3.2 Intangible assets

Intangible assets are non-physical assets that

have either been capitalised through internal

development of products (development cost),

customisation of IT applications or separate

acquisitions.

Territorial rights to the Qatari market were acquired

by Jotun A/S from Jotun U.A.E. Ltd. (LLC) for NOK

237 million. After eliminations, NOK 138 million

has been capitalised as intangible assets.

Accounting policy

Intangible assets are measured at cost, net of

accumulated amortisation and accumulated

impairment losses.

Amortisation of intangible assets with limited

economic lives are calculated on a straight-line

basis over the estimated useful life. The

amortisation method and period are assessed at

least once a year. Changes to the amortisation

method and/or period are accounted for as

a change in estimate. Intangible assets with

unlimited useful lives are not amortised but tested

for impairment annually. The methodology for

impairment testing is described in Note 3.3.

All intellectual property rights are owned by Jotun

A/S. Development costs are capitalised only if the

product is technically and commercially feasible and

the business case demonstrates a probability for

future economic benefit. Capitalised development

costs mainly include internal payroll costs in

addition to purchased materials and services

used in the development programs. Amortisation

of assets with limited useful life begins when

development is complete, and the asset is available

for use.

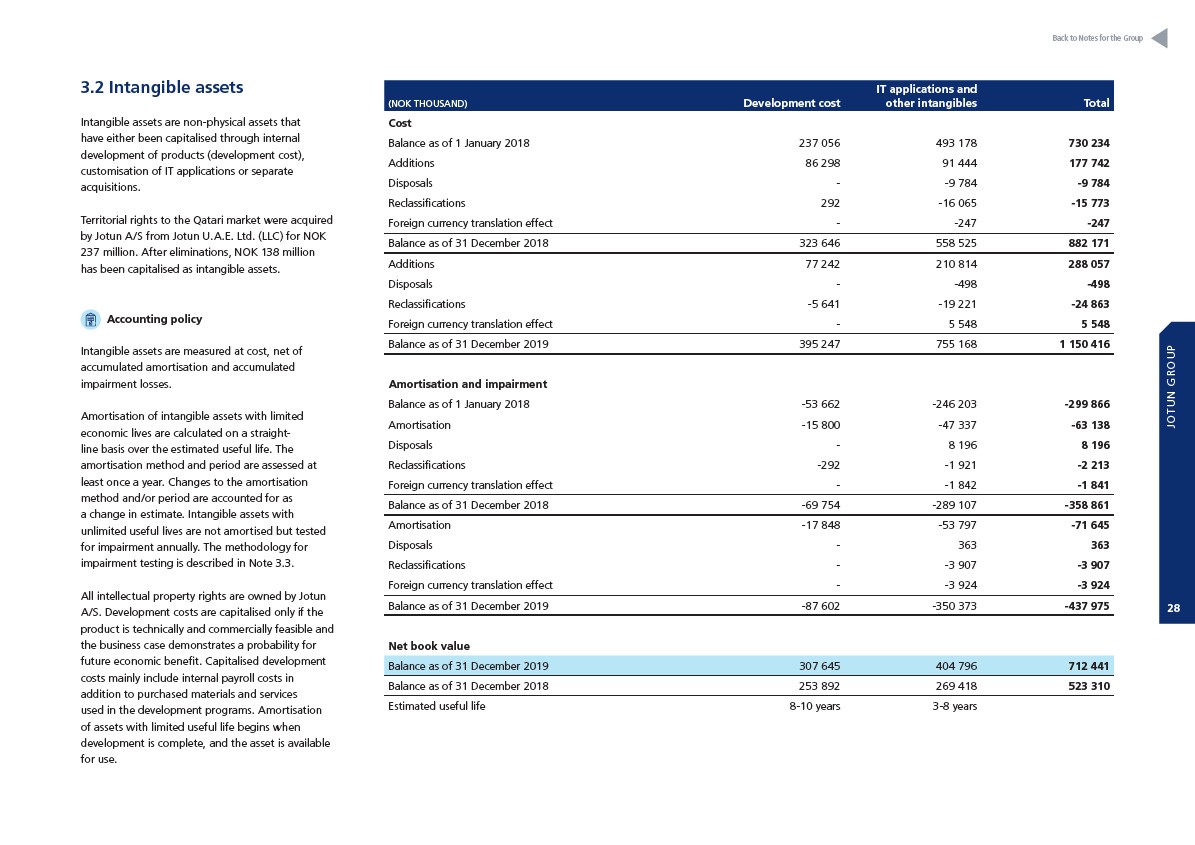

(NOK THOUSAND) Development cost

Back to Notes for the Group

IT applications and

other intangibles Total

Cost

Balance as of 1 January 2018 237 056 493 178 730 234

Additions 86 298 91 444 177 742

Disposals - -9 784 -9 784

Reclassifications 292 -16 065 -15 773

Foreign currency translation effect - -247 -247

Balance as of 31 December 2018 323 646 558 525 882 171

Additions 77 242 210 814 288 057

Disposals - -498 -498

Reclassifications -5 641 -19 221 -24 863

Foreign currency translation effect - 5 548 5 548

Balance as of 31 December 2019 395 247 755 168 1 150 416

Amortisation and impairment

Balance as of 1 January 2018 -53 662 -246 203 -299 866

Amortisation -15 800 -47 337 -63 138

Disposals - 8 196 8 196

Reclassifications -292 -1 921 -2 213

Foreign currency translation effect - -1 842 -1 841

Balance as of 31 December 2018 -69 754 -289 107 -358 861

Amortisation -17 848 -53 797 -71 645

Disposals - 363 363

Reclassifications - -3 907 -3 907

Foreign currency translation effect - -3 924 -3 924

Balance as of 31 December 2019 -87 602 -350 373 -437 975

Net book value

Balance as of 31 December 2019 307 645 404 796 712 441

Balance as of 31 December 2018 253 892 269 418 523 310

Estimated useful life 8-10 years 3-8 years

JOTUN GROUP

28