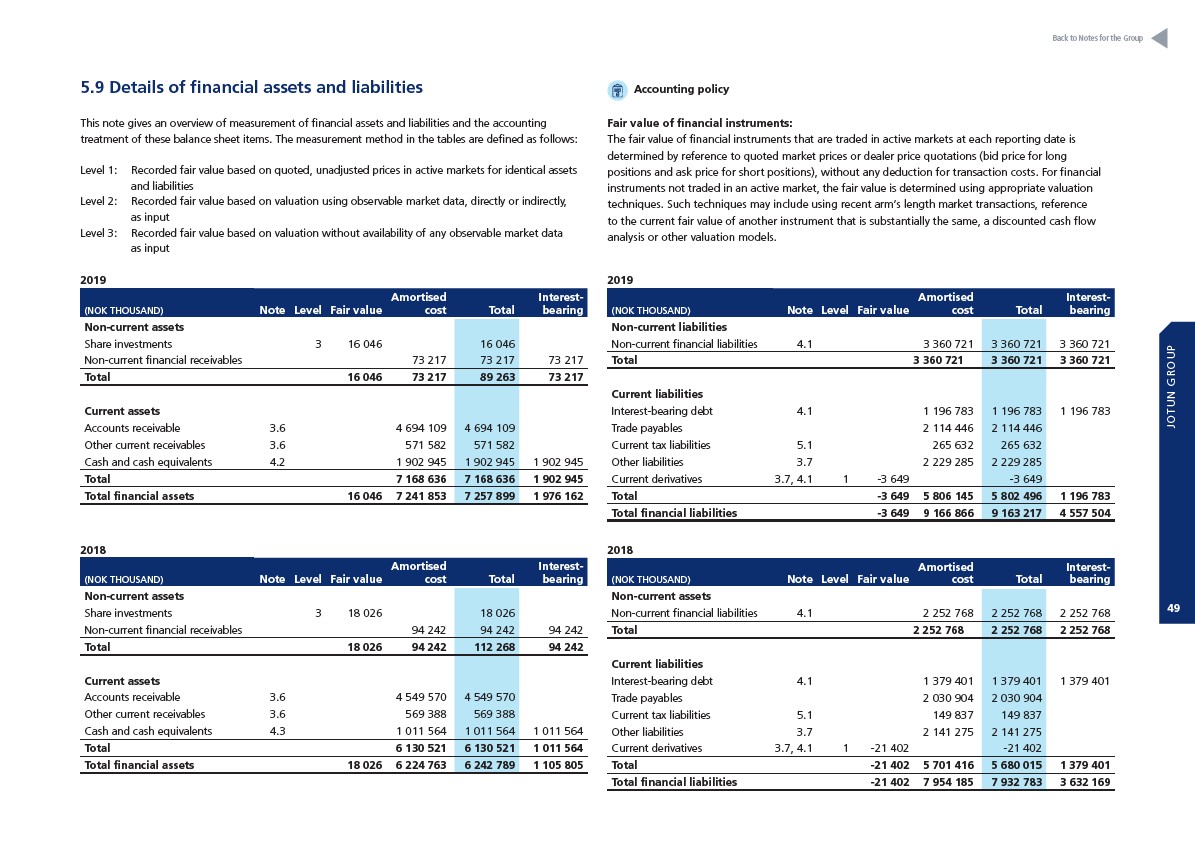

5.9 Details of financial assets and liabilities

This note gives an overview of measurement of financial assets and liabilities and the accounting

treatment of these balance sheet items. The measurement method in the tables are defined as follows:

Level 1: Recorded fair value based on quoted, unadjusted prices in active markets for identical assets

and liabilities

Level 2: Recorded fair value based on valuation using observable market data, directly or indirectly,

as input

Level 3: Recorded fair value based on valuation without availability of any observable market data

as input

2019

(NOK THOUSAND) Note Level Fair value

Amortised

cost Total

Interest-

bearing

Non-current assets

Share investments 3 16 046 16 046

Non-current financial receivables 73 217 73 217 73 217

Total 16 046 73 217 89 263 73 217

Current assets

Accounts receivable 3.6 4 694 109 4 694 109

Other current receivables 3.6 571 582 571 582

Cash and cash equivalents 4.2 1 902 945 1 902 945 1 902 945

Total 7 168 636 7 168 636 1 902 945

Total financial assets 16 046 7 241 853 7 257 899 1 976 162

2018

(NOK THOUSAND) Note Level Fair value

Amortised

cost Total

Interest-

bearing

Non-current assets

Share investments 3 18 026 18 026

Non-current financial receivables 94 242 94 242 94 242

Total 18 026 94 242 112 268 94 242

Current assets

Accounts receivable 3.6 4 549 570 4 549 570

Other current receivables 3.6 569 388 569 388

Cash and cash equivalents 4.3 1 011 564 1 011 564 1 011 564

Total 6 130 521 6 130 521 1 011 564

Total financial assets 18 026 6 224 763 6 242 789 1 105 805

Accounting policy

Back to Notes for the Group

Fair value of financial instruments:

The fair value of financial instruments that are traded in active markets at each reporting date is

determined by reference to quoted market prices or dealer price quotations (bid price for long

positions and ask price for short positions), without any deduction for transaction costs. For financial

instruments not traded in an active market, the fair value is determined using appropriate valuation

techniques. Such techniques may include using recent arm’s length market transactions, reference

to the current fair value of another instrument that is substantially the same, a discounted cash flow

analysis or other valuation models.

2019

(NOK THOUSAND) Note Level Fair value

Non-current liabilities

Non-current financial liabilities 4.1 3 360 721 3 360 721 3 360 721

Total 3 360 721 3 360 721 3 360 721

Current liabilities

Interest-bearing debt 4.1 1 196 783 1 196 783 1 196 783

Trade payables 2 114 446 2 114 446

Current tax liabilities 5.1 265 632 265 632

Other liabilities 3.7 2 229 285 2 229 285

Current derivatives 3.7, 4.1 1 -3 649 -3 649

Total -3 649 5 806 145 5 802 496 1 196 783

Total financial liabilities -3 649 9 166 866 9 163 217 4 557 504

2018

(NOK THOUSAND) Note Level Fair value

Amortised

cost Total

Amortised

cost Total

Interest-

bearing

Interest-

bearing

Non-current assets

Non-current financial liabilities 4.1 2 252 768 2 252 768 2 252 768

Total 2 252 768 2 252 768 2 252 768

Current liabilities

Interest-bearing debt 4.1 1 379 401 1 379 401 1 379 401

Trade payables 2 030 904 2 030 904

Current tax liabilities 5.1 149 837 149 837

Other liabilities 3.7 2 141 275 2 141 275

Current derivatives 3.7, 4.1 1 -21 402 -21 402

Total -21 402 5 701 416 5 680 015 1 379 401

Total financial liabilities -21 402 7 954 185 7 932 783 3 632 169

JOTUN GROUP

49