OUR BUSINESS

10

Jotun finished 2019 with all all-time high profits and sales growth in all regions.

Jotun’s excellent performance in 2019 was driven by significant

growth in the Marine and Protective Coatings segments

and strong profitability in the Decorative Paints segment,

despite lower growth. Higher gross margins were driven by

the successful implementation of price increases and the

stabilisation of raw material costs. The company was also

rewarded for its efforts to control manageable costs.

Market recovery

After some difficult years in the Marine Coatings segment,

Jotun has been successful in capturing a large share of the

newbuilding market (especially in South Korea) and has seen

good growth in the maintenance and repair markets with its

DryDock and SeaStock concepts. In the Protective Coatings

segment, Jotun has benefitted from growth in demand in the

Offshore concept and continues to increase its market share

in the Infrastructure, Energy and the Hydrocarbon Processing

Industry (HPI) concepts. And despite some challenges in key

markets in the first half of the year, the Decorative Paints

segment ended 2019 at an all-time high.

Jotun is working to improve results. For example, despite all

the hard work and dedication of personnel in the Powder

Coatings segment, Jotun’s growth and profitability did not

meet expectations. Another focus area is customer credit and

Days Sales Outstanding (DSO). In 2019, Jotun met targets

for reducing DSO, resulting in improved working capital.

The company will continue to work to further improve credit

management in the years ahead.

Investing in the future

Jotun anticipates that growth will continue in 2020. While

results may be impacted by political or economic instability in

some regions and ongoing effects of global trade disputes, the

company’s segment and regional diversity helps to mitigate

risk. In addition, Jotun’s continued investments and upgrades

in production capacity (Vietnam, Egypt) and Research and

Development facilities (the UAE, Norway) will put Jotun in a

strong position to stay profitable and grow volumes in the future.

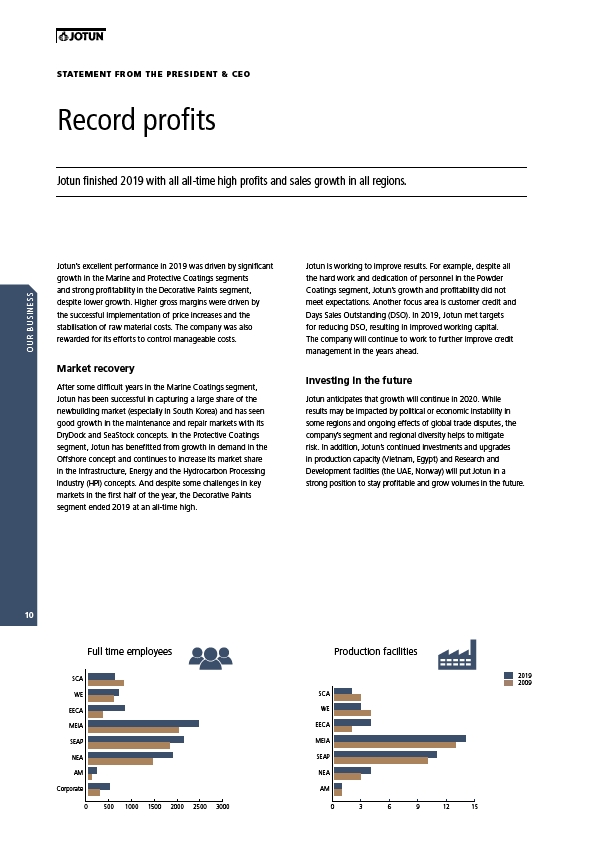

3 6 9 12 15

SCA

WE

EECA

MEIA

SEAP

NEA

AM

0

Production facilities

SCA

WE

EECA

MEIA

SEAP

NEA

AM

Corporate

Full time employees

0 500 1000 1500 2000 2500 3000

2019

2009

STATEMENT FROM THE PRESIDENT & CEO

Record profits