5.1 Taxation

Income taxes refer to taxation of the profits of the different companies in the Group. Value added tax,

property tax, custom duties and similar indirect taxes are not included in the tax expense. Income taxes

are computed based on profit before tax and broken into current taxes and changes in deferred taxes.

Deferred tax assets and liabilities are the result of temporary differences between financial and tax

accounting.

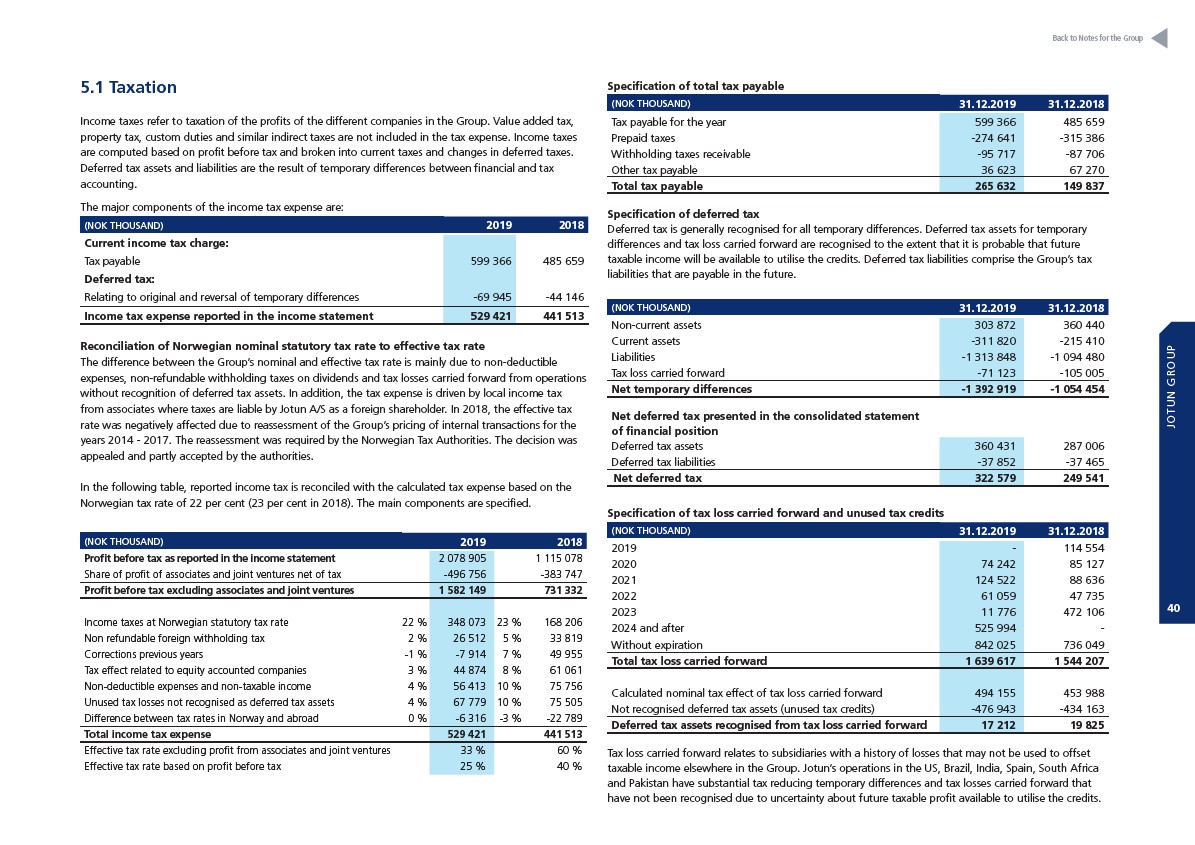

The major components of the income tax expense are:

(NOK THOUSAND) 2019 2018

Current income tax charge:

Tax payable 599 366 485 659

Deferred tax:

