5.2 Pensions and other long-term employee benefits

The Group companies provide various retirement plans in accordance with local regulations and practices

in the countries in which they operate.

The majority of the Group’s pension plans are defined contribution plans, whereby the company’s

obligation is limited to annual contributions to the employees’ pension plans. The Group also has a

few, remaining defined benefit pension plans with net pension obligation. Costs related to these plans

account for less than 15 per cent of total pension costs in 2019.

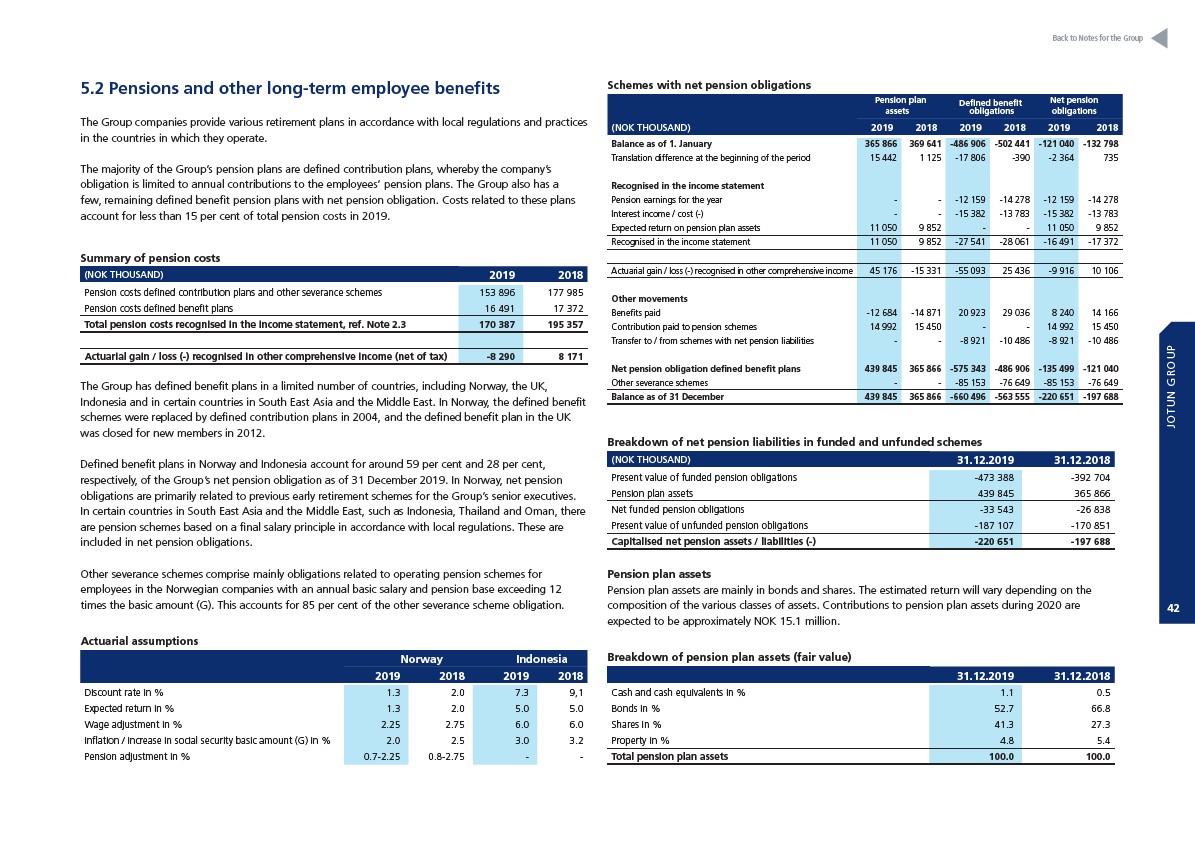

Summary of pension costs

(NOK THOUSAND) 2019 2018

Pension costs defined contribution plans and other severance schemes 153 896 177 985

Pension costs defined benefit plans 16 491 17 372

Total pension costs recognised in the income statement, ref. Note 2.3 170 387 195 357

Actuarial gain / loss (-) recognised in other comprehensive income (net of tax) -8 290 8 171

The Group has defined benefit plans in a limited number of countries, including Norway, the UK,

Indonesia and in certain countries in South East Asia and the Middle East. In Norway, the defined benefit

schemes were replaced by defined contribution plans in 2004, and the defined benefit plan in the UK

was closed for new members in 2012.

