Accounting policy

Current income tax

Current income tax assets and liabilities are measured at the amount that is expected to be paid to

or recovered from the tax authorities. The current and deferred income tax is calculated based on tax

rates and tax laws that have been enacted or substantively enacted, in the countries where the Group

operates and generates taxable income. Management periodically evaluates positions taken in the tax

returns with respect to situations in which applicable tax regulations are subject to interpretation and

establishes provisions where appropriate.

Deferred tax

Deferred tax assets and deferred tax liabilities are calculated on all differences between the book value

and tax value of assets and liabilities. Deferred tax assets and deferred tax liabilities are recognised at

their nominal value and classified as non-current liabilities and non-current assets in the balance sheet.

Deferred tax liabilities and deferred tax assets are offset as far as possible as permitted by taxation

legislation and regulations. Deferred tax assets are recognised for all unused tax losses and temporary

differences to the extent that it is probable that taxable profit will be available against which losses and

temporary differences can be utilised.

Estimate and judgement

Uncertainties exist with respect to determining the Group’s deferred tax assets and deferred tax

liabilities. Significant management judgement is required to determine the amount of deferred tax

assets that can be recognised, based upon the likely timing and level of future taxable profits, together

with future tax planning strategies.

The Group is subject to income taxes in numerous jurisdictions, and judgement is involved when

determining the taxable amounts. Tax authorities in different jurisdictions may challenge the calculation

of taxes payable from prior periods. Management judgement is required when assessing valuation of

unused losses, tax credits and other deferred tax assets. The recoverability is assessed by estimating

taxable profits in future years taking into consideration expected changes in temporary differences.

Indirect tax regimes are complex in many jurisdictions. The basis for such taxes may differ from actual

transaction prices. In some jurisdictions, including Brazil, significant credit amounts are generated

for use against future indirect and/or income tax payments. The value of such credits depends on

future taxable income. Economic conditions and tax regulations may change and lead to a different

conclusion regarding recoverability. Tax authorities may challenge Jotun’s calculation of indirect

taxes and credits from prior periods. Such processes may lead to changes to prior periods’ operating

expenses to be recognised in the period of change.

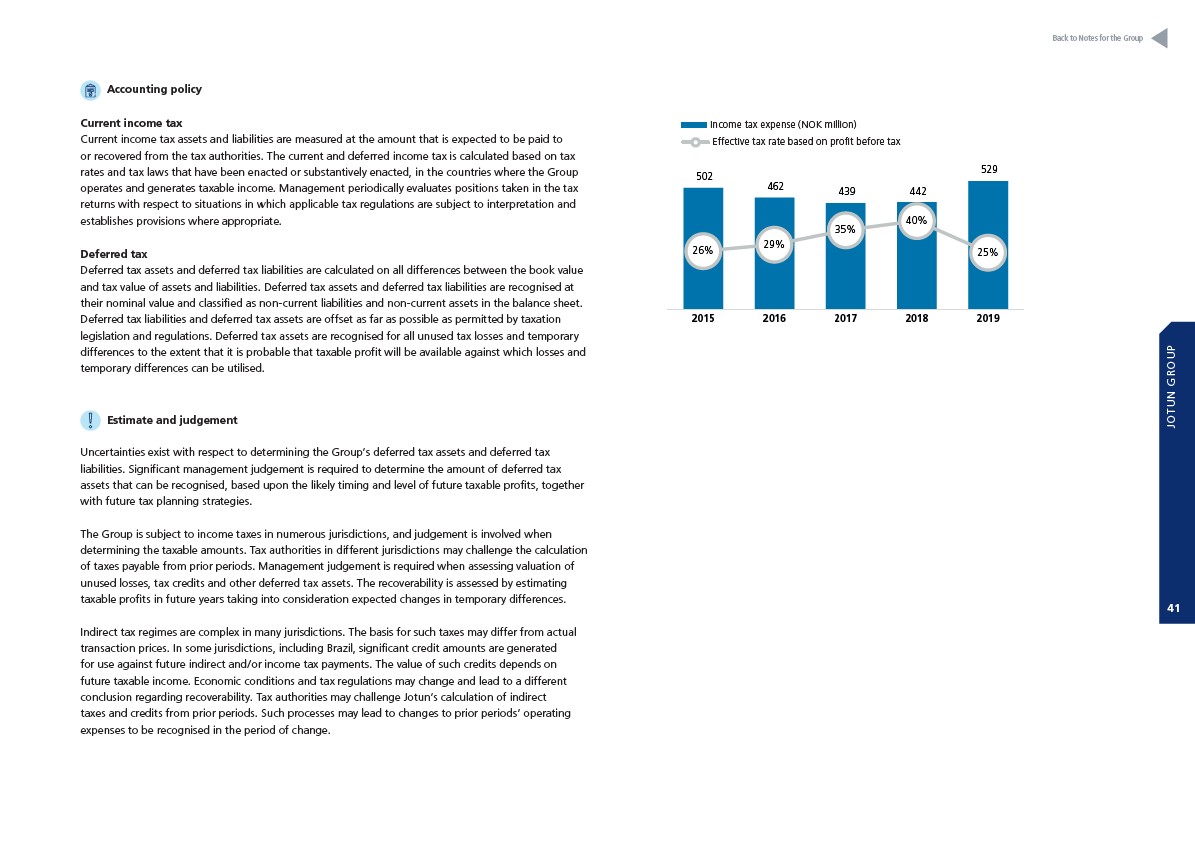

Income tax expense (NOK million)

Effective tax rate based on profit before tax

502

Income tax expence (NOK million)

Effective tax rate based on profit before tax

462 439 442

529

26%

29%

35%

40%

25%

60%

50%

40%

30%

20%

10%

0%

600

500

400

300

200

100

0

2015 2016 2017 2018 2019

Back to Notes for the Group

JOTUN GROUP

41