Relating to original and reversal of temporary differences -69 945 -44 146

Income tax expense reported in the income statement 529 421 441 513

Reconciliation of Norwegian nominal statutory tax rate to effective tax rate

The difference between the Group’s nominal and effective tax rate is mainly due to non-deductible

expenses, non-refundable withholding taxes on dividends and tax losses carried forward from operations

without recognition of deferred tax assets. In addition, the tax expense is driven by local income tax

from associates where taxes are liable by Jotun A/S as a foreign shareholder. In 2018, the effective tax

rate was negatively affected due to reassessment of the Group’s pricing of internal transactions for the

years 2014 - 2017. The reassessment was required by the Norwegian Tax Authorities. The decision was

appealed and partly accepted by the authorities.

In the following table, reported income tax is reconciled with the calculated tax expense based on the

Norwegian tax rate of 22 per cent (23 per cent in 2018). The main components are specified.

(NOK THOUSAND) 2019 2018

Profit before tax as reported in the income statement 2 078 905 1 115 078

Share of profit of associates and joint ventures net of tax -496 756 -383 747

Profit before tax excluding associates and joint ventures 1 582 149 731 332

Income taxes at Norwegian statutory tax rate 22 % 348 073 23 % 168 206

Non refundable foreign withholding tax 2 % 26 512 5 % 33 819

Corrections previous years -1 % -7 914 7 % 49 955

Tax effect related to equity accounted companies 3 % 44 874 8 % 61 061

Non-deductible expenses and non-taxable income 4 % 56 413 10 % 75 756

Unused tax losses not recognised as deferred tax assets 4 % 67 779 10 % 75 505

Difference between tax rates in Norway and abroad 0 % -6 316 -3 % -22 789

Total income tax expense 529 421 441 513

Effective tax rate excluding profit from associates and joint ventures 33 % 60 %

Effective tax rate based on profit before tax 25 % 40 %

Back to Notes for the Group

Specification of total tax payable

(NOK THOUSAND) 31.12.2019 31.12.2018

Tax payable for the year 599 366 485 659

Prepaid taxes -274 641 -315 386

Withholding taxes receivable -95 717 -87 706

Other tax payable 36 623 67 270

Total tax payable 265 632 149 837

Specification of deferred tax

Deferred tax is generally recognised for all temporary differences. Deferred tax assets for temporary

differences and tax loss carried forward are recognised to the extent that it is probable that future

taxable income will be available to utilise the credits. Deferred tax liabilities comprise the Group’s tax

liabilities that are payable in the future.

(NOK THOUSAND) 31.12.2019 31.12.2018

Non-current assets 303 872 360 440

Current assets -311 820 -215 410

Liabilities -1 313 848 -1 094 480

Tax loss carried forward -71 123 -105 005

Net temporary differences -1 392 919 -1 054 454

Net deferred tax presented in the consolidated statement

of financial position

Deferred tax assets 360 431 287 006

Deferred tax liabilities -37 852 -37 465

Net deferred tax 322 579 249 541

Specification of tax loss carried forward and unused tax credits

(NOK THOUSAND) 31.12.2019 31.12.2018

2019 - 114 554

2020 74 242 85 127

2021 124 522 88 636

2022 61 059 47 735

2023 11 776 472 106

2024 and after 525 994 -

Without expiration 842 025 736 049

Total tax loss carried forward 1 639 617 1 544 207

Calculated nominal tax effect of tax loss carried forward 494 155 453 988

Not recognised deferred tax assets (unused tax credits) -476 943 -434 163

Deferred tax assets recognised from tax loss carried forward 17 212 19 825

Tax loss carried forward relates to subsidiaries with a history of losses that may not be used to offset

taxable income elsewhere in the Group. Jotun’s operations in the US, Brazil, India, Spain, South Africa

and Pakistan have substantial tax reducing temporary differences and tax losses carried forward that

have not been recognised due to uncertainty about future taxable profit available to utilise the credits.

JOTUN GROUP

40