3.4 Investments in associates and joint ventures

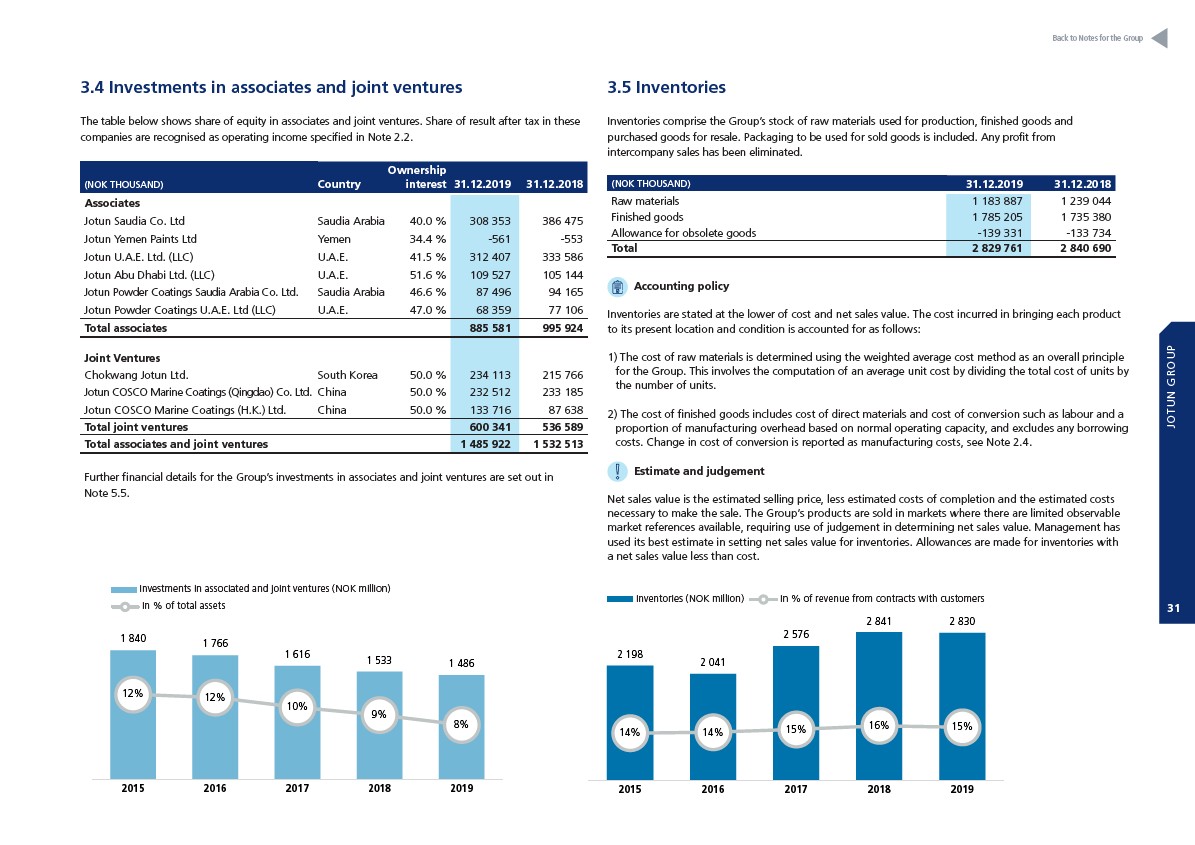

The table below shows share of equity in associates and joint ventures. Share of result after tax in these

companies are recognised as operating income specified in Note 2.2.

(NOK THOUSAND) Country

Ownership

2 000

interest 31.12.2019 31.12.2018

Associates

Jotun Saudia Co. Ltd Saudia Arabia 40.0 % 308 353 386 475

Jotun Yemen Paints Ltd Yemen 34.4 % -561 -553

Jotun U.A.E. Ltd. (LLC) U.A.E. 41.5 % 312 407 333 586

Jotun Abu Dhabi Ltd. (LLC) U.A.E. 51.6 % 109 527 105 144

Jotun Powder Coatings Saudia Arabia Co. Ltd. Saudia Arabia 46.6 % 87 496 94 165

Jotun Powder Coatings U.A.E. Ltd (LLC) U.A.E. 47.0 % 68 359 77 106

Total associates 885 581 995 924

1 500

1 000

500

Joint Ventures

Chokwang Jotun Ltd. South Korea 50.0 % 234 113 215 766

Jotun COSCO Marine Coatings (Qingdao) Co. Ltd. China 50.0 % 232 512 233 185

Jotun COSCO Marine Coatings (H.K.) Ltd. China 50.0 % 133 716 87 638

Total joint ventures 600 341 536 589

Total associates and joint ventures 1 485 922 1 532 513

Further financial details for the Group’s investments in associates and joint ventures are set out in

Note 5.5.

Investments in associated companies and joint ventures (NOK million)

In % of Total assets

1 840 1 766

1 616

1 533 1 486

12% 12%

10%

9%

8%

20%

15%

10%

5%

0%

2 000

1 500

1 000

500

0

2015 2016 2017 2018 2019

3.5 Inventories

Inventories comprise the Group’s stock of raw materials used for production, finished goods and

purchased goods for resale. Packaging to be used for sold goods is included. Any profit from

intercompany sales has been eliminated.

Investments in associated companies and joint ventures (NOK million)

In % of Total assets

1 840 1 766

20%

(NOK THOUSAND) 31.12.2019 31.12.2018

Raw materials 1 183 887 1 239 044

Finished goods 1 785 205 1 735 380

Allowance 12% for obsolete goods -139 331 -133 734

12%

Total 2 829 761 2 840 690

Accounting policy

1 616

1 533 1 486

10%

9%

8%

15%

10%

5%

Inventories are stated at the lower of cost and net sales value. The cost incurred in bringing 0%

each product

to its present location and condition is accounted for as follows:

1) The cost of raw materials is determined using the weighted average cost method as an overall principle

for the Group. This involves the computation of an average unit cost by dividing the total cost of units by

the number of units.

2) The cost of finished goods includes cost of direct materials and cost of conversion such as labour and a

proportion of manufacturing overhead based on normal operating capacity, and excludes any borrowing

costs. Change in cost of conversion is reported as manufacturing costs, see Note 2.4.

Estimate and judgement

Net sales value is the estimated selling price, less estimated costs of completion and the estimated costs

necessary to make the sale. The Group’s products are sold in markets where there are limited observable

market references available, requiring use of judgement in determining net sales value. Management has

used its best estimate in setting net sales value for inventories. Allowances are made for inventories with

a net sales value less than cost.

0

2015 2016 2017 2018 2019

Inventories (NOK million) In % of Revenue from contracts with customers*

2 198

2 041

2 576

2 841 2 830

14% 14% 15% 16% 15%

45,0%

40,0%

35,0%

30,0%

25,0%

20,0%

15,0%

10,0%

5,0%

0,0%

3 000

2 500

2 000

1 500

1 000

500

0

2015 2016 2017 2018 2019

Investments in associated and joint ventures (NOK million)

In % of total assets

Inventories (NOK million) In % of revenue from contracts with customers

Back to Notes for the Group

JOTUN GROUP

31