Defined benefit plans in Norway and Indonesia account for around 59 per cent and 28 per cent,

respectively, of the Group’s net pension obligation as of 31 December 2019. In Norway, net pension

obligations are primarily related to previous early retirement schemes for the Group’s senior executives.

In certain countries in South East Asia and the Middle East, such as Indonesia, Thailand and Oman, there

are pension schemes based on a final salary principle in accordance with local regulations. These are

included in net pension obligations.

Other severance schemes comprise mainly obligations related to operating pension schemes for

employees in the Norwegian companies with an annual basic salary and pension base exceeding 12

times the basic amount (G). This accounts for 85 per cent of the other severance scheme obligation.

Actuarial assumptions

Norway Indonesia

2019 2018 2019 2018

Discount rate in % 1.3 2.0 7.3 9,1

Expected return in % 1.3 2.0 5.0 5.0

Wage adjustment in % 2.25 2.75 6.0 6.0

Inflation / increase in social security basic amount (G) in % 2.0 2.5 3.0 3.2

Pension adjustment in % 0.7-2.25 0.8-2.75 - -

Schemes with net pension obligations

Pension plan

assets

Defined benefit

obligations

Back to Notes for the Group

Net pension

obligations

(NOK THOUSAND) 2019 2018 2019 2018 2019 2018

Balance as of 1. January 365 866 369 641 -486 906 -502 441 -121 040 -132 798

Translation difference at the beginning of the period 15 442 1 125 -17 806 -390 -2 364 735

Recognised in the income statement

Pension earnings for the year - - -12 159 -14 278 -12 159 -14 278

Interest income / cost (-) - - -15 382 -13 783 -15 382 -13 783

Expected return on pension plan assets 11 050 9 852 - - 11 050 9 852

Recognised in the income statement 11 050 9 852 -27 541 -28 061 -16 491 -17 372

Actuarial gain / loss (-) recognised in other comprehensive income 45 176 -15 331 -55 093 25 436 -9 916 10 106

Other movements

Benefits paid -12 684 -14 871 20 923 29 036 8 240 14 166

Contribution paid to pension schemes 14 992 15 450 - - 14 992 15 450

Transfer to / from schemes with net pension liabilities - - -8 921 -10 486 -8 921 -10 486

Net pension obligation defined benefit plans 439 845 365 866 -575 343 -486 906 -135 499 -121 040

Other severance schemes - - -85 153 -76 649 -85 153 -76 649

Balance as of 31 December 439 845 365 866 -660 496 -563 555 -220 651 -197 688

Breakdown of net pension liabilities in funded and unfunded schemes

(NOK THOUSAND) 31.12.2019 31.12.2018

Present value of funded pension obligations -473 388 -392 704

Pension plan assets 439 845 365 866

Net funded pension obligations -33 543 -26 838

Present value of unfunded pension obligations -187 107 -170 851

Capitalised net pension assets / liabilities (-) -220 651 -197 688

Pension plan assets

Pension plan assets are mainly in bonds and shares. The estimated return will vary depending on the

composition of the various classes of assets. Contributions to pension plan assets during 2020 are

expected to be approximately NOK 15.1 million.

Breakdown of pension plan assets (fair value)

31.12.2019 31.12.2018

Cash and cash equivalents in % 1.1 0.5

Bonds in % 52.7 66.8

Shares in % 41.3 27.3

Property in % 4.8 5.4

Total pension plan assets 100.0 100.0

JOTUN GROUP

42