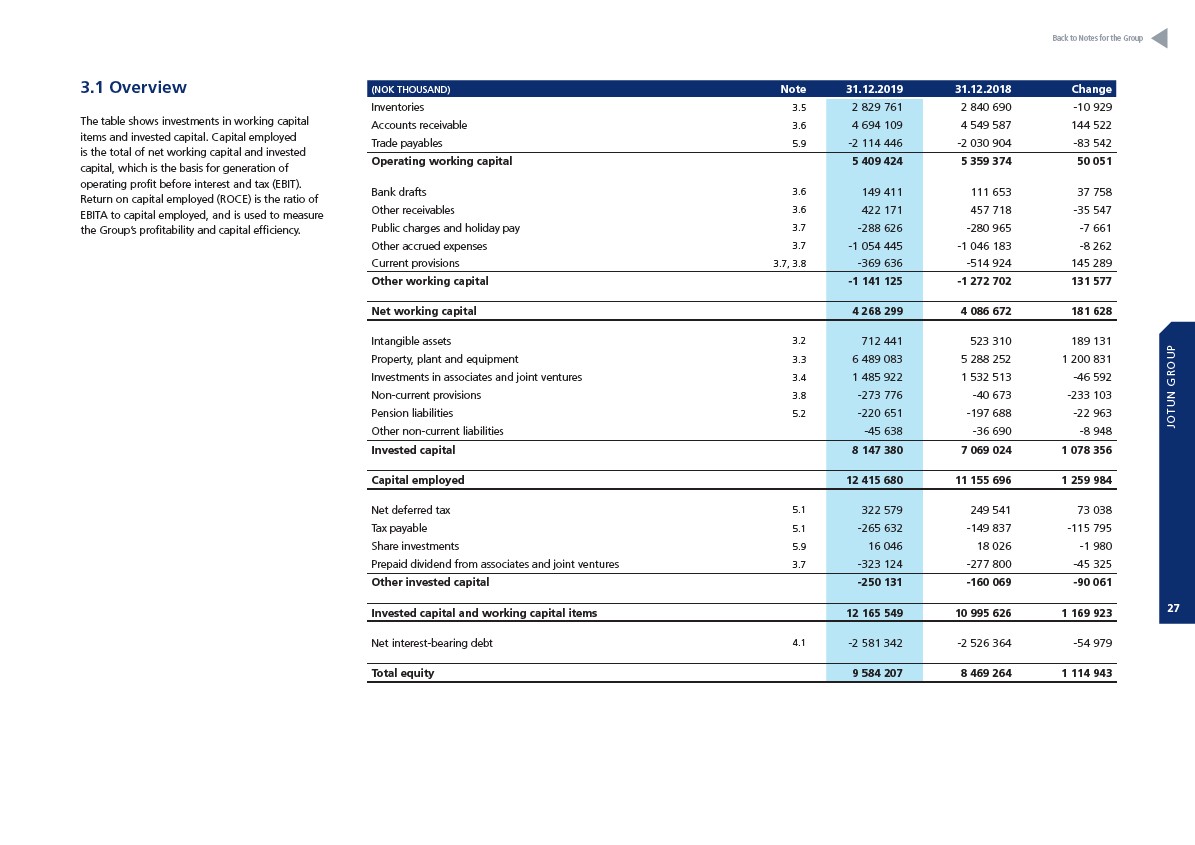

(NOK THOUSAND) Note 31.12.2019 31.12.2018 Change

Inventories 3.5 2 829 761 2 840 690 -10 929

Accounts receivable 3.6 4 694 109 4 549 587 144 522

Trade payables 5.9 -2 114 446 -2 030 904 -83 542

Operating working capital 5 409 424 5 359 374 50 051

Bank drafts 3.6 149 411 111 653 37 758

Other receivables 3.6 422 171 457 718 -35 547

Public charges and holiday pay 3.7 -288 626 -280 965 -7 661

Other accrued expenses 3.7 -1 054 445 -1 046 183 -8 262

Current provisions 3.7, 3.8 -369 636 -514 924 145 289

Other working capital -1 141 125 -1 272 702 131 577

Net working capital 4 268 299 4 086 672 181 628

Intangible assets 3.2 712 441 523 310 189 131

Property, plant and equipment 3.3 6 489 083 5 288 252 1 200 831

Investments in associates and joint ventures 3.4 1 485 922 1 532 513 -46 592

Non-current provisions 3.8 -273 776 -40 673 -233 103

Pension liabilities 5.2 -220 651 -197 688 -22 963

Other non-current liabilities -45 638 -36 690 -8 948

Invested capital 8 147 380 7 069 024 1 078 356

Capital employed 12 415 680 11 155 696 1 259 984

Net deferred tax 5.1 322 579 249 541 73 038

Tax payable 5.1 -265 632 -149 837 -115 795

Share investments 5.9 16 046 18 026 -1 980

Prepaid dividend from associates and joint ventures 3.7 -323 124 -277 800 -45 325

Other invested capital -250 131 -160 069 -90 061

Invested capital and working capital items 12 165 549 10 995 626 1 169 923

Net interest-bearing debt 4.1 -2 581 342 -2 526 364 -54 979

Total equity 9 584 207 8 469 264 1 114 943

3.1 Overview

The table shows investments in working capital

items and invested capital. Capital employed

is the total of net working capital and invested

capital, which is the basis for generation of

operating profit before interest and tax (EBIT).

Return on capital employed (ROCE) is the ratio of

EBITA to capital employed, and is used to measure

the Group’s profitability and capital efficiency.

Back to Notes for the Group

JOTUN GROUP

27