Accounting policy

Defined contribution plans

The pension cost related to the Group’s defined contribution plans is equal to the annual contribution

made to the employee’s individual pension accounts in the accounting period. Annual contributions

correspond to an agreed percentage of the employee’s salary in accordance with local pension

arrangements. In Norway, the rate is five per cent of annual basic salary, limited upwards to twelve

times the social security basic amount. In addition, 18.1 per cent contribution is made for annual basic

salary between 7.1-12 times the social security basic amount. The pension contributions are expensed

when incurred. The return on the pension funds will affect the size of the employees’ pension, and the

risk of returns lies with the employees.

Defined benefit plans

In the defined benefit plans, the Group companies are responsible for paying an agreed pension to

the employee based on his or her final pay. Defined benefit plans are valued at the present value of

accrued future pension obligations at the end of the reporting period. Pension plan assets are valued

at their fair value. The capitalised net liability is the sum of the accrued pension liability minus the fair

value of the associated pension fund asset.

Actuarial gains and losses are recognised in other comprehensive income. Introduction of new or

changes to existing defined benefit plans that will lead to changes in pension liabilities are recognised

in the income statement as they occur. Gains or losses linked to changes or terminations of pension

plans are also recognised in the income statement when they arise.

Other severance schemes

Other severance schemes comprise mainly of obligations related to pension schemes for employees

in the Norwegian companies with an annual basic salary exceeding 12 times the basic amount (G).

In addition, minor statutory obligations to employees in a few other countries are also included.

Obligations related to other severance schemes are recognised as non-current liabilities.

Estimate and judgement

Defined benefit plans are calculated based on a set of selected financial and actuarial assumptions.

Changes in parameters such as discount rates, future wage adjustment, etc. could have a substantial

impact on the estimated pension liability. Similarly, changes in selected assumptions for the return on

pension assets could affect the amount of the pension assets. The Group will not be materially affected

by a reasonable expected change in key assumptions.

All assumptions are reviewed at each reporting date. In determining the appropriate discount rate,

the interest rates of corporate bonds in the respective currency with at least AA rating and with

extrapolated maturities corresponding to the expected duration of the defined benefit obligation, are

used as a basis. Financial data for these bonds is further reviewed for quality, and those bonds having

excessive credit spreads are omitted, as they are considered to not represent high quality bonds.

As a rule, parameters such as wage growth, growth in G and inflation are set in accordance with

recommendations in the various countries.

Mortality rates are based on publicly available mortality tables for the specific countries. Future

salary increases and pension increases are based on expected future inflation rates for the respective

countries.

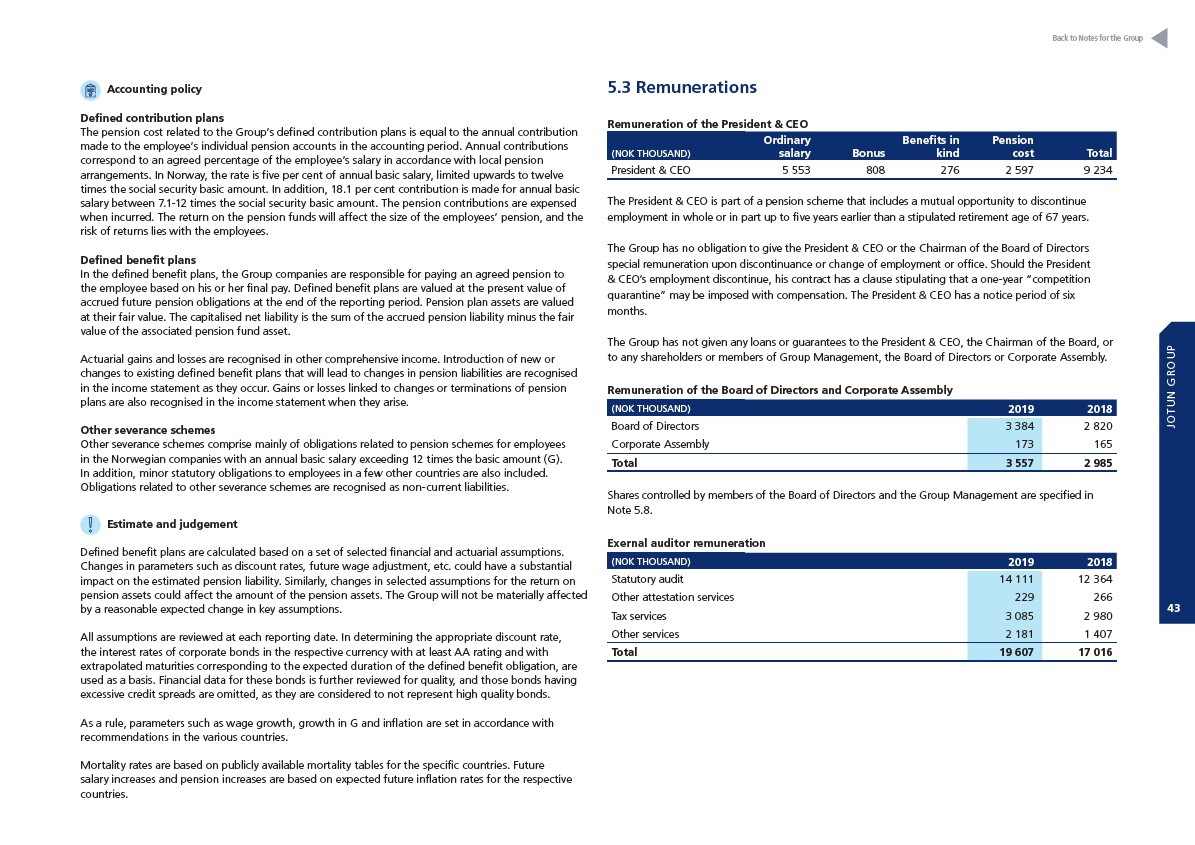

5.3 Remunerations

Remuneration of the President & CEO

(NOK THOUSAND)

Ordinary

salary Bonus

Benefits in

kind

Pension

Back to Notes for the Group

cost Total

President & CEO 5 553 808 276 2 597 9 234

The President & CEO is part of a pension scheme that includes a mutual opportunity to discontinue

employment in whole or in part up to five years earlier than a stipulated retirement age of 67 years.

The Group has no obligation to give the President & CEO or the Chairman of the Board of Directors

special remuneration upon discontinuance or change of employment or office. Should the President

& CEO’s employment discontinue, his contract has a clause stipulating that a one-year “competition

quarantine” may be imposed with compensation. The President & CEO has a notice period of six

months.

The Group has not given any loans or guarantees to the President & CEO, the Chairman of the Board, or

to any shareholders or members of Group Management, the Board of Directors or Corporate Assembly.

Remuneration of the Board of Directors and Corporate Assembly

(NOK THOUSAND) 2019 2018

Board of Directors 3 384 2 820

Corporate Assembly 173 165

Total 3 557 2 985

Shares controlled by members of the Board of Directors and the Group Management are specified in

Note 5.8.

Exernal auditor remuneration

(NOK THOUSAND) 2019 2018

Statutory audit 14 111 12 364

Other attestation services 229 266

Tax services 3 085 2 980

Other services 2 181 1 407

Total 19 607 17 016

JOTUN GROUP

43