Accounting policy

PP&E are stated at cost less accumulated depreciation

and impairment charges. Costs include expenditures

that are directly attributable to the purchase of

the asset, including borrowing cost of investment

projects under construction.

PP&E are depreciated over estimated useful life after

deduction of estimated residual value. Depreciation

methods, useful lives and residual values are

reassessed annually. Changes to the estimated

residual value of useful life are accounted for as a

change in estimate.

Costs of major maintenance activities are capitalised

and depreciated over the estimated useful life.

Maintenance costs which cannot be separately

defined as a component of PP&E are expensed in the

period in which they occur.

Estimate and judgement

The Group assess the carrying value of intangible

assets and PP&E whenever events or changes in

circumstances indicate that the carrying value of an

asset may not be recoverable.

If the carrying value of an asset exceeds its estimated

recoverable amount, an impairment loss is recognised

in the income statement.

The assessment for impairment is performed for

assets generating largely independent cash inflows.

The Group reverses impairment losses in the income

statement if and to the extent this is substantiated

by a change in the estimates used to determine the

recoverable amount

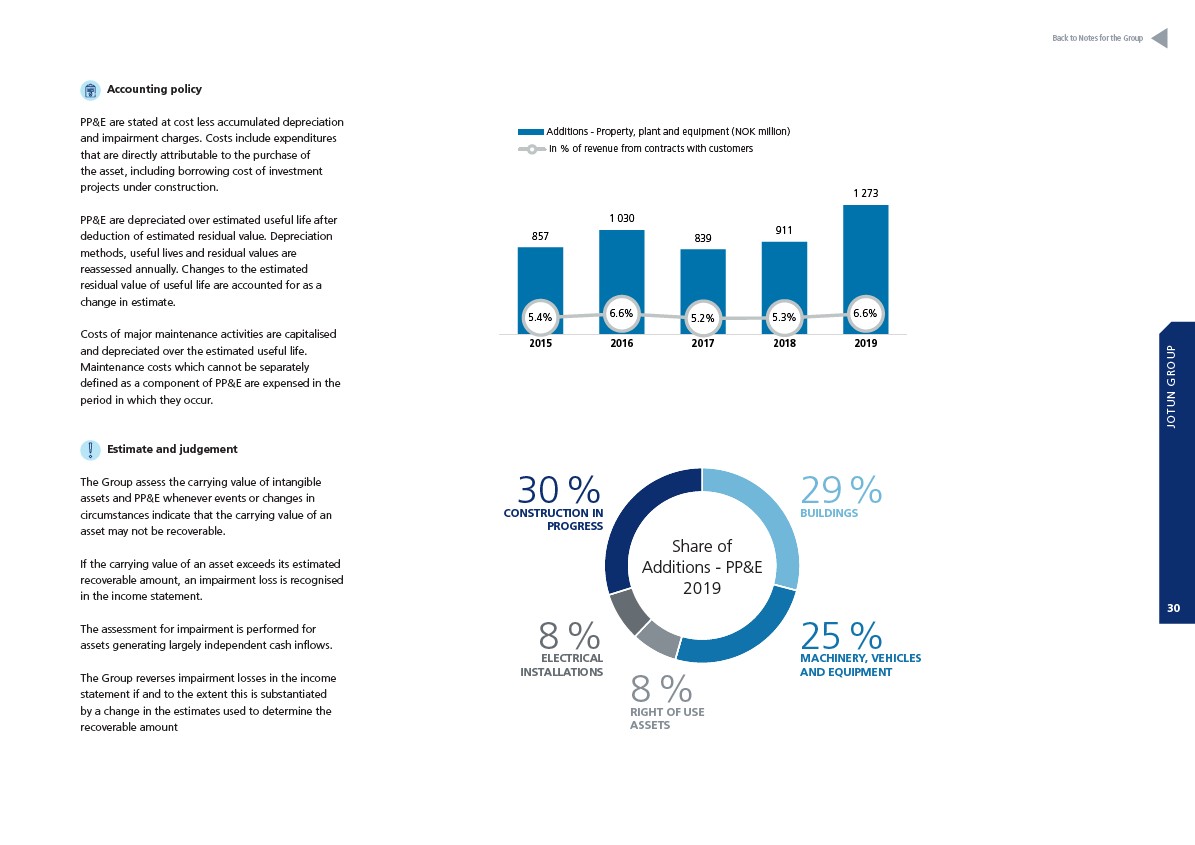

2015 2016 2017 2018 2019

Additions - Property, plant and equipment (NOK million)

In % of revenue from contracts with customers

857

Additions - Property, Plant and Equipment (NOK million)

In % of Revenue from contracts with customers

1 030

839

911

1 273

5.4% 6.6% 5.2% 5.3% 6.6%

40,0%

30,0%

20,0%

10,0%

0,0%

1 400

1 200

1 000

800

600

400

200

0

2015 2016 2017 2018 2019

Share of

Additions - PP&E

2019

29 %

BUILDINGS

25 %

MACHINERY, VEHICLES

AND EQUIPMENT 8 %

RIGHT OF USE

ASSETS

30 %

CONSTRUCTION IN

PROGRESS

8 %

ELECTRICAL

INSTALLATIONS

Back to Notes for the Group

JOTUN GROUP

30