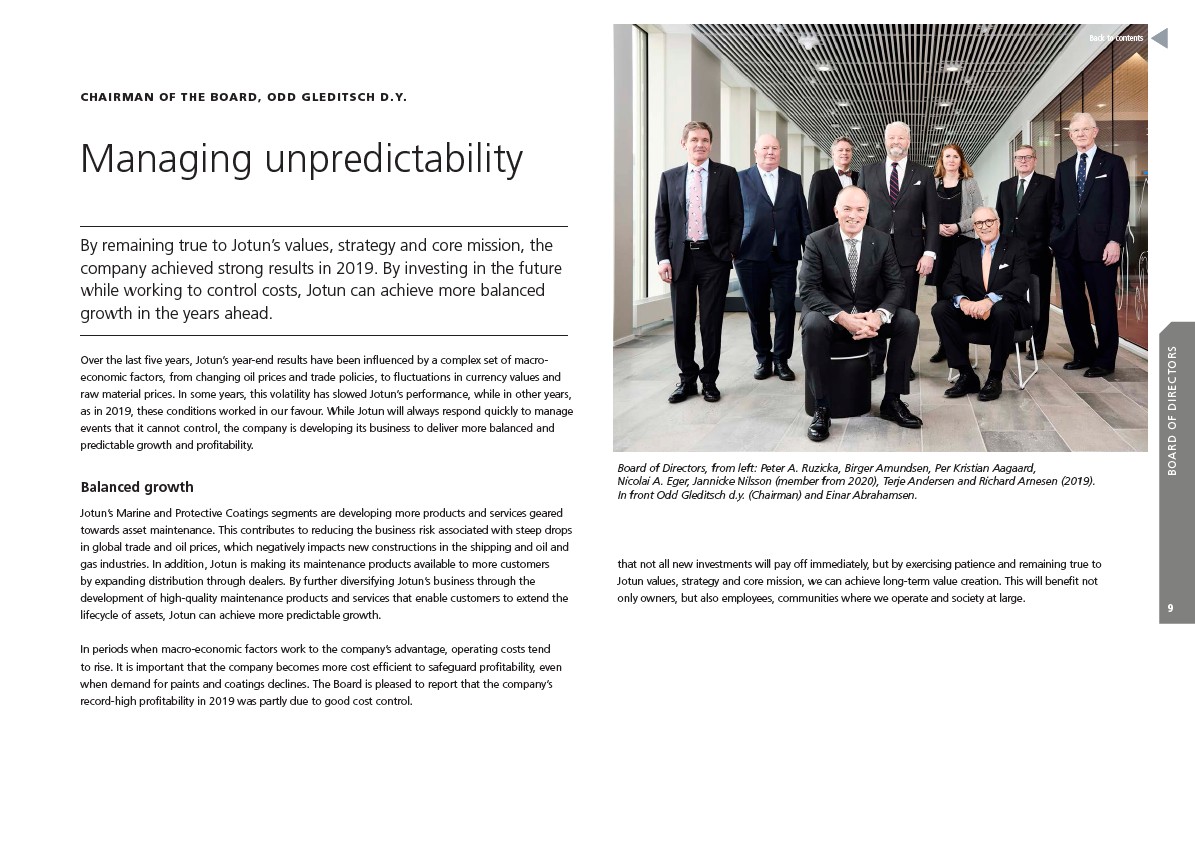

Board of Directors, from left: Peter A. Ruzicka, Birger Amundsen, Per Kristian Aagaard,

Nicolai A. Eger, Jannicke Nilsson (member from 2020), Terje Andersen and Richard Arnesen (2019).

In front Odd Gleditsch d.y. (Chairman) and Einar Abrahamsen.

CHAIRMAN OF THE BOARD, ODD GLEDITSCH D.Y.

Back to contents

BOARD OF DIRECTORS

9

9