3.6 Trade and other receivables

Trade and other receivables are presented net of allowance for bad debt. Changes in allowance for bad

debt, including realised losses, are classified as other operating expenses in the income statement, ref.

Note 2.4. Bank drafts are received as payment of accounts receivable and have a maturity period of more

than three months. Received bank draft are used to pay suppliers, ref. Note 3.10.

(NOK THOUSAND) 31.12.2019 31.12.2018

Accounts receivable 4 694 109 4 549 587

Bank drafts 149 411 111 653

Trade receivables 4 843 520 4 661 240

Other receivables 422 171 457 718

Total 5 265 691 5 118 958

The change in allowance for bad debt is shown in the following table:

(NOK THOUSAND) 2019 2018

Balance as of 1 January 189 246 198 606

Allowances for bad debt made during the period 99 131 61 111

Realised losses for the year -99 631 -70 471

Balance as of 31 December 188 746 189 246

Aging of account receivable

(NOK THOUSAND) 31.12.2019 31.12.2018

Not due 3 242 945 3 029 808

Less than 30 days 611 809 627 454

30-60 days 299 527 290 061

60-90 days 133 939 189 221

More than 90 days 594 634 602 287

Allowance for bad debt -188 746 -189 246

Total 4 694 109 4 549 587

3.7 Other current liabilities

Other current liabilities are other payables, such as unpaid government charges and taxes, unpaid wages

and holiday pay and other accruals and provisions.

(NOK THOUSAND) 31.12.2019 31.12.2018

Public charges and holiday pay 288 626 280 965

Prepaid dividend from associates and joint ventures 323 124 277 800

Other accrued expenses 1 054 445 1 046 183

Total current provisions, ref. Note 3.8 369 636 514 924

Total 2 035 832 2 119 873

Prepaid dividend from associates or joint ventures are recognised as current liability until the final

approval by the General Assembly subsequent year. Other accrued expenses are related to commissions,

bonuses to employees and other accrued expenses.

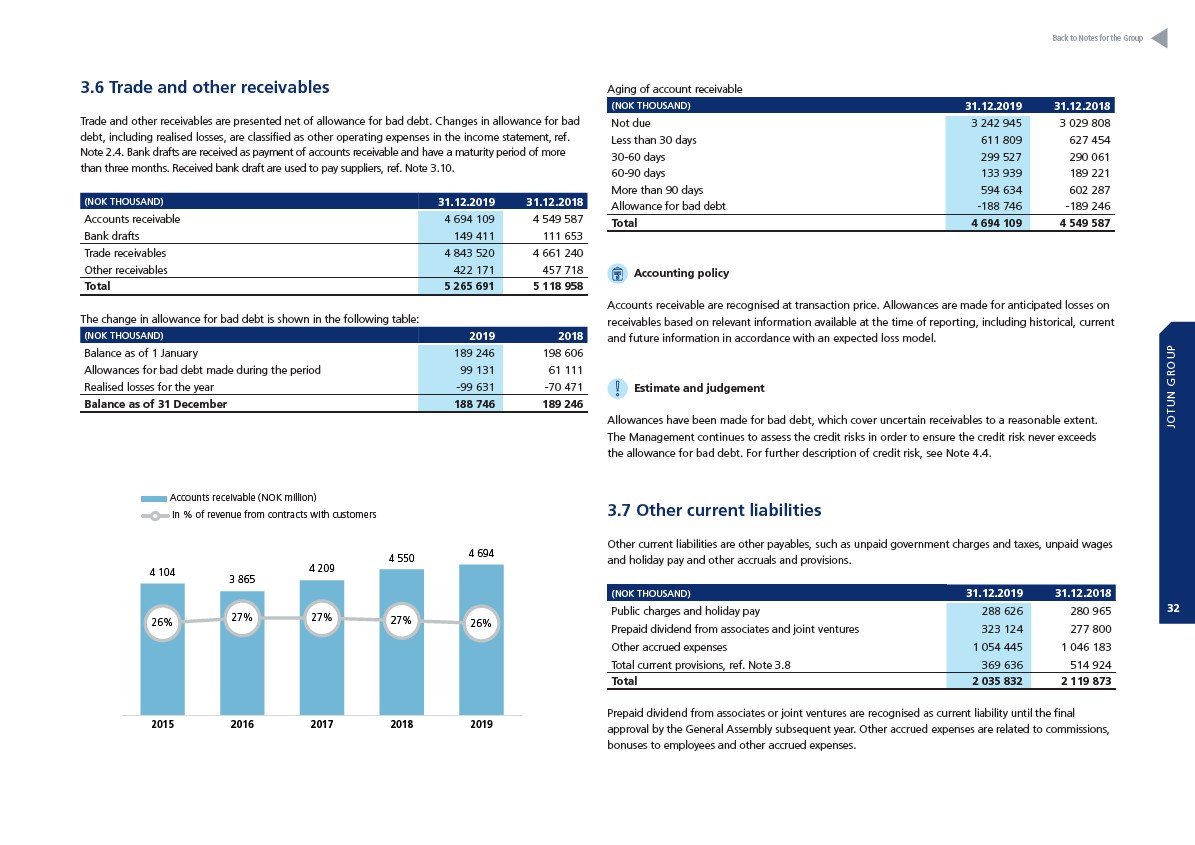

Accounts receivable (NOK million) In % of Revenue from contracts with customers*

4 104

3 865

4 209

4 550 4 694

26% 27% 27% 27% 26%

45,0%

40,0%

35,0%

30,0%

25,0%

20,0%

15,0%

10,0%

5,0%

0,0%

5 000

4 500

4 000

3 500

3 000

2 500

2 000

1 500

1 000

500

0

2015 2016 2017 2018 2019

Accounting policy

Accounts receivable are recognised at transaction price. Allowances are made for anticipated losses on

receivables based on relevant information available at the time of reporting, including historical, current

and future information in accordance with an expected loss model.

Estimate and judgement

Allowances have been made for bad debt, which cover uncertain receivables to a reasonable extent.

The Management continues to assess the credit risks in order to ensure the credit risk never exceeds

the allowance for bad debt. For further description of credit risk, see Note 4.4.

Accounts receivable (NOK million)

In % of revenue from contracts with customers

Back to Notes for the Group

JOTUN GROUP

32