18

OUR BUSINESS

Jotun’s powder coatings business grew modestly in 2017 as the company strengthened its position in

key markets.

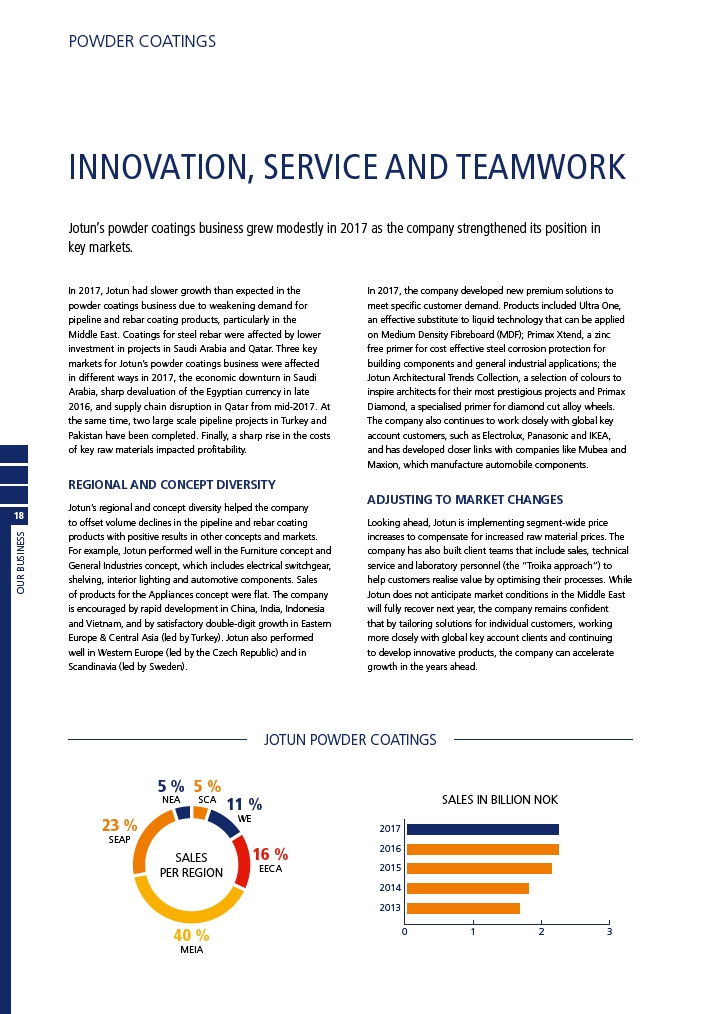

JOTUN POWDER COATINGS

POWDER COATINGS

INNOVATION, SERVICE AND TEAMWORK

In 2017, Jotun had slower growth than expected in the

powder coatings business due to weakening demand for

pipeline and rebar coating products, particularly in the

Middle East. Coatings for steel rebar were affected by lower

investment in projects in Saudi Arabia and Qatar. Three key

markets for Jotun’s powder coatings business were affected

in different ways in 2017, the economic downturn in Saudi

Arabia, sharp devaluation of the Egyptian currency in late

2016, and supply chain disruption in Qatar from mid-2017. At

the same time, two large scale pipeline projects in Turkey and

Pakistan have been completed. Finally, a sharp rise in the costs

of key raw materials impacted profitability.

REGIONAL AND CONCEPT DIVERSITY

Jotun’s regional and concept diversity helped the company

to offset volume declines in the pipeline and rebar coating

products with positive results in other concepts and markets.

For example, Jotun performed well in the Furniture concept and

General Industries concept, which includes electrical switchgear,

shelving, interior lighting and automotive components. Sales

of products for the Appliances concept were flat. The company

is encouraged by rapid development in China, India, Indonesia

and Vietnam, and by satisfactory double-digit growth in Eastern

Europe & Central Asia (led by Turkey). Jotun also performed

well in Western Europe (led by the Czech Republic) and in

Scandinavia (led by Sweden).

In 2017, the company developed new premium solutions to

meet specific customer demand. Products included Ultra One,

an effective substitute to liquid technology that can be applied

on Medium Density Fibreboard (MDF); Primax Xtend, a zinc

free primer for cost effective steel corrosion protection for

building components and general industrial applications; the

Jotun Architectural Trends Collection, a selection of colours to

inspire architects for their most prestigious projects and Primax

Diamond, a specialised primer for diamond cut alloy wheels.

The company also continues to work closely with global key

account customers, such as Electrolux, Panasonic and IKEA,

and has developed closer links with companies like Mubea and

Maxion, which manufacture automobile components.

ADJUSTING TO MARKET CHANGES

Looking ahead, Jotun is implementing segment-wide price

increases to compensate for increased raw material prices. The

company has also built client teams that include sales, technical

service and laboratory personnel (the “Troika approach”) to

help customers realise value by optimising their processes. While

Jotun does not anticipate market conditions in the Middle East

will fully recover next year, the company remains confident

that by tailoring solutions for individual customers, working

more closely with global key account clients and continuing

to develop innovative products, the company can accelerate

growth in the years ahead.

5+5 %

SCA 11 %

SALES IN BILLION NOK

WE

2017

16 16+M 11+40+23+5+%

2016

EECA

2015

2014

2013

40 %

0 1 2 3 MEIA

23 %

SEAP

5 %

NEA

SALES

PER REGION